Tech

The Latest Tech News in Crypto and Blockchain

NOTE: for previous or subsequent versions of Protocol Village, please go here.

Sept. 29: Polygon Labs, the provider of Ethereum scaling solutions, posted on X (formerly Twitter) that Google Cloud will become part of the “decentralized validator set” for Polygon’s PoS network.

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here.

Sept. 29: Matter Labs, the developer team behind Ethereum layer-2 zkSync Era, announced a competitive audit contest focused on Web3 with Code4rena, a smart-contract security marketplace, with 1.1 million USDC available to participants and a minimum of $330,000 to be distributed. The 21-day event runs Oct. 2-23. According to a press release: “The audit scope will cover several areas including: L1 and L2 system smart contracts, circuits, VM implementation.”

Sept. 29: BNB Chain, the blockchain ecosystem initiated by the crypto exchange Binance, announced an integration with Chainlink Cross-Chain Interoperability Protocol (CCIP), according to a blog post. “This integration unlocks developers from across the multi-chain ecosystem to securely expand to, and build with, BNB Chain and other CCIP-connected blockchains.” ($LINK)

Sept. 29: Stablecoin issuer Circle Internet Financial on Friday rolled out a smart contract codebase called Perimeter Protocol that aims to serve as an open-source foundation to build tokenized credit markets.

Sept. 29: Crypto custody tech company Fireblocks has acquired tokenization firm BlockFold, a “smart-contract development and consulting firm specializing in advanced tokenization projects for financial institutions,” according to an emailed announcement. Financial terms of the deal weren’t disclosed, though a person familiar with the matter told CoinDesk that the acquisition figure is $10 million.

Sept. 28: Fireblocks, an enterprise-grade platform for moving, storing and issuing digital assets, is now supporting Tezos, a proof-of-stake blockchain, according to a press release. “Fireblocks customers can securely custody FA1.2 and FA2 token standards on Tezos as well as leverage Fireblocks’ Web3 Engine to build new products and services on the Tezos blockchain.” ($XTZ)

Sept. 28: The Radix Public Network completed its Babylon Mainnet upgrade early Thursday, enabling smart-contract functionality with Scrypto and a new execution environment, Radix Engine v2. “The Babylon Wallet marks a transformative leap in DeFi and Web3.0 user experiences,” according to a blog post. ($XRD)

Sept. 28: Ethereum developers on Thursday appeared successful in their second attempt to launch the Holesky test network, after an attempt earlier this month failed. ($ETH)

Sept. 28: Ledn, a crypto lender focused on bitcoin and the USDC stablecoin, will add ether (ETH) to its Growth Accounts as of Oct. 12 with an annual percentage yield of up to 2%. “Users have been continuously asking us to add ether, so in line with our mission to offer only the best and most profitable yield options, we are thrilled to now introduce support for ETH on Ledn’s Growth Accounts,” Mauricio Di Bartolomeo, co-founder and chief strategy officer, said in a message forwarded to CoinDesk.

Sept. 27: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) went live on Coinbase’s layer-2 blockchain, Base. “We’re excited about the launch of CCIP on Base to let developers securely build cross-chain applications, empowering them to experiment further and unlock new use cases,” said Jesse Pollak, creator of Base. ($LINK)

Sept. 27: Thala, in collaboration with Aptos Foundation, are “collaborating to launch The Thala Foundry, a $1M grant fund to stand up new DeFi protocols,” according to a web post. “Thala plans to scale the initiative to $5M as protocols launch with additional grant funding and resources from Aptos Foundation.” According to a message from the team, the effort “will identify, fund and incubate at least five promising DeFi protocols over the next year. In addition to providing capital, they will also guide projects from the concept phase through product launch.” ($APT)

Sept. 27: Cartesi, an app-specific rollup protocol with a virtual machine that runs Linux distributions, had its “first dApp launched on Ethereum mainnet: Honeypot, designed to allow developers to challenge the security of Cartesi rollups,” according to a press release. “The first to hack the Honeypot will be able to drain the funds – no strings attached.”

Sept. 27: NEAR Foundation has signed a “technology partnership” with the International Cricket Council, according to a press release. A “challenge powered by NEAR’s Blockchain Operating System (B.O.S.) will enable fans to test their cricket knowledge against others to show their understanding of the sport.” ($NEAR)

Sept. 27: Stellar announced the launch of Stellar Wallet SDK, designed to make it easier “to build a Stellar network native wallet and access payment rails and use cases on the network,” according to a message from the team. “Digital wallets can integrate the SDK to become interoperable with solutions such as MoneyGram Access and/or the Stellar Disbursement Platform.” ($XLM)

Sept. 27: Bybit, the crypto exchange, and the Dubai Multi Commodity Centre (DMCC) announced a hackathon called “Web3 Unleashed: Crypto Innovation Challenge,” boasting a $100,000 prize pool. Registration is Sept. 26-Oct. 26 and the event is scheduled for Nov. 22. “All projects are welcome — Blockchain Infrastructure, Artificial Intelligence (AI), DeFi, NFTs, Metaverse, Crypto Gaming, Sustainable Blockchain Solutions,” according to a press release.

Sept. 26: Enjinstarter, an IDO [initial decentralized exchange offering] platform for Web3 gaming, AI and metaverse projects, has announced that it has “signed a partnership with Mysten Labs to bring its launchpad to the Sui network, a permissionless layer 1 blockchain. Projects building on Sui will get access to Enjinstarter’s crowdfunding launchpad, while Enjinstarter will help projects with their marketing, community building and user acquisition strategies.”

Sept. 26: Alchemy, the web3 infrastructure platform, announced it has acquired Satsuma, one of Web3’s top subgraph-indexing platforms. According to Alchemy: “Satsuma simplifies searching and analyzing data stored on a blockchain, allowing developers to get deeper insights into the data, such as the total value locked (TVL) of a DeFi protocol. Satsuma Subgraphs will be folded into Alchemy’s existing product suite of APIs, SDKs and developer tools as Alchemy Subgraphs. By combining forces with the Satsuma team, Alchemy will be poised to solve some of the biggest issues facing developers today: slow sync times, massive operational overhead, high engineering costs and poor reliability.”

Sept. 26: Immunefi, a bug bounty and security services platform for Web3, announced the launch of its on-chain Vaults System, designed to increase transparency and trust between projects and security researchers by enabling projects to deposit assets into their own sovereign vault to pay out bug bounty rewards, according to a message from the team. “This will allow projects to demonstrate to whitehats via the Immunefi UI that they have allocated sufficient funds to pay bounties and streamline the payment process…. The Vaults System is launching with SSV Network, an easy-to-use and scalable infrastructure solution for decentralizing Ethereum validators, which is leading with a $1 million deposit into its sovereign vault, representing a big commitment to taking security seriously.”

Sept. 26: Fhenix, the first confidential blockchain powered by fully homomorphic encryption (FHE), announced a $7M seed round led by Multicoin Capital and Collider Ventures, with participation from Node Capital, Bankless, HackVC, TaneLabs and Metaplanet. Other notable participants include Tarun Chitra’s and Robert Leshner’s Robot Ventures. The funds will be used to bring the Fhenix Network into public testnet early next year, and to support ecosystem application development.

Sept. 26: Avantis Labs, decentralized finance derivatives ecosystem, raises $4M in seed round led by Pantera Capital, TechCrunch reported. “Founders Fund, Galaxy, Coinbase’s Base Ecosystem Fund and Modular Capital also invested in the round,” according to the outlet. “The capital will be used to grow its flagship product Avantis, a perpetual-trading and market-making protocol.”

Sept. 26: Circle and Stellar announced that the euro-linked stablecoin EURC, available on the Ethereum and Avalanche blockchains, will be going live on the Stellar Network. The announcement was to be made on the main stage at Stellar’s Meridian conference in Madrid. “The launch of EURC on Stellar has the potential to radically enhance European remittance corridors, cross-border payments, treasury management and aid disbursement,” according to the team. ($EURC, $XLM)

Sept. 26: Push Protocol, the Web3 communication network formerly known as EPNS, which includes a dedicated channel for distributing CoinDesk news directly to users who opt in through their wallet addresses, has launched its own “Push Snap” on MetaMask. “You can now seamlessly receive notifications powered by Push Protocol directly in your wallet, ensuring you never miss out on important updates from the channels that you subscribe to,” according to the description on the MetaMask Snaps website.

Sept. 25: BNB Chain, the blockchain ecosystem initiated by the big crypto exchange Binance, released a study claiming that OpBNB, its recently launched Ethereum layer-2 network built with OP Stack, has the lowest gas fees among rivals. According to an email from the team: “With an average gas fee of just <$0.005, opBNB is setting new standards for affordability in the blockchain ecosystem. The publicly available data highlights the comparison of gas fees for opBNB, Optimism, Arbitrum, Base, Starknet, Linea, Polygon zkEVM and zkSync. It also compares the gas fees of opBNB to BNB Chain’s Layer 1, BSC.” Separately, BNB Chain posted on X that it had contacted MetaMask, the popular crypto wallet, and “resolved a glitch that made it seem like opBNB’s gas fees were unusually high.” ($BNB, $OP, $MATIC, $ARB)

Sept. 25: Moondance Labs, the company developing the Tanssi appchain infrastructure protocol, announced ContainerChains: a developer-friendly evolution for appchain deployment. According to the team: “By connecting an appchain to Tanssi, it transforms into a ContainerChain, accessing an array of infrastructure resources to eliminate appchain infrastructure complexities. The game-changer? Reducing months-long deployment timelines to just hours.”

Sept. 25: Protocol Labs, a developer focused on Filecoin, and Consensys, the Ethereum developer, announced a partnership to support blockchain startups via the Consensys Scale program. Under the deal, the founders of Protocol Labs Network will supply their mentorship and technical advice to the selected projects in the accelerator program, according to a message from the team. “Teams will also benefit from the opportunity to incorporate Filecoin and IPFS, the fundamental elements of web3 infrastructure, as well as solutions like NFT.Storage Pro and Web3.Storage Pro, as integral components of their journey,” according to the press release. ($ETH, $FIL)

Sept. 25: RockX, a blockchain node network and provider of institutional-grade staking solutions in Asia, said it has entered into a strategic partnership with Cactus Custody, the qualified institutional custodian brand of Matrixport, “to streamline and secure the staking process for mainstream financial players, prioritising both regulatory compliance and enhanced security.”

Sept. 25: Taurus SA, a Swiss institutional-grade digital asset platform to issue and manage cryptocurrencies and tokenized assets, said it has expanded its custody and tokenization offerings to support permissioned blockchains, including Hyperledger BESU, Quorum and other enterprise-grade private blockchains (EVM and non-EVM), according to a message from the team. The goal is “to meet the growing demand from some of the biggest U.S. and European banks. By leveraging Taurus’ custody platform and integrated tokenization engine, the company’s clients can now effortlessly tokenize any type of assets on public and permissioned blockchains via a single unified platform.”

Sept. 25: Tashi Finance, a decentralized borrow and lend platform built on Evmos within the Cosmos blockchain ecosystem, said it has launched its mainnet. Through partnerships with “Evmos, cross-chain bridging protocol Wormhole and liquidity aggregator Swing,” according to a press release, “Tashi will enable users to bridge their Cosmos or Ethereum-based assets onto the protocol.” ($ATOM, $ETH, $EVMOS)

Sept. 25: Particle Network announced it has activated 15 million wallets after it launched its Wallet-as-a-Service (WaaS) V2 eaarlier this month, emphasizing the growing demand for user-friendly web3 solutions. All this follows its $7m funding round closed in March 2023, backed by industry players like ABCDE, Animoca and Longhash Ventures.

Sept. 22: Brave, Electric Coin Co. (ECC) and Filecoin Foundation announced Friday on stage at Messari Mainnet that they are “teaming up to bring innovative new privacy features to the Brave browser and its integrated Web3 wallet,” according to a message from the group. “As one example, with support from ECC, Brave will integrate the Zcash protocol in the browser’s built-in crypto wallet so users can securely store, send, and receive ZEC alongside other cryptocurrencies. The three companies will also develop a privacy-based feature in the Brave browser that will offer private messages and media transmission.” ($ZEC, $FIL)

Sept. 24: Orb Technology, developer of Orb, a social media app based in the Lens Protocol ecoystem, raised $2.3M, according to a post on X.

Sept. 22: Google’s cloud-computing business is expanding its push into blockchain, adding 11 networks including Polygon, Optimism and Polkadot to Google Cloud’s ‘BigQuery’ program for public datasets. Other blockchains added recently to the BigQuery program include Avalanche, Arbitrum, Cronos, Ethereum’s Goerli test network; Fantom Opera; NEAR and Tron, according to a press release on Friday. ($AVAX, $ARB, $CRO, $ETH, $MATIC, $NEAR, $TRX)

Sept. 22: Mysten Labs, developer focused on the layer-1 blockchain Sui Network, has entered into a partnership with South Korea’s NHN Corp, a publicly traded global IT company, for its NHN Gaming division to enter the Web3 space. “NHN expects to launch its first web3 gaming projects in 2024. Mysten Labs and NHN will continue to collaborate on new use cases for the Sui blockchain in web3 game development,” according to a press release.

Sept. 21: Pocket Network, a multi-chain relay protocol that provides a decentralized Remote Procedure Call (RPC) infrastructure, “will deploy a new sovereign rollup on Celestia’s modular data availability layer (the first modular blockchain),” according to the team. Pocket Network is introducing a second gateway that will further decentralize how dApps access blockchain data, and Pocket Network Inc (PNI) has rebranded as Grove.

Sept. 21: Eco, a crypto-based payment system, “is sunsetting its U.S.-only fintech app” as its “doubling down on crypto-native products,” CEO Andy Bromberg wrote in a tweet. According to a message from the team: “Instead, they will focus on other self-custodial products like Beam (a global, non-custodial payments wallet), which has grown to over 80k users within the first month and a half. The combination of regulatory clarity for self-custodial wallets, plus new technology that enables such products to be built for the mainstream, means that it is the best area to focus energy on.”

Sept. 21: Stader, a non-custodial, multi-chain liquid staking protocol, announced the launch of rsETH, a “liquid restaked token,” according to a message from the team. “Users can restake multiple liquid staking tokens (LST) — including Coinbase Wrapped Staked ETH (cbETH), Lido Staked ETH (stETH), and Rocket Pool ETH (rETH) — across multiple networks simultaneously, improving security and accruing rewards from each network. The testnet phase is live. Participants will have the unique opportunity to restake their LSTs via Stader, offering an early experience of the rsETH ecosystem.”

Sept. 21: Freatic, a startup focused on information markets, emerged from stealth and announced it has raised $3.6M “to construct building blocks for trustless exchanges while accelerating the flow of information to maximize value from it,” according to a press release. (Investors: a16z crypto, Anagram, Archetype, Not3Lau Capital, Robot Ventures, Forward Research, Arweave, Stefano Bernardi, Meltem Demirors, Stephane Gosselin, Jutta Steiner, and MacLane Wilkison.) The news was first reported by Unchained.

Sept. 20: NEAR Foundation, which supports the NEAR blockchain ecosystem, announced a new dashboard on the project’s Blockchain Operating System, the “Mantle Ecosystem Gateway” – a “decentralized frontend” for the Ethereum layer-2 network Mantle, built by the Mantle team. According to a press release: “Hosted by popular Mantle dApp FusionX, this gateway streamlines discovery for Mantle applications, aggregating components of top dApps including the Mantle Bridge, Agni, Ammos, iZiSwap, FusionX, Gamma, Lendle, and soon, Pendle, in one place.”

Sept. 20: Fordefi, an institutional MPC wallet, announced the launch of their native integration for Cosmos, Cosmos appchains and the ATOM token. According to a message from the team: “Fordefi brings to the Cosmos ecosystem a fully integrated solution that enables clients with unprecedented transaction clarity and a best-in-class security infrastructure, that was previously inaccessible.”

Sept. 20: Vara Network, a layer-1 decentralized network created in partnership with the Gear Foundation and backed by Polkadot creator Gavin Wood, has launched its mainnet, marking “a leap forward in dApps,” according to a message from the team. “This platform simplifies the shift from Web2 to Web3 with user-friendly features, leveraging concepts like the Actor Model and Persistent Memory to enhance speed and eliminate delays. It introduces parallel processing and individual memory spaces for smart contracts, empowering developers in gaming, finance and more.”

Sept. 20: Cheqd, a startup focused on identity data, “announced the launch of Credential Payments, a new feature of its decentralized network and SaaS product, Credential Service,” according to a message from the team. “Organizations and individuals now have a way to get paid for providing their identity data while maintaining privacy, building infrastructure to create Trusted Data markets as an entirely new industry category.”

Sept. 20: Pyth, a blockchain data oracle, announced the launch of the Perseus Upgrade. “The Perseus upgrade will be a major improvement to the oracle network, significantly reducing gas costs for users while also decreasing latency and enhancing reliability,” according to a message from the team. “The upgrade brings several significant benefits to Pyth Network users including price updates that are up to 50-80% cheaper depending on the ecosystem and improvement to the path by which data flows from Pythnet, a network built on the Solana codebase, to other blockchains.”

Sept. 20: Algorand Foundation has opened registration for Build-A-Bull, a global virtual hackathon with $200,000 in prizes, for developers and entrepreneurs to “create consumer-friendly applications using the power and scalability of the Algorand blockchain,” according to a press release. It runs Oct. 18-Nov. 15 and includes five tracks: DeFi, Gaming, Consumer, Interoperability and Impact. The winner of each track will receive $25,000 and will be invited to pitch to investors, with a public on-chain vote determining an additional $10,000 Grand Prize, as well as $25,000 in AWS credits.

Sept. 19: Pyth, a blockchain data oracle, will provide price feeds to EON, the EVM-compatible smart-contracting platform for Horizen, according to a press release. “Currently, Horizen’s EON Alpha is live on mainnet and its permanent public testnet, Gobi, bolstered by an array of products, integrations, and tools, including Pyth Network. With the collaboration between Horizen and Pyth Network, the EON ecosystem is prepared to welcome a myriad of dApps and services in the coming months.” ($ZEN)

Sept. 19: Polkadot, the layer-1 blockchain ecosystem, and Circle, the stablecoin issuer, announced the launch of native USDC on Polkadot, according to a press release. “Additionally, Polkadot parachain Centrifuge is making USDC the native currency for its liquidity pools, so users will now be able to finance assets with both DAI and USDC – continuing to open up new ways to access financing on-chain.”

Sept. 19: Alumni from some well-known names in crypto and fintech are starting a new $60 million fund called Oak Grove Ventures to focus on the intersection of Web3, artificial intelligence and biotech. The Singapore-based team Sally Wang, formerly of Sino Global Capital (now Ryze Labs); Ethan Wang, former tech lead of Libra; Shawn Shi, co-founder of Alchemy Pay; as well as Michael Li, a former VP of Coinbase.

Sept. 19: Injective, a layer-1 blockchain built for finance on Cosmos SDK technology, announced the launch of “inEVM, the first-ever Ethereum Virtual Machine capable of achieving true composability across Cosmos and Solana,” according to a message from the team. “The inEVM network was developed in collaboration with Caldera, a layer-2 rollup infrastructure platform backed by Sequoia. InEVM is part of Injective’s larger plan to introduce a network of Electro Chains. In essence, this consists of a series of rollups with dedicated VM environments that would cater to the needs of distinct builders while still providing the highest levels of scalability and security. Electro Chains inherit security from Injective while also extending block space available on any one chain which directly contributes to a far more scalable network than what exists in Web3 today.”

Sept. 19: Metis, an Ethereum layer-2 solution, “is launching The Metis Journey, a $5 million community growth campaign designed to increase on-chain activity with a torrent of new wallets, users and transactions from other chains, as well as new blockchain users,” according to a press release. “The campaign will start by allocating 100,000 METIS tokens [about $1.15 million worth at the current price] to Aave Protocol V3, which powers one of the largest liquidity markets in DeFi, to incentivize supply and borrow activity. Platforms also receiving incentives include Hummus, Stargate, Synapse and Unimaia.”

Sept. 19: The Safe team provides the following update: “Ethereum security experts and developers have introduced ERC-7512, a new standard for on-chain audit report representation to bolster blockchain security. Introduced by security experts from Safe, Ackee Blockchain, OtterSec, ChainSecurity, OpenZeppelin and Hats Finance, ERC-7512 offers a crucial step toward enhancing smart contract security by standardizing on-chain audit representation.”

Sept. 18: Bastion, a startup that describes itself as an “enterprise-focused web3 orchestrator,” has secured $25M in seed financing led by a16z Crypto, with additional participation from Autograph, Laser Digital Ventures, Not Boring Capital, Robot Ventures, Alchemy Ventures and Aptos Ventures, according to a press release. The seed round will be used to scale Bastion’s operations, recruit top engineering talent and secure additional licensing to further diversify Bastion’s product offerings.

Sept. 18: Quasar Finance, a Cosmos-based yield aggregator, announced the launch of Concentrated Liquidity (CL) vaults on Osmosis, in collaboration with DeFine Logic Labs (DLL), according to a message from the team: “Quasar’s vaults are an essential DeFi infrastructure set to revolutionize liquidity provisioning (LPing) by making it easier than ever to navigate the complexities of managing profitable LP positions.”

Sept. 18: Blockchain Capital, a crypto-focused investment firm, has raised $580 million for two new funds – split between $380 million for its sixth early-stage fund, which will focus on newer companies and protocols in pre-seed and Series A rounds, and $200 million for its opportunities fund, which will target late-stage investments from Series B onward.

Sept. 18: Quickswap and Orbs sent a message that they’re launching “Uniswap X for L2s” Liquidity Hub, “bringing aggregated liquidity to any DEX-AMM – addresses the growing problem of liquidity fragmentation in DeFi, which results in higher prices for DEX traders. This partnership allows people to access the best price when liquidity is fragmented across 20+ decentralized exchanges. Going live on Quickswap today.”

Sept. 17: ZPrize, a competition with the goal of advancing zero-knowledge technology, is “kicking off ZPrize 2023,” according to a message from the organizers. “Teams will compete to win financial rewards of up to equity-free prize pool of $1.5 million in both U.S. dollars and tokens in a range of categories that aim to advance the development of practical and accessible ZK systems. ZPrize 2023 is supported by some of the biggest names in tech, including Aleo, AMD, Aztec, TrapDoor, SupraNational, Demox Labs, Ingonyama, ZKValidator, Cysic, and W3bCloud.”

Sept. 17: Sui Foundation has launched zkLogin, “a Web3 authentication solution that allows end users to login to decentralized applications,” according to a press release. “Developers can offer users the ability to authenticate with their favorite dApps using their existing accounts with Google, Facebook, Twitch and other third-party providers. Future plans include similar integrations with Microsoft, Apple, WeChat and Amazon.”

Sept. 17: Mantle EcoFund, based on a proposal approved by the project community in July and co-authored by Mirana Ventures and Mantle Core Contributor Team, announces first deployments and liquidity support provision under $200M ecosystem fund, with investments in LiquidX and Valent (a decentralized money market) and liquidity support for Range Protocol, an on-chain asset-management platform.

Sept. 15: Crypto custodian BitGo and bitcoin financial services firm Swan plan to form a BTC-only trust company as a means of offering custody without exposure to the rest of the digital asset market.

Sept. 14: Polygon, the Ethereum scaling solution, published three improvement proposals expected in the fourth quarter following community endorsement, with “the technical details for Phase 0 of building a network of interconnected zero knowledge-powered L2 chains that scale Ethereum to the size of the Internet,” according to a blog post. The proposals specify steps to upgrade the project’s native MATIC token to POL as the native gas token and staking token for Polygon PoS, as well as the launch of the staking layer.

Sept. 14: Movement Labs raised $3.4M pre-seed to develop an SDK and an adjacent Move-based blockchain called M1. According to a message from the team: “This round of investors was led by Varys Capital, dao5, Blizzard The Avalanche Fund, Borderless Capital and their Cross-Chain Fund focused on the Wormhole ecosystem with participation from Colony, Interop Ventures, Elixir Capital, BENQI and others notable partners. The raise also involved angel investors, such as dao5’s George Lampeth, Eigenlayer’s Calvin Liu, Berachain’s Smokey The Bera, Avail’s Anurag Arjun, GMX’s CoinFlipCanada and the co-founders of Ankr.”

Sept. 14: Manta Network is deploying Manta Pacific, its native layer 2 ecosystem following a $25 million raise at the beginning of this summer. According to the team: “The deployment of Manta Pacific comes after a successful one-month testnet run which saw 150,000 wallets globally initiate over 3.5 million transactions.”

Sept. 14: Astar Network, a Japan-focused enterprise and entertainment blockchain driving the Web3 initiatives of Sony and Toyota, plans to launch Astar zkEVM based on Polygon Chain Development Kit (CDK) technology. Originally based in the Polkadot ecosystem, “We are aiming to become a gateway to connect the Ethereum and Polkadot ecosystems. Astar is committed to enabling interoperability between the existing Astar VMs and enhancing cross-contract interoperability for other dApps to tap into in collaboration with partners like LayerZero and Gelato,” according to a blog post.

Sept. 14: LayerZero Labs, the team behind the cross-chain messaging protocol LayerZero, has formed a new collaboration in which Google Cloud will “serve as LayerZero’s default oracle for securing messages on the LayerZero network,” according to a press release.

Sept. 14: OnFinality announced plans to provide enterprise-level blockchain infrastructure and tooling support funded by the Polkadot treasury and build on Google Cloud for more than 40 Polkadot parachains. “In the longer term, OnFinality has proposed setting up a Parachain Infrastructure Bounty with more than 10 other solution providers to deliver provider-agnostic common good infrastructure for all active Polkadot parachains,” according to a blog post.

Sept. 14: Orderly Network will be a DeFi infrastructure provider on Google Cloud Marketplace, Cointelegraph reported. Google Cloud’s head of Asia-Pacific Web3 GTM, told Cointelegraph that the partnership was struck in light of increasing interest from clients exploring blockchain workloads on Google Cloud.

Sept. 14: BNB Chain developers said Wednesday that the opBNB network, a layer 2 based on OP Stack, is going live after months of testing in which no major bugs were encountered. The blockchain processed a maximum of 4,000 transactions per second (TPS) in that period – a significantly bigger number than Ethereum’s current 17 TPS.

Sept. 14: Messaging app Telegram has endorsed the TON network as its blockchain of choice for Web3 infrastructure, and will integrate it into the app’s user interface. A self-custodial version named TON Space is being rolled out to all Telegram users outside the U.S. The rollout should be completed by November, TON Foundation said in an email.

Sept. 14: Zodia Custody, a cryptocurrency storage provider that’s a subsidiary of the London-based banking giant Standard Chartered (STAN), will provide institutional support for the Polkadot blockchain through a new partnership with Parity Technologies, one of the network’s leading developers.

Sept. 14: Staking services company ssv.network is today releasing a blockchain it says will help decentralize staking for Ethereum and other blockchains to counter concerns the process is dominated by a few large participants. The SSV mainnet is the largest implementation of a staking network that uses a Distributed Validator Technology (DVT) network, the developers said.

Sept. 14: Grab, a consumer app in Southeast Asia, plans to conduct a pilot for a Web3 wallet along with stablecoin operator Circle. The Grab Web3 Wallet will be available to users of the ride hailing, food delivery and digital payments app in Singapore to use vouchers in non-fungible token (NFT) form and earn rewards and collectibles, the companies said.

Sept. 14: Thailand-based Kasikornbank (KBank) has started a $100 million fund to target artificial intelligence (AI), Web3 and fintech startups globally.

Sept. 14: Islamic Coin has entered into a memorandum of understanding with CoinDesk Indices to discuss building Shariah-compliant crypto benchmarks for the Middle East and North Africa markets. HAQQ, a blockchain focused on creating a Shariah-compliant financial system and the home of Islamic Coin, will get access to CDI’s API for selected digital assets, including for its digital asset exchange.

Sept. 14: ReTool, a cloud provider with Fortune 500 clients, was the third-party vendor blamed for the theft of $15 million of cryptocurrency at Fortress Trust, people familiar with the matter told CoinDesk. The theft accelerated blockchain tech company Ripple’s agreement to acquire Fortress.

Sept. 12: Particle Network, Web3 infrastructure provider, “has unveiled V2 of its Wallet-as-a-Service (WaaS) solution,” according to a message from the team. “Major enhancements have been made to privacy, user experience, and transaction efficiency with the latest version…. V2 introduces a number of new technologies including a zero knowledge (ZK) component and a protocol layer that prioritizes user privacy and security. This takes the form of Intent Fusion Protocol, which sits between the blockchain and dapp layers to support confidential transactions and authentication.”

Sept. 11: Safe, an institutional grade crypto wallet provider, has “launched its modular account abstraction stack on Polygon zkEVM, the leading ZK scaling protocol equivalent to Ethereum Virtual Machine,” according to a statement from the team. “Developers on Polygon zkEVM can now leverage Safe{Core} SDK to fully harness the power of smart wallets and modular account abstraction for a plethora of use cases, including gaming, retail wallets, decentralized social media, etc., with game-changing features like social recovery, seedless onboarding, and easy on-ramping.”

Sept. 11: Sushi, one of the longest-running decentralized exchanges (DEX), has expanded to the layer-1 blockchain Aptos.

Sept. 11: Animoca Brands raises $20M for metaverse project Mocaverse. The capital was raised through the sale of Simple Agreements for Future Equity (SAFEs) for about A$4.50 ($2.90) each, which will be automatically converted into ordinary shares after six months. Investors included CMCC Global, Kingsway Capital, Liberty City Ventures, GameFi Ventures, with Animoca co-founder Yat Siu participating in a personal capacity.

Sept. 10: Unstoppable Domains, a digital identity platform, “is broadening its support for Unstoppable Messaging to include Ethereum,” according to a statement from the team. “This expansion means that users with Ethereum Name Service (ENS) Domains will now have the capability to engage in messaging across various platforms on XMTP — including apps like Coinbase Wallet and Lens, by typing in their wallet address or domain. In July, Unstoppable integrated .eth domains, allowing anyone to natively buy via its website, and introduced novel features to help bring a new audience to .eth. Now, users can now buy their .eth, .nft, .crypto, and .polygon domains in one place.”

Sept. 10: Consensys, the Ethereum developer, plans to launch a decentralized version of its Infura platform by the end of the year, Cointelegraph reported, citing a comment last week by the firm’s head of strategy, Simon Morris. Infura provides APIs and other software tools to assist app developers on Ethereum.

Sept. 7: Binance, the world’s largest crypto exchange by trading volume, has “completed the integration of Ethereum (ETH) on the zkSync Era network,” according to a web post Thursday. “Deposits and withdrawals for Ethereum (ETH) tokens are now open on the zkSync Era network.”

Sept. 7: “JPMorgan is in the early stages of exploring a blockchain-based digital deposit token for speeding up cross-border payments and settlement, according to a person familiar with the work,” Bloomberg reported. “The deposit token would function differently from JPM Coin, as it could be used to easily send money to clients of another bank, the person familiar with the work said. It is also well-suited for settlement of trades of tokenized securities, or financial instruments issued on a blockchain.”

Sept. 7: According to the dYdX Foundation, in a semi-annual report: “There are around 57+ validators participating in dYdX Trading’s v4 Public Testnet #2. The current Public Testnet block time is approximately 1.8 seconds, and there have been over 2.9 million transactions and 2.9 million bonded tokens on the Testnet.” DYdX, which is moving toward launch of its own blockchain built with Cosmos SDK, started Testnet #2 in August after running a Testnet #1 since June.

Sept. 7: Trident Digital Group, a startup headed by Anthony DiMartino, Coinbase’s head of risk strategies and institutitonal DeFi, raised $8M in a seed round, The Block reported. (White Star Capital, New Form, CMT Digital, Joint Effects, Permit Ventures)

Sept. 7: Compound, the DeFi lender, said Thursday in a newsletter it has launched on Base, the layer-2 blockchain from Coinbase. According to a post from the team: “Compound currently features a bridged USDC market, and ETH market on Base. ETH and cbETH can be used as collateral to borrow bridged USDC, or cbETH to borrow ETH in each respective market.” (The move was previously publicized in a post on X (formerly Twitter) on Aug. 14.)

Sept. 7: IoTeX, which supports an Ethereum-compatible (EVM) layer-1 blockchain designed to accommodate smart devices as in the so-called “Internet of Things” (IoT), publicized that it was one of 18 recipients of grants in the Ethereum Foundation’s “ERC-4337 Account Abstraction grant round.” According to an email from the team: IoTeX “proposed leveraging zero-knowledge proofs (ZKPs). IoTeX’s ZKP-based account abstraction wallet enhances and broadens the potential of on-chain gaming, DeFi, DeSocial, and DePIN, among other applications…. The wallet uses zkSNARK to confirm account access: If users have the correct password, they can use a prover to generate valid proof that unlocks the account. The on-chain smart contract then verifies this proof to authenticate the transaction.”

Sept. 6: Story Protocol, set up to track intellectual property, conducted a follow-on fundraising in the third quarter, which, in conjunction to an earlier seed round, brings the total raised by the project to $54 million, according to the team. Investors include Andreessen Horowitz (a16z), Hashed and TPG Capital’s David Bonderman.

Sept. 6: Casa, a smart contract wallet provider, has introduced a new feature “ETH Pay Wallet Relay” that “offers greater privacy for people who prefer their on-chain ETH addresses not to be connected to Casa,” according to the team: “This relay uses the key from your ETH Pay Wallet to broadcast transactions to the ETH network.”

Sept. 5: Premium domain names might be worth hundreds of thousands of dollars, if not more, and have a carry cost of not more than $10 a year. But how would you get liquidity from a one-word domain name – worth a fortune on paper – if there are no buyers? Tokenization. D3 has closed a $5 million round, looking to do just that, as well as working with stakeholders such as ICANN to register Web3 top-level domains, the recognizable suffixes that direct domain names to servers. The round was led by Shima Capital with participation from Lightshift, Dispersion Capital, VentureSouq, Infinite Capital, MZ Web3 Fund, Kestrel0x1, Nonagon, C² Ventures, Arthur Hayes’ Maelstrom and Identity Digital founder Paul Stahura.

Sept. 5: Endaoment.Org, which says it’s the first on-chain 501(c)(3) nonprofit community foundation and donor-advised fund platform, has expanded its platform to Base. According to the team: “Originally available exclusively on Ethereum, Endaoment’s deployment on Base makes crypto giving more accessible while reducing transaction costs, making small gifts more affordable for donors. The deployment brings more than 7,000 new verified donation endpoints for nonprofits across 150+ countries. This integration opens new donation revenue streams for nonprofits and ensures more funds go directly to a cause, rather than fees.”

Sept. 5: Blockchain network developer Cronos Labs has started looking for eight startups to take part in the third cohort of its $100 million accelerator program aimed at supporting early stage crypto projects. The recruitment phase of the 12-week program commenced Sept. 4 to coincide with the start of Korea Blockchain Week, which runs until Sept. 10, and has a particular focus on artificial intelligence.

Sept. 5: Btrust, a non-profit organization that aims to “decentralize development of Bitcoin software,” said it acquired Qala, an organization that trains African Bitcoin and Lightning engineers, on Sept. 1. Qala will be rebranded as the Btrust Builders Programme. Btrust was originally funded by Block and Twitter co-founder Jack Dorsey along with the record producer Jay-Z.

Sept. 4: P2P.org, an infrastructure provider on Ethereum that specializes in non-custodial staking, announced on Aug. 31 that it “has launched a smart contract that enables users to stake up to 12,800 ETH from a single wallet in just one transaction instead of the usual 3,200 ETH limit,” according to an email from the team.

Sept. 4: Trust Machines, a startup developing applications for the Bitcoin blockchain and led by Stacks co-creator Muneeb Ali, announced on Aug. 31 that it has acquired wallet assets from Hiro Systems (where Ali serves as chairman) and has now launched its own flagship Bitcoin wallet brand, Leather. According to a blog post, the wallet can secure and manage bitcoin (BTC), Stacks L2 (STX) and BRC-20 tokens, and can be used to create, trade and transfer Ordinals, Stacks NFTs and Bitcoin Stamps. The former Hiro Wallet had 375,000 total installations and more than 100,000 monthly active users, according to the company.

Sept. 3: Stroom Network, a Kiev, Ukraine-based liquid-staking protocol on Bitcoin’s Lightning Network that allows users to yield-farm on Ethereum-compatible DeFi ecosystems, raised $3.5M in seed round. (Greenfield, Lemniscap, No Limit Holdings, Cogitent Ventures, SMAPE Capital)

Sept. 3: Argent, Ethereum smart wallet, has formed a partnership with Starknet Foundation “to launch a new startup studio, dedicated to building the next generation of use cases in crypto. Hito Studios will seek to attract the best and brightest founders in crypto, helping them launch and spin out new startups on Starknet, while also providing initial investment. Hito Studios will also provide ongoing support in key areas, including ideation and team formation, engineering, legal and growth,” according to a statement from the team.

Aug. 31: Herodotus, a year-old, London-based startup developing infrastructure and tooling to help developers use storage proof technology on Ethereum, has released an “on-chain accumulator” based on a custom instance of Starkware’s shared prover. “Herodotus’s new accumulator technology will enable users to read data from any point in Ethereum’s history including the Genesis block,” according to a press release shared with CoinDesk. The technological development could be useful “for account recovery mechanisms where verifying on-chain data from the past and present could play a vital role in triggering a dead man’s switch, or for insurance protocols that rely on historical on-chain events for payouts or providing coverage,” the team wrote.

Aug. 31: ChainLight, a blockchain security firm specializing in smart-contract audits and on-chain monitoring, has launched the second version of Relic Protocol, a data indexing protocol, on zkSync, a layer-2 network atop Ethereum. According to a press release, the update provides developers with “trustless access to historical Ethereum data. Various protocols can use this wealth of previously inaccessible data to enhance functionalities. For instance, a lending protocol could use historical data to determine collateral volatility to adjust risk parameters trustlessly.”

Aug. 31: Offchain Labs, the primary developer of the Ethereum optimistic rollup Arbitrum, on Thursday released Arbitrum Stylus, a new technical implementation that allows developers to build smart contracts using programming languages that are compatible with the WebAssembly industry standard format, also known as WASM. The offering, now available for use on a test network, means developers can program with popular coding languages like Rust, C and C++ alongside languages that are compatible with the Ethereum Virtual Machine, or EVM standard, which is far more common among today’s crypto developers.

Aug. 29: Casper Association, the Swiss-based organization that oversees the Casper blockchain, said its new “1.5” upgrade comes with unique “Speculative Execution Endpoint” feature, making the project “the only Layer-1 blockchain to enable the debugging of live, composable smart contracts on mainnet.”

Aug. 29: Alchemy, a platform for developing Web3 applications, has added support for Base, Coinbase’s layer-2 network on Ethereum.

Aug. 29: OpenZeppelin, a provider of blockchain security solutions, released the 2.0 version of its Defender platform, which provides automatic code analysis and can be used for ongoing monitoring of threats and automation of community governance proposals; developers and operators can use the tool to prevent and fix security issues pre- and post-deployment, according to the team.

Aug. 29: The team behind Interlay, a decentralized network designed to provide DeFi tooling for Bitcoin, announced plans for BOB, a new Bitcoin layer-2 network compatible with Ethereum’s EVM software environment, “featuring Rust smart contracts compatible with Bitcoin libraries such as Lightning and Ordinals.”

Aug. 29: Helix, a decentralized orderbook exchange built on the Injective network, announced the launch of Helix Institutional, which “enables the trading of DeFi derivatives products in a permissioned, KYC-enabled environment.” Currently Helix offers trading in perpetual futures contracts on bitcoin (BTC), ether (ETH), Cosmos’s ATOM and Injective’s INJ. Injective is a layer-1 blockchain built with Cosmos software and featuring “instant transaction finality” for financial applications.

Aug. 28: Token withdrawals out of the Shibarium bridge are now live and available to users, weeks after a much-hyped launch quickly fizzled out after being riddled with software bugs that led to millions of dollars in limbo on the network. Shibarium is an Ethereum layer-2 network, created via a fork of Polygon, that uses SHIB tokens as fees in what is part of a broader plan to position Shiba Inu as a serious blockchain project.

Aug. 27: Binance Labs wrote in a blog post that it has invested in Delphinus Lab, an infrastructure provider that is “leading the zkWASM space, where zero-knowledge (ZK) cryptography is deployed in WebAssembly (WASM) environments.” The funds will be used for development of Dephinus’s zkWASM-based application rollup platform, zkWASM Hub, according to the post. WASM is a programming environment used by several blockchains, including Cosmos and Polkadot, often positioned as an alternative to the Ethereum Virtual Machine or EVM, that’s used by the Ethereum blockchain (and associated layer-2 networks) as well as Binance Smart Chain and Avalanche.

Aug. 24: Radix Publishing, publisher of code for Radix, a layer 1 smart-contract platform, said the final update of its two-year-old Olympia Protocol would be released at the end of August, as part of the move toward Radix’s Babylon mainnet migration at the end of September.

Aug. 24: Pancake Swap, a decentralized exchange, has expanded to the Ethereum layer-2 blockchain Linea, from the big Ethereum developer Consensys. PancakeSwap was already available on Ethereum, BNB Chain, Aptos, Polygon zkEVM, zkSync Era and Arbitrum.

Aug. 23: \ Domains, a provider of digital identities that include crypto addresses, said it has launched a new “messenger feature powered by XTMP that allows owners of UD domains — or any Web3 wallet address — to chat with each other across the blockchain. You can use it for any kind of decentralized, end-to-end encrypted messaging. This could be as simple as making plans with a friend. You could even use it to negotiate an NFT trade or domain purchase. Many people in Web3 use their domain as an alias, meaning Messaging can support Web3 community building.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

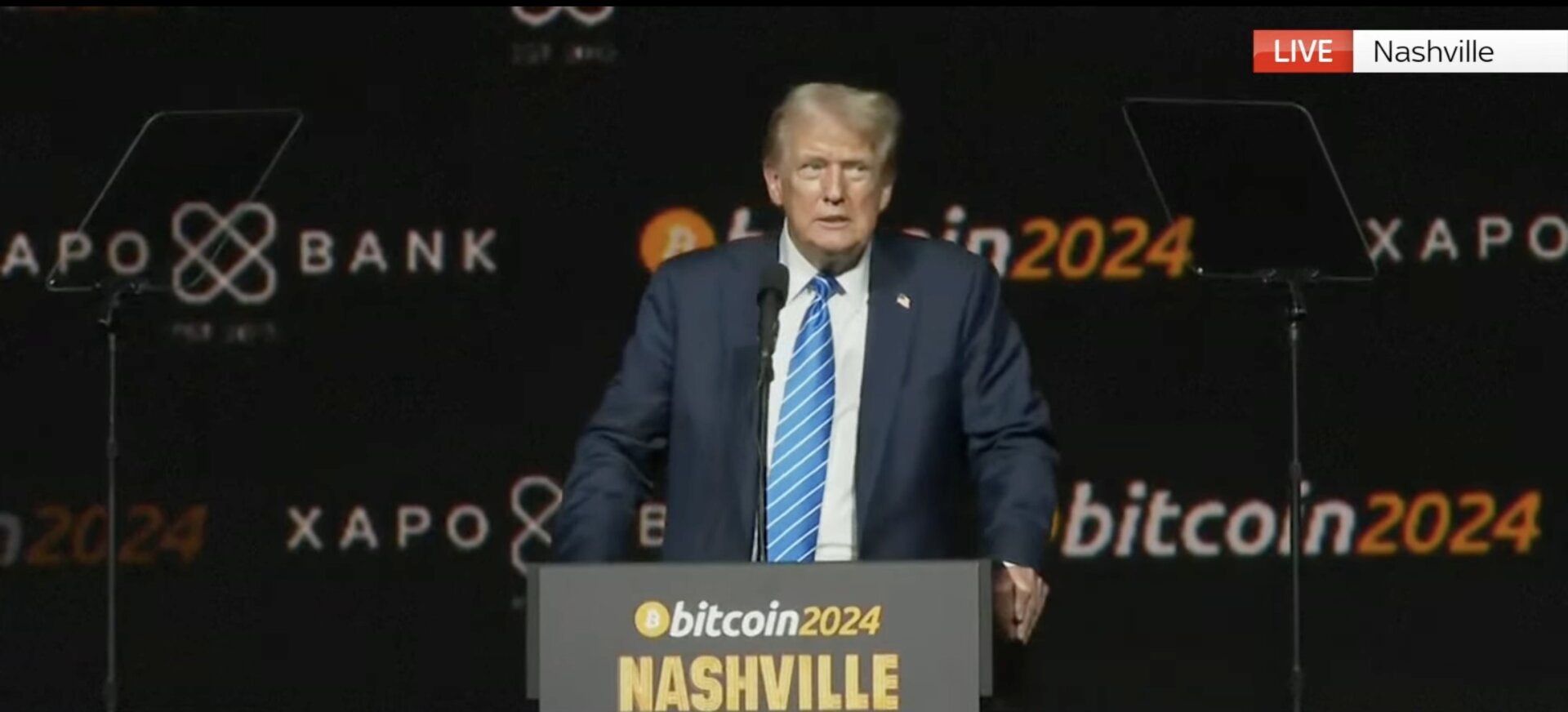

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News11 months ago

News11 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins11 months ago

Altcoins11 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto