Tech

Polkadot Parachain Moonbeam annuncia l’iniziativa “Moonrise” per la fase successiva

20 maggio (PROTOCOL VILLAGGIO ESCLUSIVO): Rete del raggio di luna, un compatibile con Ethereum paracatena di contratti intelligenti su Polkadotha annunciato l’iniziativa Moonrise, segnalando la fase successiva della sua evoluzione, secondo il team: “Supportato da una riprogettazione completa del marchio, Moonbeam ha svelato una nuova roadmap di prodotto per il 2024 con traguardi significativi, inclusi miglioramenti del protocollo principale per aumentare il throughput di 8 volte, incorporare Dencun di Ethereum aggiornare e ottimizzare la governance Altri indicatori includono la rivitalizzazione della rete Canary Moonriver con il bridging Axelar e il lancio di un programma zkAuth per l’autenticazione Web2.

Lita lancia “Valida ZkVM”, dichiara vantaggi in termini di velocità ed efficienza

20 maggio: Lita ha rilasciato Valida zkVM e Valida C Compiler Toolchain, consentendo una generazione ZKP più rapida, economica ed efficiente, secondo il team: “La compatibilità di Valida con LLVM apre le porte a una serie di linguaggi di programmazione convenzionali, aiutando gli sviluppatori a passare facilmente al mondo dei sistemi decentralizzati I benchmark di Lita per le capacità prestazionali di Valida mostrano che il proving Valida single-core è stato eseguito con una velocità che va da 1,19 a 54 volte più veloce del proving RISC Zero multi-core e da 19 a 1.600 volte più efficiente, riducendo il tempo e la produttività della CPU. energia spesa per il calcolo della prova.”

Panoramica dell’architettura di Lita con Valida (Lita)

Manta, Ethereum L2, lancia ‘Manta CeDeFi’

20 maggio: Rete Manta ha lanciato Manta CeDeFi, “un nuovo prodotto che combina CeFi e DeFi da offrire agli utenti opportunità di rendimento migliorate con sicurezza di livello istituzionale. Lavorando con Ceffu, ex Binance Custody, Manta CeDeFi consente agli utenti di guadagnare premi paralleli dall’arbitraggio CeFi stabile e dalle attività DeFi on-chain. Questa integrazione fornisce risorse reali sicure e tracciabili su Manta Pacific, garantendo conformità e agilità finanziaria.”

EasyA Consensus Hackathon – Invito ai partecipanti

Quest’anno, Consensus ospiterà il suo primo hackathon di persona insieme all’app di apprendimento Web3 numero 1 al mondo, EasyA. Si tratterà di un hackathon IRL multicatena di tre giorni con sponsor di livello mondiale, da Sui a Stellar a Polkadot e oltre, e attirerà i migliori sviluppatori del mondo per costruire il futuro del Web3 e raccogliere fondi per i loro progetti.

I progetti lanciati dagli ex studenti di EasyA hanno un valore di oltre 2,5 miliardi di dollari. L’hackathon EasyA Consensus sarà l’hackathon più importante del 2024 fino ad ora.

Abbiamo ancora alcuni posti liberi per gli hacker, quindi se sei entusiasta di partecipare, assicurati di farlo iscriviti qui!

La collaborazione di Oobit con TON consente agli utenti di spendere il Tether inviato tramite Telegram

17 maggio: Oobitun’app di pagamento mobile, ha “collaborato con la TON Foundation per integrare la sua criptovaluta nativa, TON (Toncoin), nella sua piattaforma, promuovendo l’uso della criptovaluta come mezzo di pagamento”, secondo il team: “I possessori di Toncoin potranno effettuare Tap & Pay presso oltre 100 milioni di rivenditori in tutto il mondo. L’integrazione rafforzerà ulteriormente il recente annuncio della collaborazione tra la più grande azienda nel settore degli asset digitali, Tether, e la Fondazione TON.” Secondo un comunicato stampa separato sul sito web di Tether: gli utenti potranno “inviare USDT come messaggio diretto su Telegram e spendere gli stessi USDT per pagamenti istantanei in criptovaluta Tap su Oobit.”

L’aggiornamento Radix “Bottlenose” introduce “AccountLockers” per i token di routing

17 maggio: Radixpiattaforma per DeFi e Web3, ha “proposto a Tursiope aggiornamento del protocollo alla sua comunità di runner di nodi e si prevede che venga messo in atto intorno al 3 giugno. Una delle caratteristiche salienti dell’aggiornamento è l’introduzione di AccountLockers, un “armadietto” in cui vengono instradate le consegne di token, che può essere accettato o rifiutato . Gli AccountLocker hanno lo scopo di bloccare i depositi indesiderati e semplificare la contabilità delle dApp. Altre funzionalità di Bottlenose includono miglioramenti dell’API e del Radix Engine e l’aggiunta di un deposito delle commissioni di recupero, eliminando la necessità di bloccare le commissioni di terze parti durante il recupero dell’account.”

“Bitfinity EVM” basato su Internet viene lanciato come Bitcoin L2 e supporta le rune

17 maggio: livello 2 di Bitcoin Bitfinity ha introdotto la sua Ethereum Virtual Machine (EVM) da portare contratti intelligenti Protocolli Bitcoin e sfruttare le rune per abilitare le app Bitcoin DeFi. Basato sul protocollo Internet Computer (ICP), Bitfinity si integra con la rete Bitcoin e consente il collegamento di risorse ad altre blockchain. Lo stack tecnologico di Internet Computer consentirà alle applicazioni che utilizzano Solidity, il linguaggio di programmazione dei contratti intelligenti di Ethereum, di accedere ai token basati su Bitcoin.

Mintlayer, partner Salus sulla “rete Thunder” di livello 3 connessa a Bitcoin

17 maggio: soluzione di ridimensionamento Layer-2 Mentaio e Salus, una società di sicurezza specializzata nella tecnologia a conoscenza zero (ZK), stanno collaborando per migliorare Bitcoin attraverso la creazione di Thunder Network, una soluzione basata su rollup ZK di livello 3, secondo il team. “La rete Thunder è progettata per affrontare eventuali problemi di ridimensionamento che la rete Mintlayer potrebbe incontrare, consentendo al tempo stesso funzionalità EVM aggiuntive che potrebbero essere attualmente assenti da Mintlayer”, secondo un comunicato stampa.

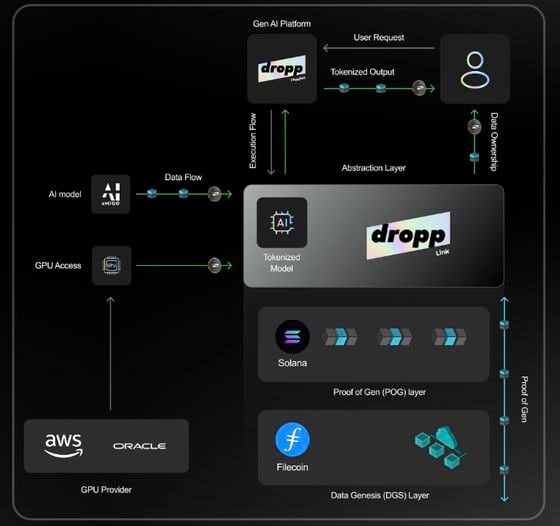

DroppGroup annuncia “DroppLink” per tokenizzare gli output Gen AI

17 maggio: Gruppo Dropp, con l’obiettivo di armonizzare l’intelligenza artificiale e la tecnologia blockchain, ha “annunciato il lancio di droppLink, una piattaforma di servizi intelligenti pronta a trasformare lo sviluppo e la gestione dell’intelligenza artificiale su più blockchain. L’architettura di DroppLink astrae i requisiti computazionali, facilita i micropagamenti e democratizza il contributo dei dati, fornendo agli utenti la proprietà e il controllo, il tutto mentre le parti interessate, note come Computational Resource Patrons (CRP), sostengono i costi delle infrastrutture e condividono le entrate generate dai processi di intelligenza artificiale che abilitano.” Secondo il sito web del progetto, “gli output della Gen AI dell’utente finale sono tokenizzati come risorse digitali uniche sulla blockchain di Solana e sono archiviati nella rete Filecoin”.

Schema che illustra droppLink in una configurazione con Solana e Filecoin (droppLink)

Schema che illustra droppLink in una configurazione con Solana e Filecoin (droppLink)

Union e Stargaze per consentire il trasferimento di “NFT Blue-Chip Ethereum” a Cosmos

17 maggio: Unioneil livello di interoperabilità modulare, sta “collaborando con Stargaze, un mercato NFT decentralizzato di proprietà della comunità, per consentire il trasferimento di NFT Ethereum blue-chip all’ecosistema Cosmos tramite il suo bridge zkIBC trustless e decentralizzato. Questa collaborazione apre la strada al raggiungimento del trustless interoperabilità per gli NFT”, secondo la squadra.

Oracle Project Pyth lancia il programma di sovvenzioni per l’ecosistema da 22 milioni di dollari

17 maggio: Pitoun progetto oracolo blockchain, sta “lanciando il loro Programma di sovvenzioni ecosistemiche con 50 milioni di PYTH (del valore di circa 22 milioni di dollari ai prezzi odierni) dedicati a questa attivazione”, secondo il team: “Il programma cerca progetti focalizzati su almeno una di queste tre aree chiave: sovvenzioni per la comunità, la ricerca e gli sviluppatori”.

DTCC, Chainlink Pilot accelera la tokenizzazione dei fondi con JPMorgan, Templeton, BNY Mellon

17 maggio: il Depositary Trust and Clearing Corporation (DTCC)il più grande sistema di regolamento titoli al mondo, completato un progetto pilota con oracolo blockchain Maglia a catena (COLLEGAMENTO) e diverse importanti istituzioni finanziarie statunitensi, con l’obiettivo di contribuire ad accelerare la tokenizzazione dei fondi, secondo a rapporto pubblicato dal DTCC. Lo scopo del progetto chiamato NAV intelligente era quello di stabilire un processo standardizzato per portare e diffondere i dati sul valore patrimoniale netto (NAV) dei fondi praticamente su qualsiasi blockchain privata o pubblica utilizzando Chainlink protocollo di interoperabilità CCIP. Tra i partecipanti al mercato figuravano American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan, MFS Investment Management, Mid Atlantic Trust, State Street e US Bank. (COLLEGAMENTO)

Protocol Village è una caratteristica regolare di Il protocollola nostra newsletter settimanale che esplora la tecnologia alla base delle criptovalute, un blocco alla volta. Iscriviti qui per riceverlo nella tua casella di posta ogni mercoledì. I team di progetto possono inviare aggiornamenti Qui. Per le versioni precedenti di Protocol Village, vai Qui. Ti invitiamo inoltre a consultare il nostro settimanale Il protocollo podcast.

FLock.io unirà la formazione decentralizzata sull’intelligenza artificiale con gli “agenti intelligenti” di Morpheus

16 maggio: FLock.iouna piattaforma per “Co-creazione dell’IA,” e Morpheus, a rete per alimentare agenti intelligentiha annunciato una partnership strategica “per far avanzare le capacità di intelligenza artificiale decentralizzata nel Web3”, secondo il team: “Unendo FLock.iodella piattaforma di modelli di formazione AI decentralizzata e guidata dalla comunità con Morpheus, che consente ai costruttori di Smart Agent di distribuire il proprio codice e ricevere ricompense, i partner mirano a ridurre la dipendenza dalle chiamate di funzioni esterne centralizzate a OpenAI e integrare più Smart Agent nei portafogli Web3. In definitiva, questa integrazione consentirà agli utenti di sfruttare l’intelligenza artificiale direttamente dai loro portafogli per esperienze di trading fluide, sicure e intuitive”.

Intreccia il livello di infrastruttura dati interoperabile con “Liquid Vault”, lancia Mainnet

16 maggio: Intrecciareuno strato di infrastruttura dati interoperabile alimentato dalla primitiva sottostante “volte liquide,” sta rilasciando la sua mainnet dopo due anni di sviluppo e una rigorosa fase di testnet, secondo il team: “La rete attualmente contiene 71 validatori, tra cui Hashkey Cloud, Rhino, Nodefi e DaiC. La rete principale presenta anche la funzionalità Photon Messaging, che consente lo sviluppo omnichain su 16 blockchain EVM e non EVM, inclusa Solana.”

Il protocollo Alvara, che sviluppa un sistema basato su DeFi per la gestione dei fondi, lancia Testnet

16 maggio: Protocollo Alvara sta “lanciando il suo testnet, segnando un’importante pietra miliare nel suo sviluppo di a Sistema basato su DeFi per la gestione dei fondi,” secondo il team: “Alvara democratizza la gestione dei fondi con un’innovativa fabbrica di fondi tokenizzati, sfruttando la DeFi, garantendo trasparenza, liquidità ed efficienza in termini di costi rispetto ai tradizionali hedge fund e agli ETF. Basato sullo standard token ERC-7621, consente a chiunque di diventare un gestore di fondi. Con il testnet live, gli utenti possono esplorare la piattaforma, fornire feedback e contribuire a modellare l’impatto futuro di Alvara sui settori DeFi e TradFi.”

Hashgraph Association e Qatar Financial Center pianificano un “Digital Assets Venture Studio” da 50 milioni di dollari

16 maggio: L’Associazione Hashgraph ha firmato una partnership strategica con il Qatar Financial Center per lanciare un Digital Assets Venture Studio da 50 milioni di dollari, secondo il team: “La piattaforma supporterà le società locali del Qatar e le società internazionali in portafoglio nello sviluppo di soluzioni finanziarie decentralizzate conformi alle normative e di asset digitali costruiti sulla rete Hedera Distributed Ledger Technology. Lo studio farà parte del Digital Assets Lab del Qatar all’interno del QFC Innovation Dome come parte della “National Vision 2030″ del Qatar per accelerare la ricerca e lo sviluppo nello spazio delle risorse digitali.”

KYVE avvia la “Fase 0” del programma di sovvenzioni con un massimo di $ 50.000 per sovvenzione approvata

16 maggio: Rete KYVE i rappresentanti hanno annunciato che il programma di sovvenzioni KYVE: Fase 0 è ora vive: “Questa fase di sovvenzione offre fino a 50.000 dollari di finanziamento per sovvenzione approvata che utilizza i set di dati e/o gli strumenti affidabili di KYVE”, secondo il team.

Lo sviluppatore di giochi Param Labs, dietro Kiraverse, raccoglie 7 milioni di dollari, guidato da Animoca

16 maggio: Param Labs, una società indipendente di sviluppo di giochi e infrastrutture dietro il gioco Kiraverse, e la piattaforma di creazione di risorse 3-D Pixel to Poly, hanno annunciato una raccolta fondi di 7 milioni di dollari in un round di investimento guidato da Animoca Brands. Secondo il team: “Anche Delphi Ventures, Cypher Capital, Mechanism Capital e altri investitori di alto livello si sono uniti ai round di finanziamento seed e privati. La società ha così incorporato oltre 50 partnership IP all’interno del suo ecosistema, con marchi come Pudgy Penguins, Neo Tokyo, Mocaverse di Animoca Brands, Pixelmon e giganti del commercio al dettaglio come GameStop.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

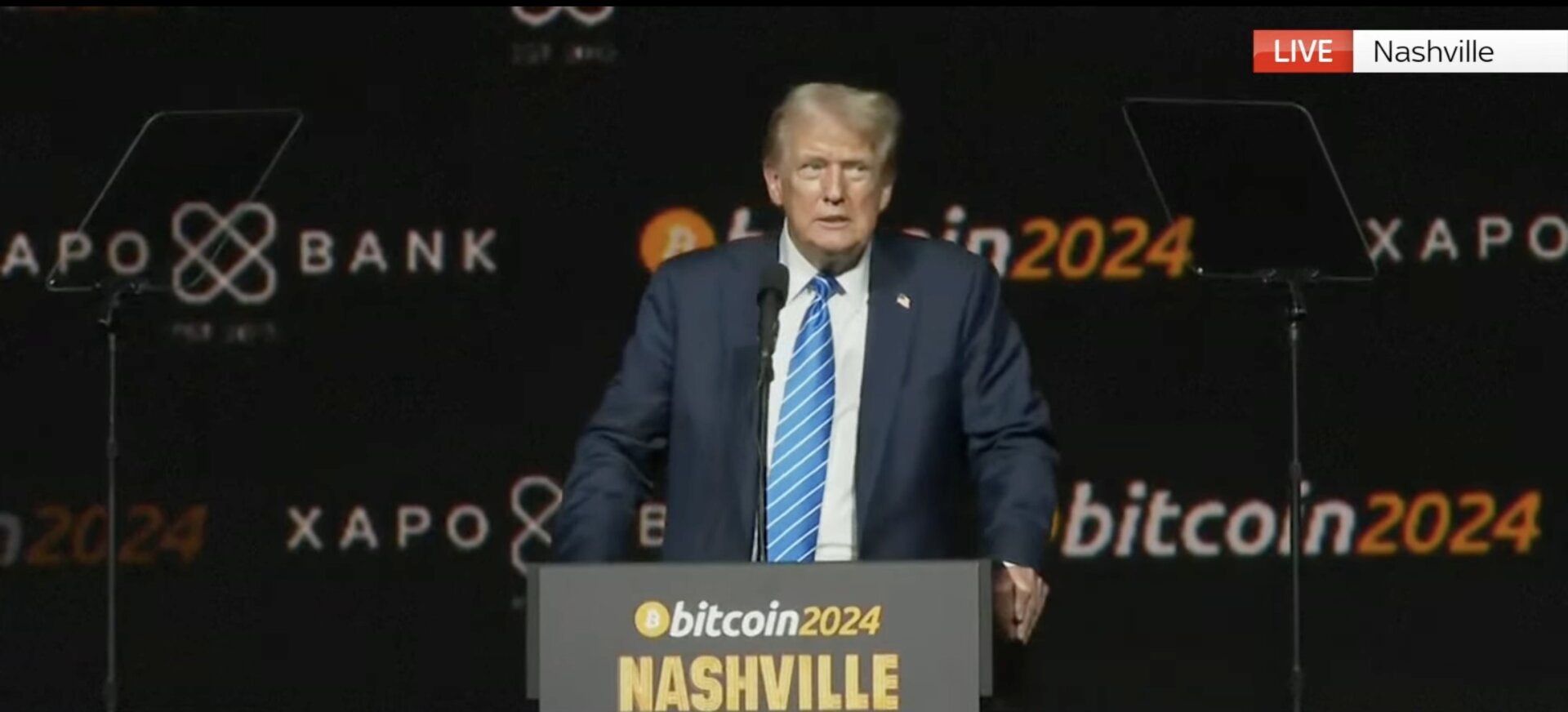

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News11 months ago

News11 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins11 months ago

Altcoins11 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!