Tech

Cryptocurrency is failing as money; Bitcoin and other cryptocurrencies need help

Cryptocurrency has so far failed to wipe out government-issued money, or bring about the broader revolution its most ardent supporters envision. But what if the underlying technology could be harnessed to transform traditional fiat currencies, for example by making them much easier and cheaper for more people around the world to use?

This goal could be achievable, with the help of governments that cryptocurrencies were supposed to overshadow.

Regular money leaves much to be desired. Most people keep it at big banks, which have sometimes used subterfuge and even outright fraud to tax their customers, and which have proven worryingly fragile in a crisis. Moving money can take days, especially if it has to make its way through the antiquated and hackable network of correspondent banks that handle international transfers. For those without bank accounts, including millions of Americans, disproportionately black and Latino, things are worse. Currency exchanges, ATMs, card issuers, and money transmitters all charge onerous fees.

Read also: Looking for a smartphone? To check the mobile device locator

Bitcoin, the original cryptocurrency, was designed to circumvent all that. Anyone with an internet connection can create a pseudonymous account, controlled with a private key. Users can send digital tokens anywhere, anytime, thanks to a voluntary network of computers that record transactions on a public ledger known as a blockchain. High-powered encryption and decentralization protect against abuse and disruption. The technology has inspired hope not just for fairer finance but for greater stability: The demise of one or more major global banks would cause far less harm if payments could proceed without them.

Bitcoin has spawned an entire movement, but so far it has failed as money. Pure cryptocurrencies are too volatile to be useful beyond speculation, illicit trade, and the occasional funding of activists in oppressive regimes. The processing power required for the Bitcoin blockchain makes it slow and expensive for smaller transactions, not to mention damaging the environment. People are afraid of losing the keys to their cryptocurrencies (an estimated one-fifth of all bitcoins have been lost this way), so they entrust them to wallet apps and other platforms that are frequently hacked. Most crypto “believers” engage in transactions through the same kinds of intermediaries (exchanges, PayPal, specialized ATMs, opaque trust companies) that the technology was intended to replace. Many of these businesses are less secure and more expensive than traditional banks. Their rapid growth threatens greater financial instability.

That said, all is not lost for cryptocurrencies.

Despite all this, cryptocurrency innovation could still lead to a better payment system.

Consider stablecoins. They manage volatility by tying their value to fiat currencies, implicitly acknowledging pure cryptocurrencies’ biggest flaw. They can run on blockchains that run more efficiently than Bitcoin and have a smaller carbon footprint. At the moment, they’re mostly used by cryptocurrency speculators to park funds while they decide what to bet on next, or to earn interest in unregulated lending pools. But as a unique form of electronic money, they have the potential to make transfers easy, instant, and cheap. The Facebook-initiated Diem Association, for example, wants to use them to enable payments on mobile apps like Facebook Messenger and WhatsApp. Ultimately, the infrastructure they use could even provide the rails on which government-issued digital currencies could ride.

Another initiative, known as Lightning, seeks to solve Bitcoin’s throughput and energy problems by establishing side channels through which multiple payments can be made, with only the final balance recorded on the blockchain. The system has enabled one application, Strike, to use Bitcoin as a utility for remittances between the United States and El Salvador. Users’ money can go in as dollars in one country and go out as dollars in the other, with virtually no time wasted on volatile cryptocurrencies.

Innovations like these are promising, but they also present risks that regulators must consider.

• They could spark runs. Stablecoins that are convertible into fiat at fixed rates and fiat balances in apps like Strike need to be securely backed. Often, they aren’t. A recent Bloomberg Businessweek exploration of Tether, the most popular stablecoin with about $70 billion in circulation, found a company “riddled with red flags.” A lack of clarity, or a lack of funding, could one day spook holders, precipitating a crash as everyone rushes for the exits.

Regulators should insist on backing in the form of high-quality assets, ideally fiat currency. In the US, this can be achieved by requiring payment apps and stablecoin issuers to invest only in bank deposits that are themselves held at the Federal Reserve, or by creating a narrowly defined banking license that allows them to open reserve accounts directly with the Fed.

• They could weaken traditional banks. If people could safely store their money in stablecoins and payment apps, they might stop putting it in banks, depriving them of the resources to lend. The resulting credit crunch could bring down the economy.

A recent Bank of England analysis suggests that such concerns are overblown. People will likely be slow to adopt new forms of digital money, its authors say, giving the system time to adapt. Still, regulators should err on the side of caution, banning stablecoins and payment apps from paying interest or reducing the interest they receive on their deposits at the Fed. Such restrictions could be eased later, once officials are able to assess any threats to the banking system and credit.

• They could crash or get hacked. It’s one thing for Facebook apps to go down for a day; it’s another thing if the company were running a global payment system. Newer protocols are still untested, as the recent Solana blockchain outage demonstrated. Lightning has known vulnerabilities.

Regulators should require sufficient equity capital to absorb unexpected losses and set standards for security and governance, such as testing for resilience and identifying who is responsible for managing emergencies. If a company cannot demonstrate that it is acting responsibly, it should not be allowed to operate a payment system. Systems should also be interoperable, so that a dollar in one can easily be converted into a dollar in another.

• They could facilitate crime. Crypto platforms typically identify users only with an alphanumeric address. This has made them useful to ransomware developers, tax evaders and other criminals, and raised concerns that they could undermine international sanctions and anti-money laundering laws.

Platforms and apps can and should require identification when necessary to enforce the law. If regulators required it, such as when balances or transactions exceeded certain thresholds, cryptocurrency-enabled payment systems could remain widely accessible and still be far more transparent than the current banking system. In most cases, transactions are already visible on public ledgers, which has helped both law enforcement and the cryptocurrency community track down and recover ill-gotten gains.

For many, the speculative frenzy surrounding cryptocurrencies won’t end well. Officials like U.S. Treasury Secretary Janet Yellen are right to call for urgent measures to address the growing risks. But they’re also right not to ban cryptocurrencies entirely, as China has attempted. Growing innovation is already driving competition, both private and public, to upgrade a financial system that can certainly stand some improvement. The result could benefit people everywhere, as long as regulators don’t fall further behind in guarding against the dangers.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

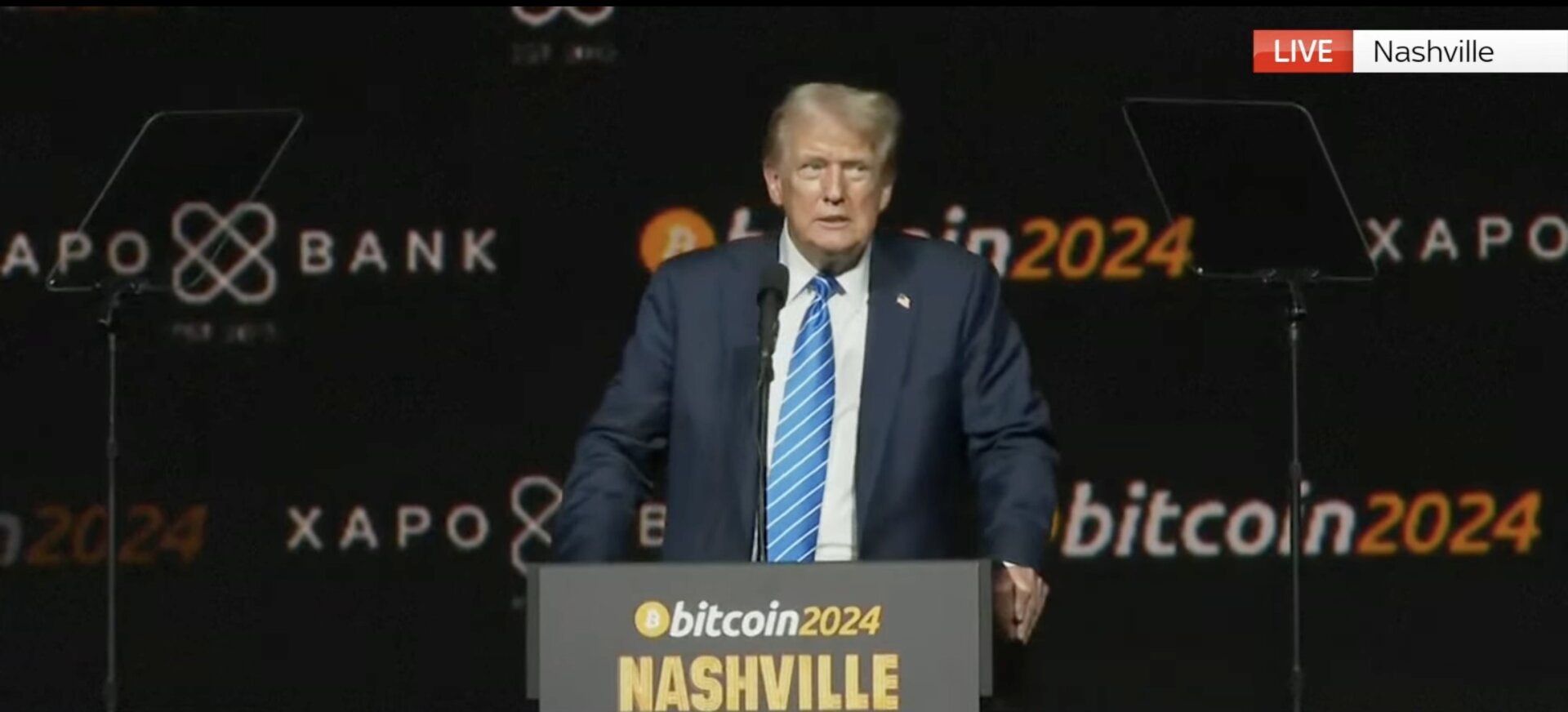

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News11 months ago

News11 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins11 months ago

Altcoins11 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!