Tech

Bitcoin Plummets From All-Time High; Tech Drags Down Indexes

Equity Indexes Wrap: Mag Seven (Minus Nvidia) Weighs on Indexes; Discount Retailers, Energy Gain

March 05, 2024 04:13 PM EST

The Dow

Walmart (WMT) gained 1.2% after competitor Target reported better-than-expected earnings.

Intel (INTC) led the index lower, falling 5.4%. It was followed by tech peers Salesforce (CRM), down 5%, and Microsoft (MSFT), down 3%. Amazon (AMZN) shed 2%.

Apple (AAPL) fell 2.8% after a report suggested iPhone sales in China fell 24% year-over-year in the first six weeks of the year.

The S&P 500

Target (TGT) soared 12% after its quarterly earnings topped Wall Street estimates.

Dialysis provider DaVita (DVA) gained 7.1% after data showed Novo Nordisk’s (NVO) Ozempic was a less effective treatment for kidney disease than analysts had expected.

Regional bank stocks advanced. Citizens Financial Group (CFG) rose 5.2%, Zions Bancorp (ZION) advanced 4.5%, and Comerica (CMA) gained 3.8%.

Nvidia (NVDA) was the only stock in the Magnificent Seven to rise on Tuesday. It rallied the last 30 minutes of the session to close 0.9% higher.

Albemarle (ALB) plummeted 17.9% after it announced a $1.75 billion depositary shares offering as it seeks to weather a prolonged slump in lithium demand and prices.

Meta Platforms (META) slipped 1.5% amid widespread Facebook, Instagram, and Threads outages.

Advanced Micro Devices (AMD) ticked down 0.1% after the Commerce Department said the chip maker would still need a license to sell to China a semiconductor that was specially designed to meet U.S. export controls.

The Nasdaq 100

Energy stocks advanced as investors shunned growth in favor of value. Baker Hughes (BKR) added 2.5% and Diamondback Energy (FANG) rose 0.7%.

Dollar Tree (DLTR) gained 1.8% after Guggenheim raised its price target to $170 from $155 and reiterated its buy rating.

The index’s highest-flying tech stocks were some of its largest losers on Tuesday. MongoDB (MDB), up more than 80% in the past year, fell 7.7% while CrowdStrike Holdings (CRWD), which has seen its share price more than double in the last 12 months, tumbled 5.2%.

Tesla (TSLA) fell 3.9% after a suspected arson forced it to halt production at its Berlin factory.

Starbucks (SBUX) dipped in the market sell-off even though a coalition of unions representing its workers withdrew its board nominees, citing progress in negotiations.

GitLab Stock Plunges After Issuing Disappointing FY Earnings Guidance

March 05, 2024 03:30 PM EST

GitLab (GTLB) shares plunged Tuesday after the software infrastructure company disappointed investors with weak full-year earnings guidance.

The San Francisco-based company, which operates an open-source repository development platform for coders, said it expects full-year fiscal 2025 adjusted earnings of between 19 and 23 cents per share, with the high end of that forecast coming in significantly below Wall Street’s modeling of 35 cents a share.

For the fiscal 2024 fourth quarter, ending Jan. 31, the company disclosed adjusted earnings of 15 cents per share on revenue of $163.8 million, surpassing analysts’ expectations of 8 cents a share on sales of $157.9 million.

Source: TradingView.com.

GitLab shares have carved out a textbook inverse head and shoulders pattern over the past 18 months—a chart formation that often signals a market bottom. However, the price looks set to break down below the pattern’s neckline after the company’s disappointing earnings outlook.

Investors should keep an eye on the $57.50 level, which may find support from a trendline connecting the formation’s head and right shoulder. A close below the right shoulder would invalidate the pattern and could lead to a retest of the stock’s record low at $26.24 set in May last year.

GitLab shares were down 20.5% at $59.21 with about half an hour left in the session.

Albemarle Tumbles on $1.75 Billion Depositary Shares Offering

March 05, 2024 02:43 PM EST

Shares of lithium miner Albemarle (ALB) plummeted Tuesday after the company said it would sell $1.75 billion of depositary shares in a public offering as it seeks to weather a prolonged slump in lithium prices.

Each depositary share will represent a 1/20th interest in a share of preferred stock, and holders of the depositary shares will be entitled to a proportional interest in the rights of preferred stockholders. The terms of the listing also give the offering’s underwriters a 30-day option to purchase up to an additional $262.5 million of depositary shares.

Albemarle said it would use the proceeds for general business purposes, which could include funding the construction and expansion of operations in Australia and China.

Albemarle, one of the world’s largest lithium miners, has struggled with lower lithium prices over the last year amid a slowdown in demand for electric vehicles, which often contain lithium-ion batteries. Prices began plunging in November 2022 as EV demand flagged under the weight of higher interest rates, leading carmakers to scale back their EV ambitions.

On Tuesday, lithium carbonate traded in China at about 108,500 yuan ($15,076) per metric ton, down about 70% from a year ago. And experts see few signs of improvement. Goldman Sachs analysts on Tuesday forecast lithium prices would fall 25% in the next 12 months, suggesting they see lithium slipping as low as $10,000.

SoFi Slumps on Plan To Sell Up To $862.5 Million in Convertible Bonds

March 05, 2024 01:34 PM EST

Shares of SoFi Technologies (SOFI) tumbled 13% Tuesday, after the online financial services provider said it was planning to sell up to $862.5 million in convertible bonds.

Convertible bonds are a fixed-income corporate debt security that pay interest but can also be converted into a predetermined number of common stock or equity shares. SoFi’s share price drop reflects the potential dilution to existing shareholders if the bonds are converted into stock, although SoFi said it will use part of the proceeds to pay for capped call transactions to limit that dilution.

Essentially, it means SoFi will be buying a form of call options on its own stock.

SoFi said it would be offering $750 million in convertible senior notes due in March 2029. In addition, initial investors will have the option to purchase another $112.5 million within a period of 13 days from when the notes are first issued.

SoFi shares were down 14.3% at $7.35 Tuesday afternoon, and are about 26% lower this year.

Dialysis Stocks Soar After Ozempic Kidney Disease Data Disappoints

March 05, 2024 12:50 PM EST

Shares of dialysis companies surged Tuesday after Novo Nordisk (NVO) reported results from a trial of Ozempic as a kidney disease treatment that fell short of some analysts’ expectations.

Novo Nordisk said on Tuesday that Ozempic reduced kidney disease progression and the odds of cardiovascular or kidney death by 24%. The trial, called FLOW, compared outcomes for 3,533 people with type 2 diabetes and chronic kidney disease, who were either given 1 mg injections of Ozempic or a placebo. The trial was ended last October, a year ahead of schedule after preliminary data demonstrated the drug’s efficacy.

The results add to a growing body of evidence that GLP-1 agonists, like Novo’s Ozempic and Wegovy and Eli Lilly’s (LLY) Mounjaro, have uses beyond diabetes treatment and weight loss. In August, Novo published data showing Wegovy reduced patients’ risk of major cardiovascular events by 20%.

The results, however, weren’t quite what analysts and investors were expecting. Novo Nordisk shares were down more than 2.7% Tuesday afternoon, while dialysis providers soared. DaVita (DVA) climbed 7% to $134, while Fresenius Medical Care (FMS) rose more than 11% to nearly $21.

Apple Stock Slips as China iPhone Sales Plunge 24% in First Six Weeks of Year

March 05, 2024 12:18 PM EST

Apple’s (AAPL) sales of iPhones in China, its biggest overseas market, fell by 24% over the first six weeks of this year, according to market research firm Counterpoint.

The data follows Apple’s disclosure last month that its Greater China sales during the fiscal first quarter fell 13%.

The iPhone maker’s market share in China fell to 16% in the first weeks of 2024, falling to fourth place from second place in 2023, when it had a 19% share. Chinese retail giants JD.com, TMall, and Pinduoduo are offering steep discounts on Apple’s iPhone 15 just five months after launch to generate demand.

Apple shares were down 2.7% midday Tuesday. They have lost about 11% of their value so far this year.

Tesla Stock Slides as Arson Halts Production at Berlin Plant

March 05, 2024 10:46 AM EST

Tesla (TSLA) shares slid in early trading on Tuesday after the electric vehicle maker was forced to halt production at its Berlin factory following an arson attack on a nearby electricity pylon.

The fire, which occurred in a field near Tesla’s Gigafactory Berlin-Brandenburg in Grünheide, cut off power to the plant and the surrounding area. The factory was evacuated and workers were sent home.

The attack comes amid local opposition to Tesla’s efforts to expand the factory, its only assembly plant in Europe. Tesla last July filed applications with local authorities to expand the plant, with plans to add a battery testing center and water treatment facilities. Tesla hopes the plant will eventually produce 1 million cars a year, about double its current output.

But it has run into resistance from locals and environmental activists. Late last month, Grünheide residents voted against Tesla’s planned expansion in a non-binding vote. And last week nearly 100 activists set up camp in a forest near the factory that Tesla intends to fell as part of its expansion.

Residents and activists have also expressed concern about the factory’s water consumption and its potential to contaminate the region’s groundwater.

Tesla shares were down about 4.7% at $179.38 as of 10:45 a.m. ET Tuesday. They have lost nearly 28% of their value so far this year.

Target Stock Surges on Q4 Earnings Beat

March 05, 2024 10:12 AM EST

Target (TGT) shares surged in early trading Tuesday as the company posted stronger-than-expected earnings for the fourth quarter of fiscal 2023.

The retail giant reported net income of $1.38 billion, up 57.8% from the fourth quarter of 2022 and well above Target’s own guidance and analyst estimates compiled by Visible Alpha. Earnings per share (EPS) at $2.98 also surpassed estimates as revenue rose 1.7% from a year ago to $31.9 billion, beating projections.

The company said that the higher profit came in part as a result of lower costs and improved inventory management, and outlined plans to introduce a new membership program as part of its Target Circle rewards program.

Shares of Target were up 12.2% at $168.87 Tuesday morning. They’ve gained close to 18% so far this year.

Stocks Making the Biggest Moves Premarket

March 05, 2024 09:18 AM EST

Gains:

- Target Corp. (TGT): Shares of the retailer jumped 8% after it reported fiscal fourth-quarter earnings of $2.98 a share, beating Wall Street’s consensus estimate of $2.41.

- Coinbase Global Inc. (COIN): Shares of the cryptocurrency exchange gained 2% as the price of Bitcoin rose above $68,000 to trade just shy of an all-time high.

- Newmont Corp. (NEM): Shares of the gold miner ticked up 1% as the price of gold continued to climb after hitting a record high yesterday.

Losses:

- Gitlab Inc. (GTLB): Shares of the coding collaboration platform tumbled 22% after it forecast full-year fiscal 2025 earnings of between 19 and 23 cents per share, far less than the 35 cents per share analysts were expecting.

- Tesla Inc. (TSLA): Shares of the electric vehicle maker fell about 3% after it stopped production at its plant outside Berlin amid a suspected arson attack that cut off power to the factory.

- Apple Inc. (AAPL): Shares of the tech giant slid about 2% amid reports iPhone sales in China were 24% lower in the first six weeks of the year than in 2023.

Stock Futures Slip in Premarket Trading

March 05, 2024 08:41 AM EST

Futures contracts connected to the Dow Jones Industrial Average were down about 0.3% in early trading on Tuesday.

S&P 500 futures were also off about 0.3%.

Nasdaq 100 futures traded 0.5% lower about an hour before markets opened.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

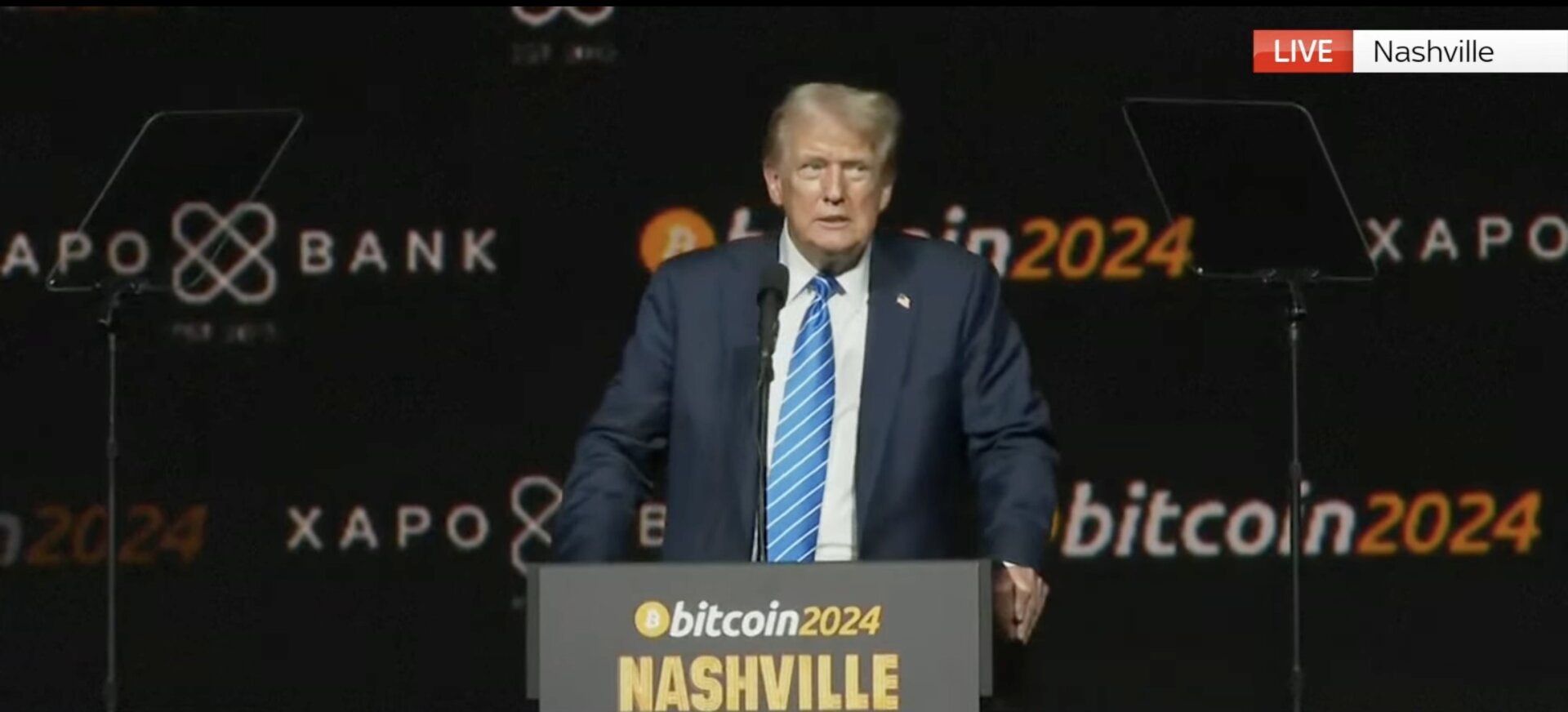

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!