Tech

Chainlink CCIP to Power New ‘FIX-Native Blockchain Adapter’ With Rapid Addition

May 1: Rapid Addition, a FIX connectivity solutions provider, and Chainlink, a blockchain data oracle and interoperability project, announced development of a FIX-native blockchain adapter for institutional digital asset trading, powered by Chainlink CCIP, which stands for Cross-Chain Interoperability Protocol. According to the team: “This new collaboration will allow banks and other financial institutions to deliver messages and interact with a broad spectrum of tokenized assets – an untapped market opportunity spanning carbon credits and renewable energy products to real-world assets such as real estate, infrastructure, and collectibles.”

Stacks Delays Nakamoto Activation for 8 More Weeks of Development

May 1: Bitcoin layer-2 project Stacks announced a “significant” delay to the activation of its highly anticipated Nakamoto upgrade, citing the need for eight more weeks of development time. In a blog post, Mitchell Cuevas, who heads the Stacks Open Internet Foundation, wrote: “With the benefit of more information and practical experience with aspects of the new network, the core developers have identified the need for a more advanced Signer resiliency/recovery system, something initially scoped for a later release. As a result, they are projecting an additional eight weeks of development time, plus time for testing, before the second hard fork that brings us Nakamoto features at ‘Activation.’ Code complete on the new Signer resiliency features is expected July 15 and Activation starts August 28. Shifting dates this late in the game is not fun and I recognize this is disappointing. Fast blocks just can’t get here fast enough! However, this change is being made to ensure the safety and liveness of the network upgrade.”

Alchemy Rolls Out Support for ZkSync

May 1: Alchemy, a Web3 development platform, is rolling out support for zkSync, an EVM-compatible, zero-knowledge rollup layer-2 solution, according to the team: “By combining zkSync’s hyperscalable zk-powered technology with Alchemy’s powerful developer tools, devs can build fast, affordable and user-friendly onchain apps. Starting today, devs can begin building on zkSync Mainnet and zkSync Sepolia Testnet and will have access to Alchemy Supernode, enhanced APIs and Alchemy Signer for embedded accounts.”

Solana Foundation Plans IRL Overnight Hackathon in Berlin

May 1: Solana Foundation will be hosting an IRL overnight hackathon in Berlin on May 21-22 during Berlin Blockchain Week. According to the team: “65 developers of all skill levels will have the opportunity to compete for a prize pool of over $15,000 from the Solana Foundation and ecosystem projects. This is a unique opportunity for developers to learn, collaborate and build across three tracks: Decentralized Finance & Payments; Consumer Apps & NFTs; and Public Goods.”

Minima, Online Payment Platform Work on Token-Enabled System for Sharing EV Chargers

May 1: Minima, a layer-1 blockchain focused on DePIN, is working with Online Payment Platform (OPP) on a project that would allow electric-vehicle drivers to rent out private chargers to other members of the public. According to a press release: “Charge Point Operators (CPOs) and private wallbox owners will be able to accept tokens generated on the Minima blockchain. The tokens will represent kWh balances, access rights, or authentication details. This would enable a more secure and efficient ecosystem for electric vehicle charging, offering a novel approach to managing energy resources and facilitating access across a broad network.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Coinbase Integrates Lightning Network With David Marcus’s Lightspark

April 30: Coinbase announced the much-anticipated launch of its support for the Lightning Network, “enabling its millions of users to send, receive, or pay with Bitcoin faster and cheaper than ever, directly from their Coinbase account,” according to the team: “Until now, bitcoin transfers processed on-chain via Coinbase could take anywhere from 10 minutes to two hours and could be costly for users. With the Lightning Network, Coinbase will now provide instant off-chain bitcoin transfers at a fraction of the cost.” The integration was made through a partnership with Lightspark, which is headed and was co-founded by David Marcus, former head of Facebook/Meta’s Libra/Diem project.

Luke Dashjr’s Ocean Lets Miners Take Lightning Payouts Using BOLT12

April 30: Ocean, the Bitcoin mining pool backed by Jack Dorsey and led by longtime Bitcoin Core developer Luke Dashjr, said miners can now receive payments over the Bitcoin Lightning Network using the Lightning technology BOLT12. According to the team, miners can “get liquidity directly into a Lightning channel without having to rely on third-party custodians. This latest announcement aligns with OCEAN’s overarching goal of increasing miners’ sovereignty while promoting greater transparency and decentralization in the Bitcoin network.” According to a press release: “BOLT12 is a nextgen upgrade in Lightning which solves previous limitations that restricted Lightning’s utility and adoption.”

Style, for Transferring In-Game NFTs Between Blockchains, Raises $2.5M

April 30: Style Protocol, which transforms NFTs into 3D assets that can be used in any game or metaverse, has raised $2.5 million in seed funding, according to the team. From the project’s whitepaper: “Style Protocol builds on Polkadot, which creates a blockchain of blockchains. Style Protocol aims to be built on the top of Polkadot to increase the interoperability with all chains and make NFTs available in each chain. However, there are two steps to build the protocol to be flexible and usable for all chains. First, create the bridging logic using smart contracts on Solidity and gain all Ethereum Virtual Machine (EVM) compatible chains such as Binance Smart Chain, Fantom, Polygon and Avalanche. Second, create the logic on a separated pallet (Parachain) on Polkadot to fit with all other chains. Also, from a usability point of view, the first step will allow users to pay through a MetaMask wallet easily. However, the second step will build the Style wallet to host most of the payments that will be done on Polkadot.”

Ether.Fi Integrates SSV.Network’s Distributed Validator Technology

April 30: Ether.Fi, the biggest liquid restaking protocol in the Ethereum blockchain ecosystem, has integrated SSV.Network‘s distributed validator technology (DVT) into its platform, according to the team. “In recent weeks, Ether.Fi has onboarded almost 2,000 validators to SSV.Network,” according to a press release. “In addition to increasing resilience, the integration of SSV has improved relay liveness through the use of operators that leverage the same MEV Relay correlation. This has improved protocol efficiency while enhancing overall performance and network stability. Earlier this month, an SSV cluster that was used by Ether. Fi recieved an 11 ETH MEV block reward.” Ether.Fi has about 40,000 validators overall and also has a partnership with another DVT project, Obol.

Foundation Supporting Xai Gaming Blockchain, From Offchain Labs, Launches ‘RPC Nodes’

April 30: Xai Foundation, supporting the Xai gaming-focused blockchain, announced the public launch of “mainnet Xai RPC nodes on Nirvana Cloud,” according to the team: The nodes “are available for developers via the Nirvana Labs developer platform. This integration will significantly improve cost, global distribution, speed, and reliability for Xai game developers, delivering a better overall user experience for their end users.” According to a press release, “Xai is developed by Offchain Labs leveraging Arbitrum technology.”

Chirp, Peaq Team Up for ‘Decentralized Connectivity for Smart Devices’

April 30: Chirp, a telecommunications network for wireless and Internet of Things (IoT), has joined forces with peaq, a layer-1 blockchain for DePIN and Machine RWAs, to provide decentralized connectivity for smart devices, according to the team: “Chirp is building a unified, multi-protocol decentralized connectivity network that will enable the exchange of data over any supported protocol and from any distance. Its network includes its ‘Blackbird‘ gateways, already spread across 33 countries, which provide connectivity for other IoT hardware across a variety of channels, including LoRaWAN, LoRa 2.4 gHz, BLE, and more.”

TradeDog’s TDeFi, Dubai’s DMCC Announce ‘Cohort-3’ of Web3 Acceleration Program

April 30: TDeFi, the incubation and consulting unit of TradeDog Group, and DMCC, an authority of the government of Dubai, announced “Cohort-3” of Web3 Acceleration Program, teaming up with Elysium Chain as the blockchain partner. According to the team: “The top three projects from this program stand to win $150,000 in investments. With mentors like Mario Nawfal and Ravikant Agrawal, the program offers 15 immersive sessions covering fundraising, compliance, tokenomics and go-to-market strategies.”

Sui Collaborates With Google Cloud on Web3

April 30: Sui, the layer-1 blockchain and smart-contract platform created and launched by the core research team responsible for building Facebook’s Libra and Diem projects, is collaborating with Google Cloud to support Web3, via a partnership with Mysten Labs. According to the team: “This joint effort will focus on enhancing security, scalability, developer tools and user experiences across a range of Web3 and AI-powered applications. Key initiatives of this partnership include data-driven dApps, AI-enhanced development, seamless user experience and robust scalable infrastructure.” (SUI)

X10, Hybrid Exchange Led by Ruslan Fakhrutdinov, Emerges From Stealth With $6.5M of Funding

April 30: X10, a crypto exchange featuring an “optimized hybrid model” with self-custody and settlement of trades on-chain, emerged from stealth on Tuesday and announced $6.5 million of funding. The project was founded by Ruslan Fakhrutdinov, former head of crypto ops at Revolut, according to the team. Investors include Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware and Cyber Fund. According to the team: “X10 perfectly fits the post-FTX 2024 landscape, blending the best of both worlds of CeFi and DeFi. The user experience, product portfolio, and speed are inherited from CeFi exchanges, along with the benefits of decentralization, which secures transparency and safety through on-chain trade settlement, validation, and self-custody.”

X10 founder Ruslan Fakhrutdinov (X10)

Omnity, On-Chain Interoperability Protocol on ICP, Integrates Runes

April 29: Omnity, the first on-chain, omnichain interoperability protocol built by the Octopus Network team on Internet Computer (ICP), announced its integration of Runes, Casey Rodarmor’s UTXO-based Bitcoin metaprotocol that allows for the trading of fungible tokens on Bitcoin. According to the team: “This integration aims to enable the trading of Rune tokens without gas or transaction fees. It also paves the way for greater Runes utility, including use within DeFi, marketplace integration, and token swaps without having to rely on risky cross-chain bridges.” (ICP)

Tether Buys $200M Majority Stake in Brain-Computer Interface Company Blackrock Neurotech

April 29: Tether, the issuer of stablecoin USDT, said Monday that it invested $200 million to acquire a majority stake in brain-computer interface company Blackrock Neurotech via its venture capital division Tether Evo. Blackrock Neurotech develops medical devices that are powered by brain signals and aims to help people impacted by paralysis and neurological disorders.

Dolomite to Launch Lending Protocol on OKX’s New L2, X Layer

April 29: DeFi lending protocol Dolomite announced it will launch its lending protocol on OKX’s new Ethereum layer-2 network, X Layer, according to the team: “Dolomite seeks to replicate its success on Arbitrum, where it quickly became the fourth largest lending market and the lending market with the most supported assets. Dolomite’s expansion to X Layer will transform it into a multi-chain protocol and introduce X Layer users to sophisticated tools for unlocking dormant capital, launching initially with support for OKB, WETH, USDT, USDC and WBTC.” As reported by CoinDesk earlier this month, X Layer is built on Polygon’s Chain Development Kit, compatible with Ethereum’s EVM runtime and making use of zero-knowledge technology.

Natix, Crowdsourced Camera Network With Web3 Incentives, Secures $9.6M

April 28: Natix, driver-led DePIN powered by AI cameras, has secured $9.6 million in funding in a new round spearheaded by Borderless Capital, co-led by Tioga Capital with angel investors from Bitget, Figment and Crypto Banter, according to the team: “NATIX, one of the largest crowdsourced camera networks with 92,000 registered drivers globally, sets to transform driver-led data collection and driver applications with Web3 incentives.” Said Alireza Ghods, NATIX’s CEO and co-founder: “Looking ahead, collaborating with leading high-performance networks like Solana and Peaq is crucial for advancing our mission.”

Burnt Banksy’s XION Launches Chain Abstraction Solution

April 28: Burnt Banksy’s XION platform has officially launched its user-friendly chain abstraction solution, according to the team: “With this launch, users of XION are now able to extend the blockchain’s ease of use with a frictionless sharing of apps, liquidity and more across ecosystems – starting with Injective. For the first time, users are able to interact with Injective’s Talis marketplace from their XION account simply by using an email. They can do so without any understanding of cross-bridging, browser plugins, seed phrases, gas fees and more.”

Hinkal, Multi-Chain Protocol for ‘Discreet’ Hedge Fund Trades, Raises $1.4M in Strategic Funding Led by SALT

April 28: Hinkal, a multi-chain protocol that allows hedge funds and institutional investors to discreetly trade in the DeFi ecosystem, announced a $1.4 million strategic funding led by SALT. According to the team: “As traditional financial institutions continue to enter the crypto market, they are seeking solutions that grant them the same level of discretion and privacy they are used to in traditional equities markets. Using Hinkal, institutions can execute their trades privately and mitigate the risk of frontrunning or trade copying that is becoming increasingly prevalent in the industry.”

Magic’s Wallet-as-a-Service to Integrate With Tezos, Supported by Tezos Foundation Grant

April 28: The Tezos Foundation and Magic have teamed up to enhance Tezos’ accessibility and usability, according to a message from the project: “Magic’s Wallet-as-a-Service will seamlessly integrate with Tezos, streamlining user onboarding for dApps. This collaboration eliminates traditional password hassles, reducing entry barriers to Web3. Supported by a Tezos Foundation grant, this partnership aims to make dApps more user-friendly and encourage mainstream adoption. Tezos joins Magic’s platform as a featured chain alongside Ethereum, Solana, Polygon and Flow, offering developers tools to create secure and user-centric applications.” (XTZ)

Wormhole’s ‘Native Token Transfers’ Make W Token Available on Solana, Ethereum and EVM L2s

April 28: Blockchain bridge Wormhole’s native W tokens are now available on Solana, Ethereum and all Wormhole-connected EVM chains through Wormhole Native Token Transfers (NTT), according to the team: “With NTT, users can seamlessly transfer W across Solana, Ethereum mainnet, and EVM L2s without the complications of liquidity fragmentation. Making W natively multichain completes the second phase of the W launch roadmap, and will lead to an industry-first multichain governance system, MultiGov, and W locking for self-delegation. These advancements lay the groundwork for future token functionality that is only possible with NTT and a native multichain token.”

Bitcoin-Linked Stablecoin Firm OpenDelta Raises $2.5M

April 26: Bitcoin-centric stablecoin company OpenDelta raised $2.15 million in a pre-seed round led by 6th Man Ventures, CEO Konstantin Wünscher told CoinDesk. “We want to use bitcoin to create stable value in a fiat-denominated currency,” Wünscher said in an interview. OpenDelta will plant itself in the newest greenfield for decentralized finance (DeFi) atop the newest trend in Bitcoin, Runes.

SEDA, Data and Computation Network, Launches Mainnet Genesis

April 25: SEDA, a data transmission and computation network that enables a permissionless environment for developers to deploy data feeds, announced the launch of its mainnet genesis event. According to the team: “By mitigating native deployments via a modular and chain-agnostic design, SEDA is building to offer complete developer flexibility with chain-agnostic integrations alongside completely programmable data feeds, enabling a ‘permissionless optionality’ that promotes Web3’s ethos for builders. Mainnet will see the deployment of SEDA’s solvers, an overlay network offering one-click node spinups for community and bespoke mechanics for network OEV capture and value redeployment back into the hands of network participants.”

Soarchain, Layer-1 DePIN for Mobility, Allows Vehicle Data Upload, for Things Like ‘Smart Insurance’

April 25: Soarchain, a layer-1 DePIN built for mobility and data exchange, is bringing mobility data on-chain with their mainnet vehicle data network, according to the team: “Users can now seamlessly upload their vehicle data in real-time and convert their vehicles into connected, data-rich platforms from which they can extract real-world value. Vehicle data can serve as a foundation for applications like smart insurance, maintenance monitoring, and safety enhancements. Soarchain is also collaborating with Maruti and Suzuki to demonstrate the practical applications of their technology with real-world automotive scenarios.”

Movement Labs Raises $38M for Rollup Based on Facebook’s Move Language

April 25: Movement Labs, a blockchain company that aims to bring Facebook’s Move Virtual Machine to Ethereum, has secured $38 million in a Series A financing round led by Polychain Capital. The firm was founded by Rushi Manche, 21, and Cooper Scanlon, 24 – Vanderbilt college dropouts who say they are on a mission to “make blockchain security sexy” with the launch of Movement L2, their new layer-2 Ethereum blockchain based on the Move programming paradigm.

Movement Labs co-founders Cooper Scanlon and Rushi Manche (Movement Labs)

EigenLayer-Powered Aligned Layer Raises $20M to Make ZK Proofs Faster, Cheaper on Ethereum

April 25: Ethereum verification protocol Aligned Layer has raised a $20 million Series A to enable faster and cheaper zero-knowledge (ZK) proofs on the world’s second-biggest blockchain. The fundraiser was led by Hack VC and included contributions from DAO5, L2Iterative, NomadCapital_io, FinalityCap, Symbolic VC and Theta Capital. Aligned Layer is an EigenLayer “actively validated service” (AVS).

Avail Data Availability Integrated by Arbitrum, Optimism, Polygon, StarkWare, ZkSync

April 25: Avail, a blockchain project known for data availability (DA), shared Thursday that five major layer-2 networks in the Ethereum ecosystem will integrate with its Avail DA solution. Those chains include Arbitrum, Optimism, Polygon, StarkWare and zkSync.

Nym’s Layer-0 Mixnet to Pair With Aleo’s Zero-Knowledge Privacy-Focused Blockchain Platform

April 25: Nym Technologies is partnering with Aleo, a prominent privacy-focused blockchain platform, according to the team: “The partnership harnesses the power of Aleo’s zero-knowledge Layer-1 blockchain with Nym’s layer-0 mixnet protocol. Through integration with Nym’s mixnet and NymVPN’s decentralized privacy solutions, users will enjoy enhanced privacy and security across TCP/IP and on-chain transactions, ensuring robust protection for their online interactions. Leo Wallet’s intuitive user interface will seamlessly connect users with the Nym mixnet, streamlining the integration of the Aleo blockchain and Nym’s mixnet.”

ZetaChain Launches 100M ZETA ($120M) Developer and Dapp Ecosystem Program

April 25: ZetaChain, describing itself as the “first Omnichain blockchain for chain abstraction” has launched a 100 million ZETA ($120M) developer and dapp ecosystem growth program, with 25 million ZETA specifically allocated for Bitcoin projects, according to the team: “The program aims to support impactful projects focusing on Bitcoin-based DeFi, gaming, and socialfi dapps, offering grants, incentives, and support programs to accelerate their development on the ZetaChain blockchain.”

BNB Chain Integrates Native Liquid Staking on BSC Following Beacon Chain Sunset

April 25: BNB Chain is integrating native liquid staking on BSC following the Beacon Chain sunset, according to the team. The move will enable “high-APY native staking on BSC in addition to enhanced MEV rewards. Liquid staking on BNB Chain will allow participants to secure the network while maintaining liquidity of their assets. Users can engage in DeFi activities without sacrificing asset utility. The LSDFi integration is scheduled to take place between April and early May.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

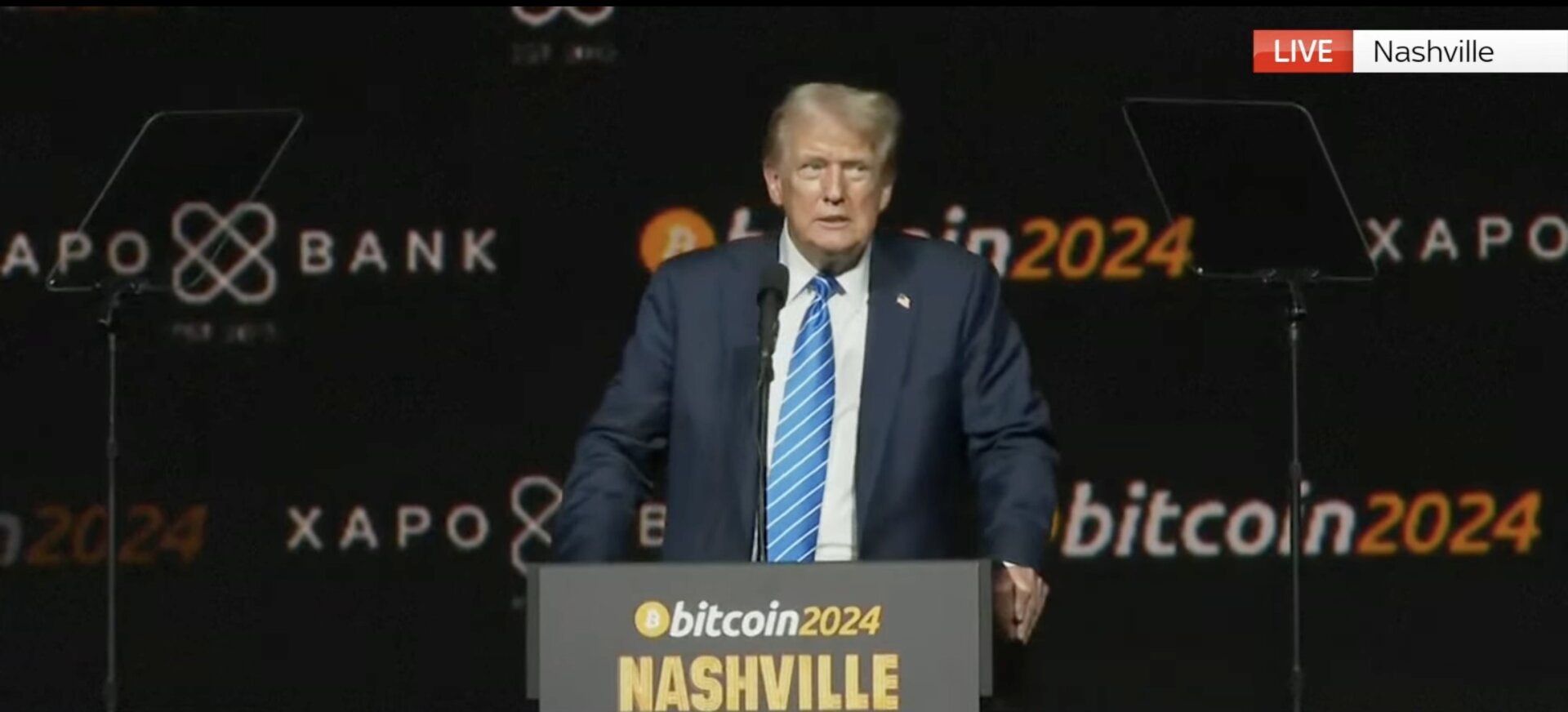

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!