Tech

Disney does NOT “partner” with crypto companies

On Tuesday I wrote and posted at column breaking the news and reflecting on Dapper Labs’ recently announced tie-up with Disney, the historic, century-old entertainment company that, under the leadership of CEO Bob Iger, has become even more of an intellectual property powerhouse and technology follower. This article contained some errors.

This is an excerpt from The Node newsletter, a daily roundup of the most crucial crypto news on CoinDesk and beyond. You can sign up to get the full service newsletter here.

Most embarrassingly, I misspelled the last name of one of my sources, Ridhima Khan, vice president of partnerships at Dapper Labs, and misattributed one of her quotes to CEO Roham Gharegozlou. Such errors have been corrected and are regretted.

More importantly, however, a central claim of the article – that Dapper and Disney were “partners” in a venture called Disney Pinnacle, which will license Disney IP and sell digital tokens modeled after collectible pins – now appears to be incorrect.

According to Rachel Rogers, public relations manager at Dapper Labs, on Thursday, two days after the story was published:

“Also, Disney has not launched the Disney Pinnacle platform. Dapper Labs created in collaboration with Disney. Can you update? Disney doesn’t use the word partner: it just collaborates or teams up with.”

The news was picked up and cited by a number of widely read tech news outlets, some of which received similar calls from Dapper to remove the term partner from the registry. I’m writing this story, in part, to correct the situation: Disney isn’t working with Dapper. Disney, which did not respond to a request for comment, will likely never partner with a cryptocurrency company.

Instead, Disney is licensing its IP to Dapper. The terms and conditions of the agreement are not known. When asked, Dapper said: “Like all of our partnerships, we cannot comment on financial breakdowns.” I asked in a few different ways, at a few different times in a call with Khan and Gharegozlou as well as in follow-up questions sent via email.

It’s not unreasonable to think that “a Disney-authorized partner,” as Dapper initially described the deal, might pay for the privilege. Such financial deals are not uncommon in the world of NFTs. What is licensed is valuable property.

In a call, Gharegozlou and Khan suggested that Disney has been in close contact with Dapper during the development process, even though Dapper is doing all the construction. The mobile app hasn’t launched yet, only the waiting list opened on Tuesday.

In my article, I basically argued that this project could have the potential to be one of the few non-embarrassing NFT experiments. I argued that Disney has a large fan base, full of people who like to collect Disney junk. It makes sense to work with recognizable content that people already have an emotional connection with, rather than convincing them to buy what could be described as a JPEG with a blockchain pointer.

Otherwise you’ll end up with something like Bored Ape Yacht Club, because it’s almost impossible to build a brand from scratch. And the Yacht Club is essentially the most successful “bootstrap” NFT project to date, if you want to call paying or otherwise enticing celebrities to load up their bags.

I mean, as I argued, even Dapper’s previous experience could be called a success by cryptocurrency standards. NBA Top Shots, where Dapper pioneered the concept of licensing beloved intellectual property to sell tokens, doesn’t see much action today, but it was once essentially the crown jewel of Dapper properties and a significant part of the reason so Dapper was, now in hindsight, comically overrated.

Assuming Disney Pinnacle is still happening, although it appears that Disney has reprimanded Dapper for claiming to have “collaborated” in a cryptocurrency capture, it could also be successful. People buy Disney products even though they are often inherently worthless, and it’s not yet clear whether Disney fanatics have as visceral a hatred of NFTs as they do some consumer segments, like gamers.

It might work! And if it does, it will be as much thanks to Dapper’s design work as Disney’s ownership. But it’s not a partnership.

I’m not really sure why Gharegozlou, Khan, and Rogers were all so adamant about calling it a partnership. The term has been used a lot. And I made sure to ask multiple times and in different ways how to describe the working relationship precisely because crypto companies often incorrectly use the term partner or exaggerate in their relationships with established brands.

For example, I’m pretty sure I’ve seen a company call a Google Cloud subscription a deal. Ethereum relies on Amazon, but Amazon is not a supporter of Ethereum in the traditional sense.

And I get it, at least in Dapper’s case I’m sure it was an honest mistake. Khan said she went to Disneyland nearly 20 times as the main connection and reason for the lack of collaboration between Disney and Dapper. I enjoyed talking to them and thought Gharegozlou was unusually sociable for someone in her position.

. But I find the request to substantially reconstruct history morally questionable. As I told Rogers in an email, “I cannot change the quotes and I cannot change the fact that partner/partnership was the term used by Roham and Ridhima and in the company’s written communications.”

I can’t change their quotes. At the time of publication the information was accurate. Our job is not to do favors for companies, and if we accepted this request it would open a glass jar for every time a source says something on the record that he or she later regrets.

The part of the job I like most is calling things by their name. Another of Dapper’s shameful requests was to change a comment made about “investing” in NFTs when asked about the differences between digital and tangible collectibles. I understand, discussing NFTs as financial assets opens up a regulatory attack surface. But to suggest that you can INVEST in physical pins but only COLLECT digital ones is foolish.

NFTs are investments, they are treated like investments, and in my brief communications with Dapper we talked about them as investments and collectibles. And in the absence of solid information about the “pins,” such as whether they carry perks like discounts or Disney opportunities, presumably one of the main reasons to buy one is because it might increase in value.

Dapper isn’t alone here. Cryptocurrencies have an honesty crisis. The industry is not only riddled with fraud, literally measurable fraud, but it is also in the business of deceiving people. Cryptocurrencies are a technology without a use case, which promises to solve every problem, and which has failed in almost every way. The purpose that cryptocurrencies are actually useful for (buying things online that you don’t want on your credit card statement) is completely underappreciated.

There’s no way a decade of misrepresentation won’t end up causing collateral damage. In many ways it already has. Cryptocurrencies have a bad reputation, and not even interestingly, in a way that denotes low social standing and dishonesty. And for good reason. Millions of people have collectively lost billions of dollars. A technology that should be to attach it to humans is obsequious.

In other words: Cryptocurrencies are petty and untrustworthy. He is the George Santos of financial technology.

And it won’t get better until its leaders prove honesty. Pretend it’s a profession.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

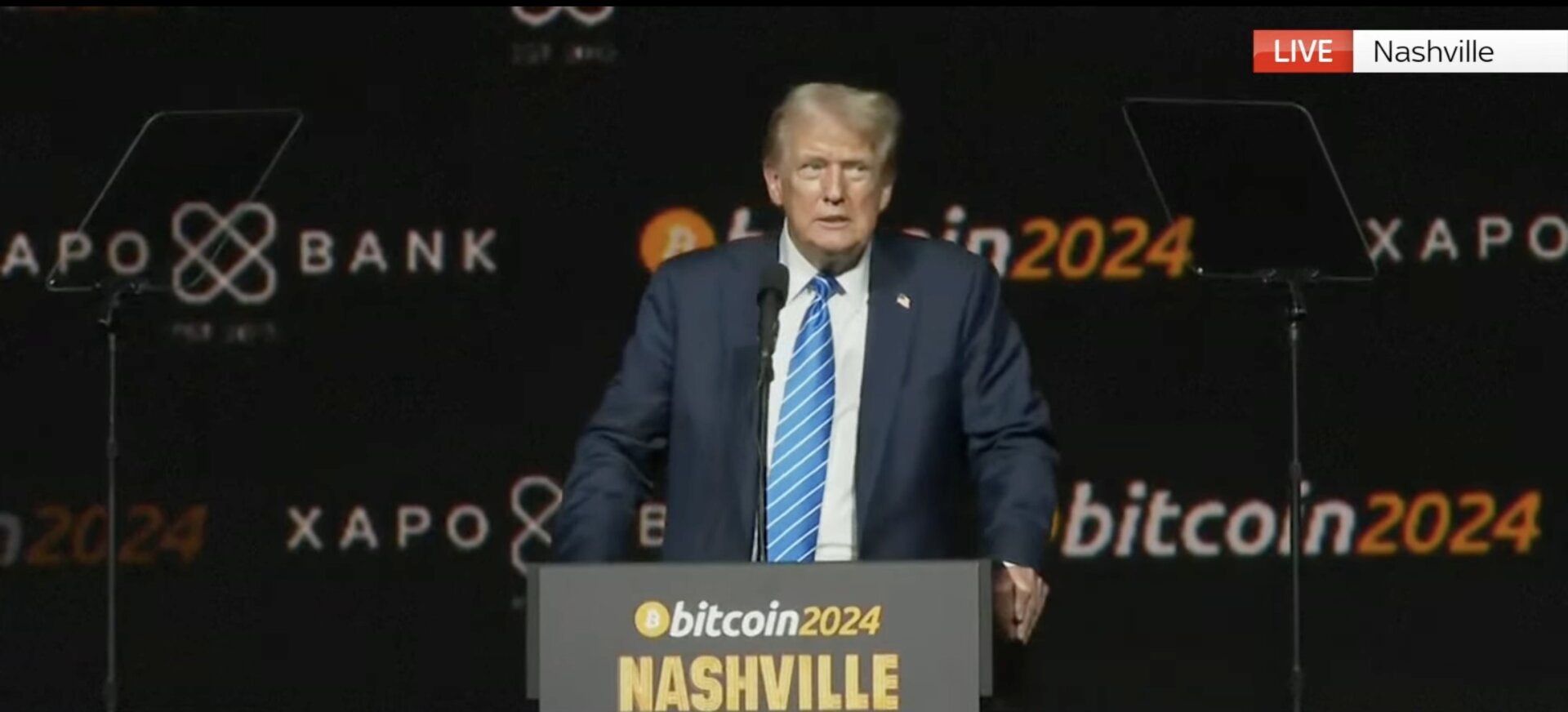

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!