Tech

Cyber, Formerly CyberConnect, Unveils Social-Focused Layer 2 on OP Stack

May 15: Cyber, the just-unveiled rebranding for the developer formerly known as CyberConnect, has launched its own layer-2 network in the Ethereum blockchain ecosystem, describing it as the “first L2 for social.” According to the team, the new chain relies on “top modular solutions. Cyber integrates Optimism’s OP Stack, EigenDA and custom features to provide low fees, high TPS and a user-friendly experience.” According to a blog post: “AltLayer will manage the rollup’s technical launch, ongoing management, operations and future upgrades. With AltLayer’s help, Cyber is one of the first OP Stack Chains with Plasma Mode deployed to mainnet. Plasma Mode enables OP Stack chains to leverage alternative data availability (DA) layers to Ethereum Mainnet, significantly reducing their transaction costs while minimizing tradeoffs to security and decentralization.”

Gnosis Launches ‘Genome,’ a Native Digital ID Service With Human-Readable Names

May 15: Gnosis announced the launch of Genome, a digital ID service native to Gnosis Chain. According to the team: “Developed in collaboration with Web3 domain and identity platform SpaceID and Web3 messaging protocol dm3, Genome allows users to translate their lengthy, technical wallet addresses to human-readable names, making it easier to send and receive transactions and interact within the Gnosis ecosystem. Genome automatically grants users ownership of both .GNO and .gnosis.eth names, providing a seamless, interoperable user journey within Gnosis across EVM-compatible blockchains.” The domains are interoperable with ENS. (GNO)

Humanity Protocol Raises $30M at $1B for Decentralized Identification to Rival Worldcoin

Lightning Labs CEO Describes Test Transaction of Stablecoins Atop Bitcoin Using Taproot Assets

Komodo Plans Transition to Proof-of-Stake From Proof-of-Work

May 15: Komodo, a project for blockchain interoperability and atomic swap technology, plans to transition its blockchain to proof-of-stake from proof-of-work, according to a press release: “This transformative shift underscores Komodo’s unwavering commitment to environmental sustainability, as PoS consumes significantly less energy compared to PoW…. Once implemented, KMD holders will be able to secure the Komodo blockchain by staking KMD. In turn, users will earn part of the 1 KMD block reward proportional to the staked amount. The KMD consensus change will coincide with the annual network upgrade in 2025 or 2026.”

Evmos Introduces ‘EvmOS,’ for EVM Compatibility on Cosmos SDK, Plans XRP Ledger Integration

May 15: Evmos introduced evmOS, a modular and customizable tech stack offered by Evmos. According to the team: “evmOS enables EVM compatibility and full customizability on top of the Cosmos SDK. Ripple and Peersyst will leverage evmOS to further develop and enhance the XRP Ledger (XRPL) EVM sidechain, which is currently in Devnet. Powered by evmOS, the XRPL EVM sidechain aligns with industry standards and joins one of the most versatile Web3 ecosystems, the interchain.”

XR Foundation Launches Gaming-Dedicated Blockchain Built on Arbitrum Technology

May 15: XR Foundation, in partnership with Saltwater Games, announced the launch of its gaming-dedicated blockchain, XR One. “Built on Offchain Labs’ Arbitrum technologies, the Layer 3 XR One promises unparalleled performance and security benefits of Ethereum, setting a new standard for interactive, continuous development and entertainment,” according to the team. David Plisek, chief operating officer of Saltwater Games, said in a press release that “XR One has been in the works for a couple of years, and we have been deep in conversations with a range of blockchain technology partners, waiting for the convergence of technologies to enable us to take the leap. Finally the time has arrived, and the team at Offchain Labs have delivered a truly scalable technology-driven ecosystem.”

Worldcoin Foundation Launches ‘Secure Multi-Party Computation’ System

May 15: The Worldcoin Foundation on Wednesday announced it “launched and is open sourcing a novel secure multi-party computation (SMPC) system.” According to the team: “The system, available now in a GitHub repository for any organization to use, aims to set a new standard for data protection, including the protection of biometric data. The Worldcoin Foundation also announced that, after the migration of iris codes to the new SMPC system, the previous uniqueness-checking system, including iris codes, was securely deleted.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Lens, a Stani Kulechov-Overseen Social Project, to Launch Own Chain With ZkSync

May 14: Lens Lab, a part of the Stani Kulechov-led Avara and the team behind Lens Protocol, a Web3 social platform built on Polygon PoS, announced that it is now developing its own blockchain network, Lens Network. The new network will be built on Matter Labs’ ZK Stack, powered by zkSync on Ethereum. “The Lens Network will set a new baseline/precedent for how social networks should be built,” Alex Gluchowski, co-founder and CEO of Matter Labs, said in a press release. “Users care about owning their data, censorship of information, freedom of speech, and whether their personal data is sold by a select few companies, but this can’t come at the cost of a user-friendly interface, speed and safety. The Lens Network on zkSync solves this.” According to the press release: “The permissionless Lens Network will be rolled out in three phases, starting with a Validium using ZK compression techniques on Ethereum to ensure data accessibility. Later phases will introduce separate Validium chains to support various use cases of social networks with variable levels of private and public interactions, culminating in a Volition network that combines rollups and Validium for ultimate security and flexibility.”

Polkadot Debuts ‘Asynchronous Backing’

May 14: Polkadot, the layer-1 chain ecosystem co-founded by Ethereum co-founder Gavin Wood, has debuted Asynchronous Backing, according to the team: It sets the stage for Polkadot 2.0, “a wave of enhancements expected to significantly improve the scalability, cost, speed and flexibility of the network, and accelerate growth of decentralized applications,” according to the team. “Asynchronous Backing cuts block time in half (from 12 to 6 seconds) enables parallel transaction validation block production, and delivers up to 10x higher throughput for Polkadot’s parachain consensus protocol.” (DOT)

Hylé, for Verifying ZK Proofs, Closes $2.6M Funding Round Led by Framework

May 14: Hylé, a blockchain that specializes in zero-knowledge proof (ZKP) verification, announced the closing of a $2.6 million funding round led by Framework Ventures, a crypto-native venture capital firm. Additional participants in the round included Cherry Crypto, as well as Fabric Ventures, Frst Capital and Heartcore Capital, bringing Hylé’s total initial funding to $3.4 million. According to a press release: “The Hylé network is built specifically for ZKP verification and will be running its own consensus mechanism. Hylé will verify all zero-knowledge proof schemes, and will give users and app developers the flexibility to choose the system that best fits their needs. With Hylé, applications are free to choose their execution environment, their data availability solution and their proof system, all the while remaining permissionless.” Currently, Hylé has released a public devnet with key partners in the rollup-as-a-service space, according to the release.

Hylé’s verifier in a system (Hylé)

Owlto Finance, Intent-Centric Interoperability Protocol, Raises $8M

May 14: Owlto Finance, an intent-centric interoperability protocol, raised $8 million in a strategic funding round led by Bixin Ventures and CE Innovation Capital, with participation from Hailstone Labs, Skyland Ventures, Presto Labs and SNZ Capital. Owlto’s innovative AI Agent protocol suggests optimal bridging paths across multiple chains, simplifying and securing cross-chain transactions.

Peter Thiel’s Founders Fund, Vitalik Buterin Back $45M Investment in Polymarket

May 14: Polymarket, the cryptocurrency-based prediction market platform that’s enjoying a breakout year in the run-up to the U.S. presidential election, raised $45 million in a series B funding round with a roster of big-name investors. Billionaire Peter Thiel’s Founders Fund is the lead investor, Polymarket founder Shayne Coplan told CoinDesk via Telegram message. Other participants include Ethereum creator Vitalik Buterin, 1confirmation, ParaFi and Dragonfly Capital, Coplan said. He did not disclose how much the company was valued in the transaction. The round follows a previously undisclosed $25 million series A led by General Catalyst.

Anomaly, AI-Powered Layer-3 Network Focused on Gaming, Raises $1.45M

May 14: Anomaly, developer of an AI-powered zero-gas layer-3 network focused on gaming and Telegram users, has raised $1.45 million in an oversubscribed pre-seed funding round led by industry players including Decasonic, Shima Capital, BreakOrbit and Round13 Capital. According to the team: “Additionally, Web3 luminary and The 333 Club founder Zeneca has also made a strategic investment, endorsing Anomaly’s vision. Anomaly is an avant-garde AI gaming studio and Layer 3 blockchain that integrates custom AI engine built mini-games on widely used social platforms. The company is poised for a node sale and an ecosystem token launch later this year, promising to further cement its position in the Web3 gaming ecosystem.”

Indian Crypto Exchange CoinDCX’s DeFi Arm Okto to Launch Blockchain and OKTO Token

May 14: Indian crypto exchange CoinDCX has expanded what started as the Okto wallet into an Okto ecosystem, which will include launching a blockchain, a token, and a points program starting Tuesday. The aim is to give global users a single-click mobile experience while traversing the Web3 space, its co-founders Neeraj Khandelwal and Sumit Gupta told CoinDesk in an interview. “We believed all CeFi platforms would eventually have a DeFi arm,” Gupta said. “The Okto Chain will power thousands of applications being built in the Web3 space.”

Stellar Development Foundation Gets Investment from Blockchain Accelerator Draper University

May 14: Stellar Development Foundation is “receiving significant investment from blockchain accelerator Draper University, in which both organizations will jointly launch the Stellar Foundation Hacker Houses and Accelerator Programs,” according to the team “This initiative will impact 80 startups currently building on the Stellar network and caters to early-stage platforms leveraging smart contracts to converge AI and blockchain technology.” A representative told CoinDesk that Draper University is investing $50,000 in 10 Web3 companies and giving a $20,000 grant to builders through its hacker house.” (XLM)

Amberdata Launches ‘ARC,’ an Open-Source Master Security Database

May 14: Amberdata, a provider of crypto market data, has launched “ARC (Asset Reference and Classification), an open-source security master database that enables financial institutions to segment and view the digital asset universe with a consistent lens,” according to the team: “This innovative database eliminates proprietary biases and ensures up-to-date information through community input. By bringing traditional finance data standards to the digital asset space, ARC facilitates accurate record-keeping with enhanced transparency, supporting institutional confidence in digital asset adoption.”

ChainML Unveils Theoriq, an ‘AI Agent Base Layer’

May 13: ChainML, a protocol for decentralized computation, unveiled Theoriq, “our revolutionary AI agent base layer, launched after successfully raising over $10M in seed and super seed rounds, led by Hack VC,” according to the team: “Theoriq redefines AI agent development with its principles of composability, extensibility and community governance, aiming to democratize AI through blockchain technology.”

Overview of Theoriq’s solution (Theoriq.ai)

Gateway.fm Launches ‘Node-as-a-Service’ Solution

May 13 (PROTOCOL VILLAGE EXCLUSIVE): Gateway.fm has launched its Node-as-a-Service (NaaS) solution to simplify the process of setting up and managing nodes, “making it easy for project communities to acquire nodes and contribute to network security, and earn rewards,” according to the team. “Upon purchasing a node, users receive a unique Node License NFT for proof of ownership. NaaS works with zkEVM roll ups, not just Optimistic, and enables projects to conduct strategic node sales to generate revenue before their networks go live. Projects can create tiered options with varying price points, token limits and durations to cater to different requirements.”

Safe Introduces ‘Native Swaps’ With CoW Protocol Integration

May 13: Safe has announced the introduction of native swaps. According to the team: “This new native token swap feature integrates the CoW Protocol and is built directly into the world’s most used multisig wallet, Safe{Wallet}. In partnership with CoW Protocol, this integration leverages CoW Protocol’s advanced aggregation and intent-based architecture to access a vast liquidity pool across decentralized exchanges, offering Safe{Wallet} users low prices and a wide selection of tokens for seamless trades on CoW Protocol. In the last three years, a total of $23 billion in swap volume has been facilitated through Safe Smart Accounts.”

Marshall Hayner’s Metallicus Launches ‘Metal L2’ on Optimism Superchain

May 13: Metallicus, a project started by Marshall Hayner to build a “customer-centric digital-asset banking network,” has launched its new “Metal L2” on the Optimism Superchain, “enhancing DeFi and TradFi integration,” according to the team: “This new Layer 2 solution offers direct bank connectivity, comprehensive on-chain identity solutions and introduces Metal Dollar (XMD), a stablecoin facilitating instant transfers between major stablecoins and fiat, all while ensuring compliance with regulatory standards like the BSA.”

Zest Raises $3.5M, Led by Tim Draper, for On-Chain Bitcoin Lending Using Stacks

May 13: Bitcoin lending protocol Zest has raised $3.5 million to enable bitcoin (BTC) holders to deploy their assets in on-chain and generate yield. The seed raise was led by billionaire investor Tim Draper with participation from Binance Labs, Flow Traders, Trust Machines and others, Zest Protocol announced by email on Monday. Zest Protocol uses the Nakamoto upgrade by Bitcoin layer 2 Stacks and bridging asset sBTC (pegged 1:1 to bitcoin) to create a lending experience fully native to the world’s largest blockchain network.

DYdX Founder Antonio Juliano to Step Down as CEO of the Decentralized Exchange; Ivo Crnkovic-Rubsamen Takes Over

May 13: Antonio Juliano, the founder of decentralized crypto exchange dYdX, is stepping down as CEO of the main company responsible for building the major crypto trading platform. In a blog post Juliano said he will become chairman and president of dYdX Trading Inc. Ivo Crnkovic-Rubsamen takes over as its head.

Euclid, Cross-Chain Liquidity Infrastructure Powered by Nibiru, Emerges From Stealth

May 9: Euclid, a Nibiru-powered Web3 start-up built to be a “decentralized unified cross-chain liquidity infrastructure,” emerged from from stealth. According to the a press release: “The announcement comes on the heels of Euclid raising $600,000 via a pre-seed funding round backed by tech investment firm Kahuna Network and angel investor Tomoaki Sato, with participation from angels associated with Lavender Five, Andromeda and Nibiru Chain…. The funds will be used for the development of the architecture and project as well as business development, audits and marketing…. This unification of liquidity is achieved by creating a single source-of-truth ledger through a Virtual Settlement Layer (Nibiru) that all Euclid integrated blockchains can seamlessly connect to, offering the lowest slippage and fairest prices across the whole ecosystem. The framework is based on Euclid’s proprietary LiquiSync model, making it easy for any chain or protocol to access permissionlessly.”

Gnosis Inks Strategic Partnership with Zeal, Invests $2M

May 9: Gnosis, an Ethereum sidechain, said it will partner with Zeal, creators of a comprehensive digital wallet, to enhance everyday crypto use, according to the team: “This collaboration involves exploring easy solutions for daily self-custodied crypto transactions, akin to using cash. Gnosis also commits $2 million to Zeal, boosting its total funding to $9 million after a previous $7 million seed round.”

Layer-1 Chain Inco to Work With Privy to Enable Web3 Apps on Telegram

May 9: Inco, described as a “modular confidential computing layer-1 blockchain and universal confidentiality layer for Ethereum and other networks,” announced a partnership with Privy, a system for onboarding Web3 users, to launch non-custodial Web3 apps and games in Telegram. According to the team: “Using Inco, developers can build dapps and mini-games like slot machines, card games, predictions market and more as Telegram Mini Apps that work with your wallet provider and leverage FHE technology, thus enabling new forms of gameplay with confidential elements. By integrating the Privy SDK, developers can now provide users with self-custodial wallets, enhancing security for on-chain experiences within Telegram.” FHE stands for fully homomorphic encryption, a type of encryption where data can be processed without the data having to be exposed.

Ripple, XRPL Labs Join DeRec Alliance as Founding Members With Hedera, Algorand Ecosystems

May 9: The developers Ripple and XRPL Labs have joined Algorand Foundation and Hedera developer Swirlds Labs as founding members of the DeRec Alliance. The alliance supports the Decentralized Recovery (DeRec) open-source protocol. According to a press release, this protocol maps out “a standard approach to secret management, based on secret sharing among a set of helpers (e.g. friends or businesses), who can assist the user to recover their secret when needed. Each helper’s share reveals no information about the original secret, and half the helpers can give the user their shares to reconstruct the secret, even when a user has lost their phone or other two-factor recovery device. The protocol includes automatic regular confirmations that helpers still have shares of secrets, and automatic re-sharing when secrets change or helpers join or leave. The user never reveals who the helpers are, nor even how many helpers there are, and even the helpers won’t know that.”

Solana-Based Marketplace AgriDex Raises $5M to Tokenize Agricultural Industry

May 9: AgriDex, a Solana-based tokenization platform, has raised $5 million to bring agricultural commodities on-chain. The pre-seed funding round included investments from Endeavour Ventures, sub-Sarahan African agricultural group African Crops and South African vineyard group Oldenburg Vineyards, the company said by email on Thursday. AgriDex allows various crops to be bought on its marketplace. When finalized, deals are then secured by minting a non-fungible token (NFT) recording the key transaction details.

Arcium, ‘Paralellized Confidential Computing Network,’ Raises $5.5M in Strategic Round Led by Greenfield

May 9: Arcium, the first parallelized confidential computing network, has announced the completion of a $5.5 million strategic funding round led by Greenfield Capital bringing the total capital raised to $9 million, according to the team: “Founded by the team behind Elusiv, an application-layer zero-knowledge (ZK) privacy protocol based on Solana, Arcium leverages Multi-Party eXecution Environments (MXEs) to enable secure computation on encrypted data. This funding will bolster the Arcium ecosystem ahead of the upcoming mainnet launch. So far Arcium has received over five thousand applications for its incentivized testnet.”

API3’s New ‘OEV Watchtower’ Measures Liquidity Losses to Oracles

May 9: API3, a first-party blockchain oracle, has introduced the OEV Watchtower, “enabling protocol developers for the first time to measure annual liquidity losses to Oracle services, potentially amounting to millions,” according to the team: “This tool allows dApps to benchmark their OEV retention against major protocols like Iron Bank, Morpho Aave, and MakerDAO. It also enhances transparency by letting users input their liquidation incentive rate and TVL to track money liquidated, incentives paid, amounts sent to builders, and losses to searchers.”

Hyperbolic, led by Math Olympian Zhang, Releases ‘Proof of Sampling’ to Address Trust in Decentralized AI

May 9: Hyperbolic, the two-year-old startup that Jasper Zhang leads focused on decentralized AI computing, said Thursday that it is introducing a protocol called “Proof of Sampling (PoSP),” aimed at addressing challenges with trust in decentralized AI networks. Hyperbolic was co-founded in 2022 by Zhang and Yuchen Jin, who holds a Ph.D. in computer science from the University of Washington.

Arch Raises $7M for Turing-Complete ‘Bitcoin-Native’ Proof-of-Stake Application Platform

May 9: Arch Labs, building Arch, described as the “first Bitcoin-native application platform,” raised $7 million in a seed round led by Multicoin Capital, with participation from Portal Ventures, OKX Ventures, Big Brain Holdings, CMS Holdings, Tangent, Cypher and Newman Capital, according to a press release: “The company plans to use the funds to hire additional core developers, help launch the Arch Network into mainnet in H2 2024 and continue to support its burgeoning app ecosystem.to build the first bitcoin-native application platform… The Arch Network is a parallelized, proof-of-stake network that uses zk-proofs to enhance Bticoin-native programmability. The network consists of a Rust-based zkVM, called the ArchVM, and a decentralized verifier network.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

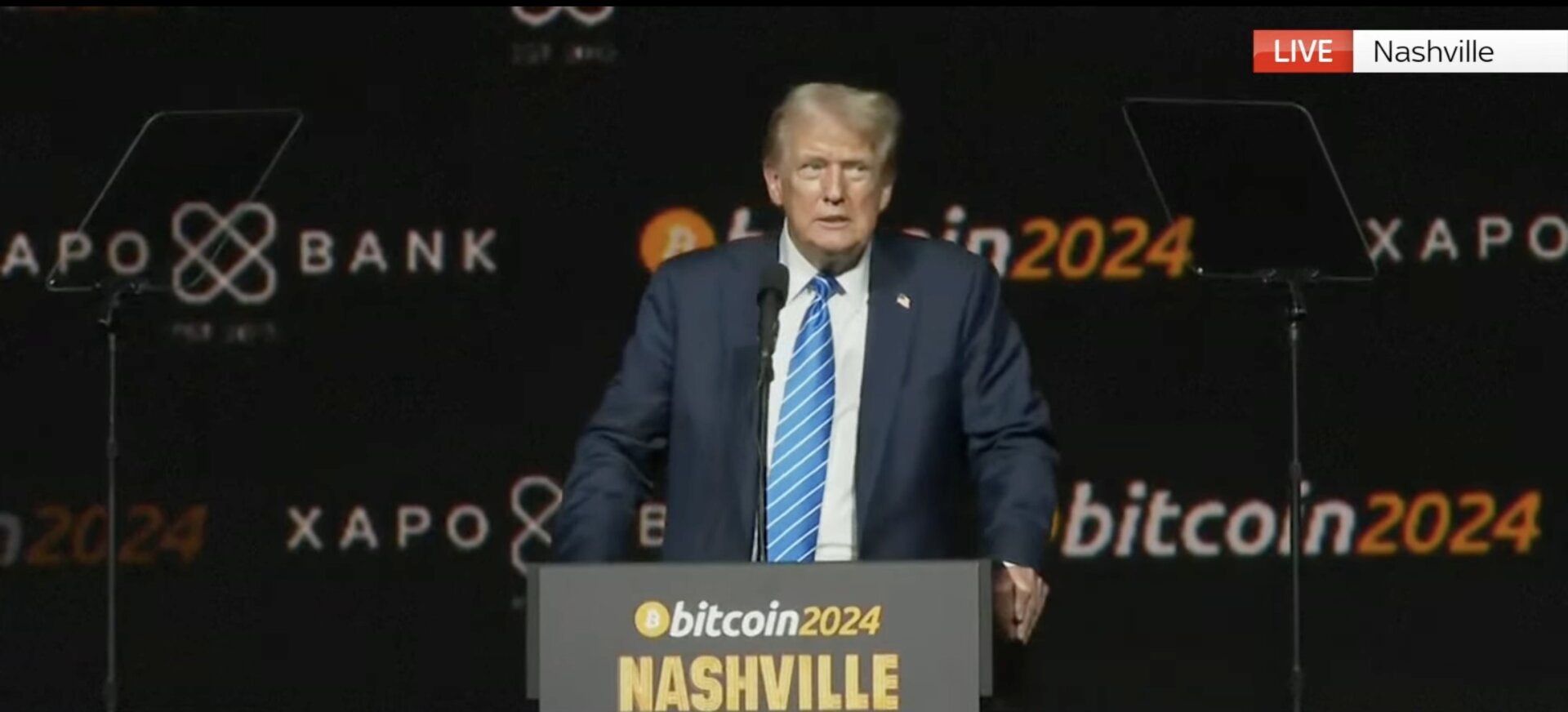

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!