DeFi

Breaking DeFi Barriers: Overcoming Liquidity Fragmentation with Omnichain Trading Infrastructure

By unifying liquidity across blockchains, streamlining the trading experience, and providing robust support for diverse trading needs, omnichain infrastructure is revolutionizing DeFi, driving efficiency and broader market participation.

As decentralized finance (DeFi) continues to grow, a critical problem of liquidity fragmentation has emerged. A investigation points out that over $100 billion in assets are locked in DeFi protocols, but fragmented liquidity reduces overall market efficiency.

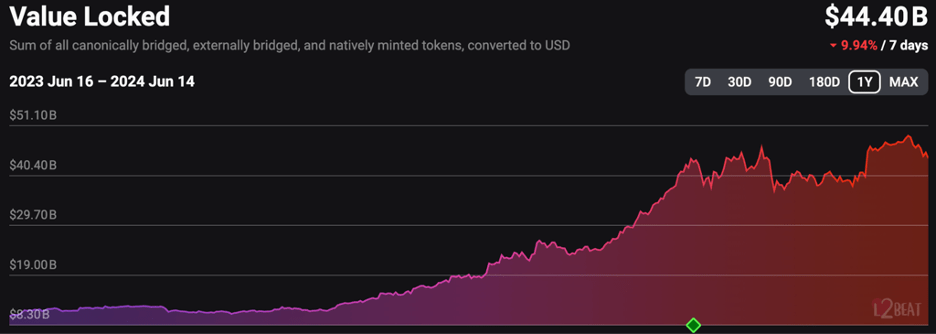

A report predicts that Layer 2 (L2) solutions, designed to increase blockchain scalability, will propel Ethereum’s market cap to $1 trillion by 2030. watch that the number of L2 networks on Ethereum has increased by 40% over the past year, worsening the problem of fragmentation.

Cumulative total value locked Ethereum L2. Source: L2beat

Another study finds that reconciling assets across L2s increases processing times by 30% and costs by 25%, contributing to user frustration and market inefficiency. When assets and transaction volumes are scattered across different L2s, users need to bridge different layers, leading to high transaction costs and security risks.

These challenges not only discourage casual users, but also pose a barrier to broader adoption of DeFi, highlighting the importance of interoperability and the importance of multi-chain alternatives.

Orderly Network: Redefining DeFi with Cross-Chain Solutions

A permissionless liquidity layer for Web3 trading, Ordered network aims to redefine DeFi by providing a robust omnichain trading infrastructure that unifies liquidity across different blockchains. This approach addresses critical challenges in the DeFi sector by providing liquidity and settlement support for any asset, chain or interface, thereby improving efficiency and trading experience across various platforms.

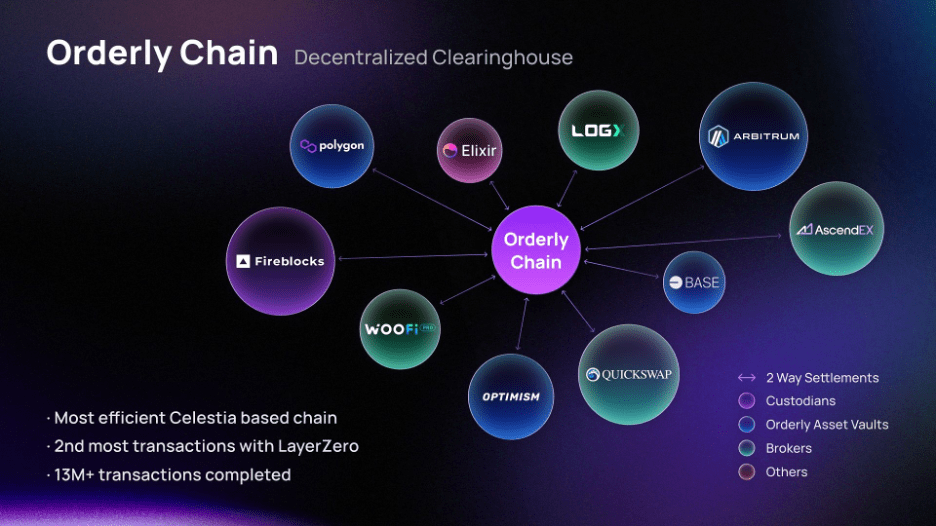

To achieve these capabilities, Orderly has implemented the Orderly Chain, which serves as the primary settlement layer and ledger for all transactions, including user balances and trading data. The platform is built on OP Stack, which facilitates the development and deployment of blockchain applications.

Orderly Network combines an order book-based trading system with a liquidity layer for spot and perpetual. Source: Ordered Network

The ordered chain leverages Celestia’s data availability to ensure constant access to data and LayerZero’s cross-chain protocol to facilitate seamless transfers between blockchains. As one of the most active protocols on LayerZero, Orderly ensures smooth operation even during potential downtime of the corresponding engine order book. This resilience allows brokers to manage trading positions and user balances without interruption with confidence. According to recent data, Orderly is the largest user of the Celestia network, accounting for over 35% of its data. It also remains the second largest protocol on LayerZero, accounting for 28% of all messaging on LayerZero.

Orderly’s system offers cross-network features that improve transaction efficiency, increase liquidity, tighten spreads, and integrate features that were previously inaccessible in DeFi. This functionality is similar to the CME operating model in traditional finance. Orderly Network aims to improve and solve the problem of fragmented liquidity.

With its robust trading system and liquidity layer, it not only supports the continued development of the ETH ecosystem, but also extends its benefits to other blockchains. Orderly functions as an omnichain trading and transaction platform, facilitating seamless transactions across various blockchain networks.

Versatile solutions for enhanced trading across all platforms

Orderly Network supports various use cases by offering a permissionless liquidity layer for Web3 trading. Wallets and custodians can leverage the network to provide users with optimal swap rates for major assets and create custom swap widgets. Sophisticated trading desks and traders benefit from Orderly’s API, which provides a centralized exchange-level experience with low-latency order execution.

Spot aggregators can leverage Orderly’s vast liquidity to obtain market-leading rates, generate volume and earn trading fees. Perpetual aggregators can access the shared order book and liquidity to develop integrated front ends to the perpetual ecosystem.

Orderly Network deploys its omnichain vaults across major chains. Source: Ordered Network

Games and decentralized applications (dApps) can improve user experience by integrating Orderly’s in-game widget for seamless token exchanges. Trading robots can access the highest and perpetual rates with features like stop-loss and limit orders, gas-free trades, and customizable fees.

Additionally, Orderly provides comprehensive hedging tools that help protect positions on other exchanges with its extensive order book, ensuring effective risk management strategies.

Driving Growth and Expanding the DeFi Landscape

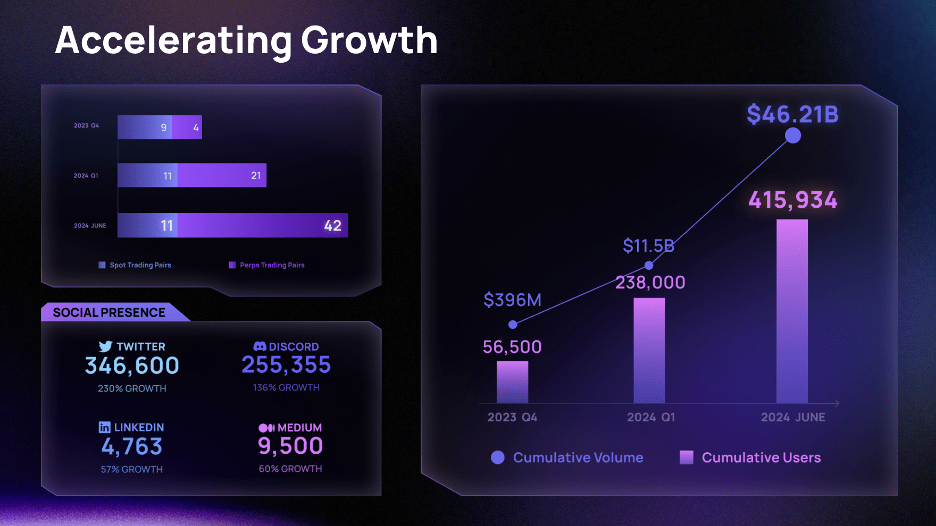

Orderly Network achieved significant milestones, including surpassing $50 billion in cumulative trading volume and seeing a 100% increase in total value locked (TVL) to $40 million in just one month. The network has deployed vaults in six major blockchain ecosystems: Near, Polygon, Arbitrum, Optimism, Base and Mantle. It has also expanded its infrastructure to include the Ethereum mainnet, simplifying deposits and withdrawals between Ethereum and other supported chains. With support for over 14 DEXes, Orderly ranks in the top five on DeFiLlama’s lists.

Orderly Network has seen consecutive quarterly increases in cumulative transaction volume and number of users. Source: Ordered Network

Highlighting the importance of liquidity in the dynamic DeFi landscape, Ran Li, co-founder of Orderly Network, said: “As pioneers of omnichain, we provide various users with liquidity support and settlement for any asset, any chain or any interface. We are excited to see how this next phase plays out and continue to push the boundaries of DeFi trading together.

Innovating with the Omnichain SDK and future developments

Orderly introduced its Omnichain SDK, designed to streamline the development of perpetual protocols and advanced trading tools for EVM developers. This toolkit, operating as a plug-and-play system, allows developers to quickly create perpetual DEXs based on a backlog, significantly reducing the development time and effort of Web3 teams.

In preparation for its symbolic launch, Orderly Network has launched “The Road to the Order” campaign, a gamified initiative that rewards active traders with “merits” for each trade. These merits will contribute their share of the next airdrop after the token generation event. The campaign, currently in its 11th year, has already engaged over 57,000 weekly active traders, who can track their progress and rewards via a dedicated webpage.

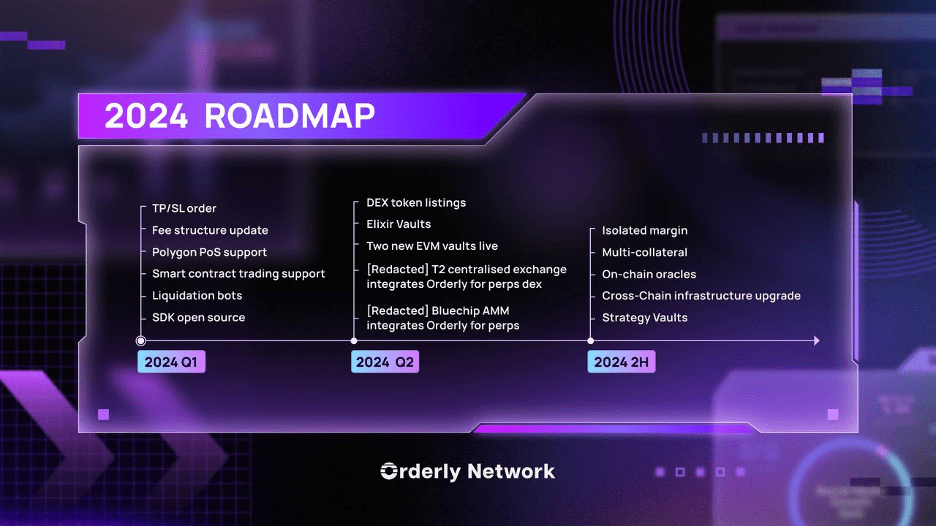

Orderly Network’s roadmap contains ambitious goals for the second half of 2024. Source: Orderly Network

Looking ahead, Orderly Network plans to improve its platform capabilities and user experience in the second half of 2024 with initiatives such as the introduction of isolated margins to improve risk management and trading flexibility. This feature will allow traders to assign specific amounts of margin to individual positions, thereby limiting potential losses. Another important addition is the multi-collateral feature, which will increase the versatility of the platform by allowing investors to use various assets as collateral for their positions.

Ordered network also plans to integrate on-chain oracles to provide continuous, transparent and diverse data sources for pricing, improving the reliability and security of the platform. As Orderly continues to grow and introduce new features, it aims to set new standards for liquidity and risk management in DeFi, facilitating smoother and more efficient trading experiences.

Social connections

Official site | Twitter | Telegram | Discord | Linkedin

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!