DeFi

Institutions are likely to be interested in Bitcoin DeFi applications

Last updated: May 10, 2024, 5:01 p.m. EDT | 6 minutes of reading

Bitcoin (BTC) is evolving rapidly. Although the Bitcoin network has been primarily used for payment transactions, current activity appears to resemble that of Ethereum during the height of decentralized application (Dapp) projects.

The introduction of Bitcoin Runes and BRC-20 tokens – which emerged at the time of fourth Bitcoin halvedt – likely sparked the evolution of Bitcoin’s native decentralized finance (DeFi).

The emergence of Bitcoin DeFi

Rena Shah, VP of Product at Trust Machines – a team focused on growing the Bitcoin economy – told Cryptonews that two years ago, Bitcoin DeFi was not a narrative the ecosystem was discussing.

However, Shah noted that the emergence of staking platforms and lending protocols on the Bitcoin network have sparked investor interest in transitioning assets from a store of value to a source of value.

The growth of the Bitcoin DeFi (BTCFI) ecosystem is astounding 🧡

🟧 @ALEXLabBTC leading the charge, with @Bitflow_Finance & @StackingDao following.

– Data from @signal21btc pic.twitter.com/87MP5hMCbL

– stacks.btc (@Stacks) May 8, 2024

“The desire to move from a passive Bitcoin asset to a productive asset is real in 2024,” she said. “We are building this future because we can see that Bitcoin DeFi attracts not only retail investors but also institutional investors.”

Institutions will show interest in Bitcoin DeFi

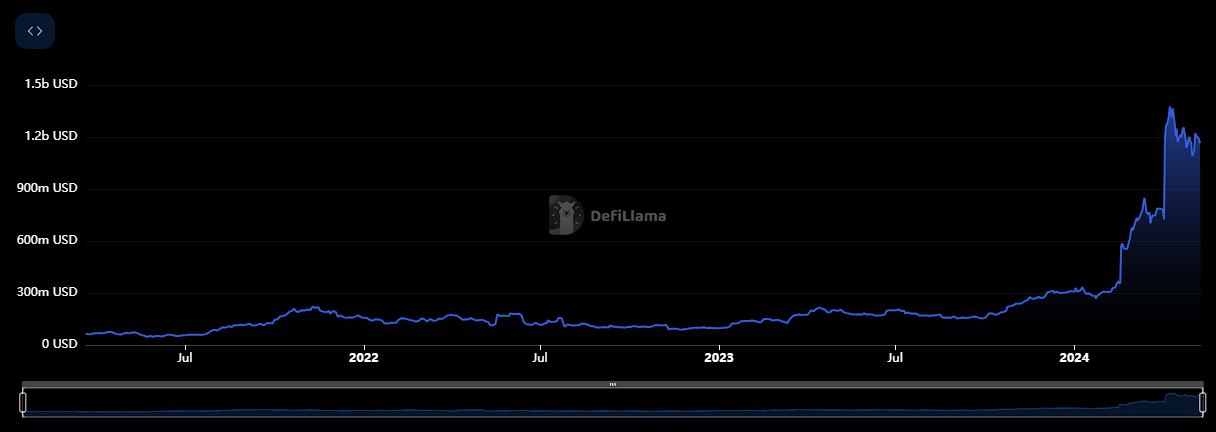

Data from DeFiLlama watch that the total value locked (TVL) of Bitcoin is approximately $1.2 billion. Yet, according to Shah, nearly $1 trillion in capital is locked on the Bitcoin blockchain.

“Even the smallest percentages of capital that become productive in DeFi will make huge waves in the Bitcoin ecosystem,” Shah emphasized.

This, along with the recent approval of Spot Bitcoin exchange-traded funds (ETFs) in the United States, increases the potential of Bitcoin DeFi applications. In particular, this will likely appeal to Bitcoin-holding institutions and retail investors.

Tycho Onnasch, the co-founder of Zest Protocol, told Cryptonews that he believes BTC is a more institutional asset than the rest of crypto.

“Therefore, I expect institutions to play a larger role in using and starting Bitcoin DeFi,” Onnasch said.

Bitcoin DeFi Apps for Institutions

Although Bitcoin DeFi is still a relatively new concept, a number of projects aim to enable and advance the sector.

For example, Onnasch explained that Zest Protocol is creating a lending protocol specifically for Bitcoin. He mentioned that the aim of the platform is to create permissionless financial infrastructure for BTC lending markets.

“Zest allows users to collateralize BTC to borrow other tokens such as stablecoins,” he said. “The platform also allows users to earn yield on their BTC.”

Indeed, the primary use case for Bitcoin DeFi applications appears to be to ensure that Bitcoin becomes a more productive asset for investors.

Dr. Chiente Hsu, co-founder of ALEX and XLink, told Cryptonews that Alex is a new financial layer for the Bitcoin network.

“Our goal is to seamlessly integrate Bitcoin with Layer 2 (L2) solutions and the Ethereum Virtual Machine (EVM) world,” Hsu said. “This will allow us to grow the Bitcoin economy,” Hsu said.

For example, Hsu explained that investors can earn a return on their BTC by connecting a Bitcoin Wallet to XLink. He noted that XLink is powered by ALEX’s Automated Market Maker (AMM) and Decentralized Exchange (DEX). This will enable cross-chain exchanges between Bitcoin L2 and the EVM world.

“Bitcoin DeFi for institutions will be looking for Bitcoin yield generating assets,” Hsu said.

Hsu believes this is likely to be the case due to the amount of capital present on the Bitcoin network.

“There is well over $1 trillion of Bitcoin capital that is ‘idle’ in the sense that its value rises and falls relative to the Bitcoin spot price,” he said. “But unlike Ethereum, Bitcoin cannot be natively locked to generate yield. This is a solution that ALEX is actively pursuing, which will allow institutions holding Bitcoin to earn a return on their Bitcoin capital.

Bitcoin DeFi resembles its Ethereum counterparts

Another interesting point is that even though Bitcoin DeFi is unique, applications tend to look like DeFi projects on Ethereum (ETH). This is important to consider as institutions have started to show interest in many current DeFi applications.

Digital asset management company Fireblocks have recently seen increased institutional DeFi activity on the Fireblocks platform. According to the firm, there was a 75% jump in the first quarter of 2024.

Fireblocks reported that some of the most popular Dapps that institutional clients interact with when trading, lending, staking, and bridging include Uniswap, Aave, Curve, 1inch, and Jupiter.

Jeff Yin, CEO of Merlin Chain – a Bitcoin L2 facilitating fast and profitable transactions with support for BTC Dapps – told Cryptonews that DEXs, derivatives and lending are all areas where BTC has learned a lot from lending. ‘ETH. He added that many new protocols are emerging.

“For example, “Surf” is a derivatives trading protocol launched on Merlin Chain and now boasts a daily trading volume of over $10 million. These are similar to their Ethereum counterparts,” Yin said.

Yin explained that a specific Bitcoin DeFi application would replicate one of the largest ETH DeFi Protocols, Lido – which holds $28 billion and represents half of Ethereum’s DeFi TVL.

“SolvBTC is currently developing an underlying BTC yield protocol,” Yin said. “Additionally, Unicross has implemented a Rune trading protocol on a BTC L2, allowing users to trade layer 1 (L1) assets at a lower cost on L2. These represent the most innovative aspects of the sector.

Bitcoin DeFi Could Overtake Ethereum

Although Bitcoin DeFi may resemble Ethereum, Shah believes that decentralized finance using BTC could eventually surpass Ethereum.

“Look DappRadar, Ethereum has over 600 active applications with varying volume and activity,” Shah said. “I have no reason to expect that Bitcoin DeFi cannot match Ethereum, and eventually replace it with Dapps in the ecosystem.”

Some solutions also make it easier to introduce Ethereum Dapps on Bitcoin.

Zack Voell, director of marketing at Botanix Labs, told Cryptonews that Botanix has created a “Spiderchain” that easily enables DeFi on Bitcoin.

“Spiderchain creates a fully EVM-equivalent environment for Dapps and smart contracts on Ethereum to be copy-pasted to run natively on Bitcoin,” Voell said. “Botanix Labs is building the Spiderchain to combine the two most Lindy technologies in crypto – EVM and Bitcoin – instead of trying to reinvent a whole new protocol or virtual machine.”

Challenges can slow adoption

Although it is too early to determine the fate of Bitcoin DeFi, there are some challenges that could slow its adoption.

For example, Yin pointed out that liquidity fragmentation often results from the difficulty of implementing DeFi on an L1 network. This in turn forces most activities to disperse through various L2 solutionsbut Yin noted that this could make it difficult to concentrate liquidity.

“One potential solution could be to create omnichain liquidity, similar to the Stone protocol in the Ethereum ecosystem,” he said. “We look forward to future implementations such as M-STONEBTC and Solv Protocol that could unify BTC L2 liquidity.”

Furthermore, Shah mentioned that the challenge of Bitcoin is to keep the base layer secure, stable and unaltered.

“This is where scaling becomes critical,” she said. “A healthy and diverse L2 ecosystem will be what ultimately allows Bitcoin DeFi, as a vertical, to succeed.”

Shah added that programming environments on Bitcoin are inherently difficult because many developers in other ecosystems are less familiar with Bitcoin scripting.

She stressed that one way to combat this phenomenon is to create WebAssembly (WASM) or different runtime environments like Rust, Solidity and Cosmos with L2.

“This approach will likely help attract new developers to the ecosystem,” she noted.

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!