Tech

The Latest Tech News in Crypto and Blockchain

Oct. 25: Clearpool, a DeFi credit marketplace, has expanded to Optimism’s OP Mainnet and received a 150,000 OP grant (about $205,000) from the Optimism Foundation, entirely designated to reward lenders in the borrower pools, according to a message from the team. “Fasanara Digital and Portofino Technologies have launched the first pools, enabling users to lend USDT and earn auto-compounded, dynamic risk-adjusted returns with no lock-up periods. The pools also benefit from Idle’s Yield Tranches (YTs), adding advanced risk diversification, and extra yields from Idle, which also received a 150,000 OP grant designated for lenders on Clearpool.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here.

Mastercard Teams Up With MoonPay for Web3 Push

Oct. 25: Mastercard has teamed up with MoonPay, a cryptocurrency and non-fungible tokens (NFTs) payments app, to explore how the blockchain-based Web3 world can connect with and build loyalty among consumers, the companies said at the Money20/20 event in Las Vegas. The partnership allows MoonPay to avail itself of Mastercard’s Crypto Credential system, a way of ensuring transactions are trusted and compliant with regulations, as well as integrating payments tech like Mastercard Send and Click to Pay, according to a blog post.

Index Coop Tokenizes CoinDesk Indices’ Ether Trend Indicator

Oct. 25: The Index Coop, a DAO focused on on-chain structured products, launched a new “Index Coop CoinDesk ETH Trend Index (cdETI), a tokenized implementation of CoinDesk Indices’ Ether Trend Indicator, which is “designed to take advantage of ETH’s price volatility, without the need for constant market monitoring and active trading,” according to a press release.

LayerZero, Cross-Chain Protocol, Expands to Telos Network

Oct. 24: LayerZero, a cross-chain bridging protocol, has expanded to include Telos Network, a delegated proof-of-stake layer-1 blockchain compatible with Ethereum Virtual Machine (EVM) standard. “The tech will add a new layer of interoperability to the Web3 space by enabling users to seamlessly transfer assets between Telos, Ethereum, Arbitrum, BSC, Polygon and Avalanche,” according to a message from the team.

Fantom Launches Testnet for ‘Sonic’

Oct. 24: Fantom, a smart-contracts blockchain, launched a test network for “Sonic,” its new technology stack, replacing the previous “Opera,” according to a blog post. “Sonic is anticipated to achieve beyond 2,000 transactions per second at a finality of around one second. However, as this is the upper limit, the network will offer a far quicker sub-second finality under real-world circumstances. Storage requirements are reduced by up to 90%, which reduces validator node size from around 2,000 GB to 300 GB and non-pruned archival node size from above 11 TB to below 1 TB.” $FTM

Aleo, Privacy Blockchain, Unveils ‘zPass’ for Decentralized Identity

Oct. 24: Aleo, a privacy-focused protocol for decentralized applications with zero-knowledge proofs at layer 1, unveiled zPass, a decentralized digital identity solution, according to a message from the team. “Set to launch alongside Aleo’s mainnet this year, zPass uses ZK cryptography for private decentralized identity verification. ZPass can onboard pre-existing signed credentials (e.g., passports) as proofs on the Aleo blockchain that can be generated locally on a user’s device, ensuring greater privacy. ZPass enables selective information sharing and seamless verification while shielding sensitive data and eliminating intermediaries.”

Mastercard Plans Web3 Collaborations With Self-Custody Wallet Firms

Oct. 24: Payments giant Mastercard is exploring how best to collaborate with self-custody wallet firms like MetaMask and Ledger, according to a Web3 strategy workshop report seen by CoinDesk. Mastercard pointed out in a presentation deck that having a payments card helps wallet providers increase the number of active users and build loyalty and other revenue streams while giving cardholders the opportunity to spend their crypto balance in a frictionless way.

Bitmain, Crypto Mining Server Manufacturer, Announces Plans for Aleo Antminer

Oct. 24: Bitmain, the crypto mining-machine manufacturer, is planning the “Aleo Antminer” for the Aleo project, according to a notice on its website. Aleo, a layer-1 blockchain reliant on the Rust-based domain-specific language Leo, uses zero-knowledge cryptography to enhance privacy. The startup Aleo Systems announced a $200 million funding round in early 2022. Aleo CEO Alex Pruden told CoinDesk in a statement Tuesday: “We’re excited to see Bitmain and others contribute to the space with their specialized proving hardware.”

Oct. 24: Cube.Exchange, a hybrid trading platform fusing traditional finance with blockchain technology, has raised $9 million in seed funding, according to a press release. Investors include Asymmetric Technologies, Susquehanna Private Equity Investments, Everstake, Foundation Capital, Big Brain Holdings, Third Kind Venture Capital, Arche Fund, WW Ventures and members of Cube.Exchange management, according to a message from the team: “Many of the named firms are strategic partners. Proceeds will be used to hire in development, marketing, compliance and admin, to obtain licences, and to open additional offices. Cube.Exchange will launch as a spot exchange before expanding to additional offerings next year.”

Celestia Labs, Pushing Toward Network Launch, Introduces ‘Blobstream’

Oct. 23: Celestia Labs, which is helping to develop the Celestia blockchain for “data availability,” has introduced “Blobstream,” according to a blog post: “Formerly known as the Quantum Gravity Bridge (QGB), Blobstream relays commitments of Celestia’s data root using an onchain light client, enabling Ethereum developers to create high-throughput L2s as easily as they develop smart contracts.” $TIA

Lightspark, Led by Former Facebook Libra Exec, Releases ‘Universal Money Address’ Standard

Oct. 23: Lightspark, the Lightning Network-focused payments protocol led by David Marcus, creator of Facebook owner Meta’s since-abandoned to launch the Libra (later renamed Diem) stablecoin, announced the open-source Universal Money Address (UMA) standard, according to a blog post: “UMA addresses enable near-instant, secure, and open payments in any currency. UMA extends the capabilities of LNURL and Lightning Addresses to add messaging support for compliance and fiat currency FX. These additional features, combined with the Lightning Network’s near real-time settlement capabilities and the global liquidity profile of Bitcoin, will enable people worldwide to send and receive money at low cost.”

Blockaid, Web3 Security Firm, Raises $27M From Ribbit, Variant

Oct. 23: Blockaid, a Web3 security company used by firms like Metamask and Opensea, has raised a $27 million Series A led by Ribbit Capital and Variant. The round also saw participation from Cyberstarts, Sequoia Capital and Greylock Partners. The New York and Tel Aviv-based company said it would use the funding to scale its product, customer base and team to address the industry’s security challenges, which it described as “never-ending” in an emailed announcement on Monday.

CEO Ido Ben-Natan and CTO Raz Niv (Blockaid) (Blockaid)

Hybrid Exchange GRVT to Build on Matter Labs’ ZK Stack

Oct. 22: Gravity (GRVT), a new self-custodial crypto hybrid exchange, will operate a Hyperchain using Matter Labs’ ZK Stack. “Custom sequencing logic enables GRVT to unlock CEX-like high throughput and low latency,” according to a blog post. “Custom sequencing logic enables GRVT to unlock CEX-like high throughput and low latency. On the other hand, an example of how GRVT can horizontally scale its infrastructure is by running different orderbooks as dedicated app-chains, with the expectation of achieving speeds of up to 600,000 trades per second with less than 2 milliseconds of latency.”

Hiro, Maker of Bitcoin Developer Tools, Releases Clarinet SDK

Oct. 22: Hiro, a maker of developer tools for Bitcoin layers, has “opened up Clarinet to the JavaScript world,” according to a post. The team has released a new software development kit (SDK) “allowing developers to write Clarinet tests in a more standard and readable format.”

ZkLend, Money-Market Protocol, Launches on Starknet

Oct. 22: ZkLend, a layer-2 money-market protocol on Starknet, announced its mainnet launch, according to a message from the team: “With Cairo VM technology, zkLend ensures scalability and security. The mainnet introduces wstETH support for staking and DeFi. ZkLend holds 17% of Starknet DeFi TVL, totaling $7.5 million, showcasing its leadership.”

Oct. 22: Upland, a Web3 metaverse app on the EOS blockchain, raised an additional $7 million as an extension to its Series A funding, according to a press release. “The Series A extension adds EOS Network Ventures as a new investor, alongside participation from existing investors C3 Venture Capital, Animoca Brands, and angel investors.” $EOS

Oct. 22: Coinbase’s Base blockchain has introduced “Base Bootcamp,” an “eight-week immersive program,” according to a blog post. “Base Bootcamp is designed for experienced developers (mid to senior level Software Engineering individual contributors) who are interested in learning smart contract development.” Applications for the coming cohort will close Oct. 27.

Oct. 20: Key U.S-based clearinghouse Depository Trust & Clearing Corp. (DTCC) has agreed to buy institutional blockchain infrastructure provider Securrency to expand its digital asset capabilities. According to a Thursday press release, Securrency will become DTCC’s fully-owned subsidiary under the name DTCC Digital Assets.

Crypto Platform Beluga Raises $4M, Led by FinCapital

Oct. 19: Beluga, a crypto platform for onboarding new users, raised $4 million in a seed round, according to a press release. The round was led by Fin Capital with participation from Anagram, UDHC, Dispersion Capital, Aptos Labs, 2 Punks Capital, Borderless Capital, Kyber Capital, 186 Ventures, W11 Capital and Rubik Ventures. “Angel investors include Charlie Lee, founder of Litecoin; Mike Lempres, former chief risk and legal officer of Coinbase; Brandon Gath, head of Kraken Ventures; Akash Garg, former CTO of MoonPay; Salil Pitroda, former Blockchain.com board observer; Howard Lindzon, co-founder of Stocktwits; and Jim Robinson, co-founder of RRE Ventures.”

Oct. 19: SynFutures, a perpetual futures decentralized exchange (DEX), has raised a $22 million Series B led by Pantera Capital, alongside fellow crypto industry investor heavyweights. Pantera Capital was joined by Susquehanna International Group and HashKey Capital, according to an emailed announcement on Thursday.

Nomura-Backed Komainu Joins Crypto Custodian Copper’s ClearLoop Network

Oct. 19: Komainu, a crypto custody joint venture of Nomura, Ledger and CoinShares, is joining Copper’s ClearLoop network, the company said Thursday. The tie-up will allow institutional clients of Komainu to trade over ClearLoop, the firm said. The clients will be able to benefit from regulated, on-chain custody provided by Komainu, while at the same time gaining access to off-exchange settlement through the network.

Oct. 19: USDC stablecoin issuer Circle Internet Financial on Thursday released an upgrade for its Web3 programmable crypto wallet that allows merchants to take over and pay for their customers’ transaction fees. According to the press release, the new function called Gas Station lets businesses sponsor users’ gas fees – the cost for money transfers on blockchains – leveraging the ERC-4337 paymaster. $USDC

Copper Integrates Stacks Layer for Bitcoin

Oct. 19: Copper.co, a digital-asset custodian, has integrated Stacks, a network that enables the creation of decentralised applications (dApps) and smart contracts on top of the Bitcoin blockchain, according to a press release. “Through this integration, institutional clients gain the ability to safely custody, trade, and leverage Stacking with all existing and future SIP-010 tokens on the Stacks blockchain.” $BTC

Bitcoin Asset Manager Onramp Unveils Multisig Platform, Adds BitGo to Custodians

Anoma Foundation to Incent Namada Builders With 10M NAM

Oct. 19: Anoma Foundation announced new rewards for the Community Builders Program for Namada, the first multichain privacy protocol on Cosmos, according to the team: “The Anoma Foundation will also incentivize selected builders with 10 million NAM tokens (appx 1% of the total supply). It will be encoded into the genesis block of the Namada blockchain following the completion of the Retroactive Public Goods Funding (RPGF) Round.”

Coreum Blockchain Turns to BitGo for Custom Payments

Oct. 19: Coreum, an enterprise-grade layer-1 blockchain, announced a new partnership with crypto custodian BitGo, according to a message from the team: “This partnership with BitGo aims to create a highly secure and streamlined gateway for global institutions to leverage Coreum’s enterprise solutions. BitGo’s bank-grade custody services allows Coreum to offer novel blockchain-based solutions including custom payments, rewards programs, tokenization opportunities, and peer-to-peer insurance products.”

Primex Finance Deploys Mainnet App

Oct. 19: Primex Finance announced the deployment of its mainnet app, accompanied by a liquidity mining program, according to a message from the team: “This marks the most significant milestone for the protocol in the past two years. Commencing on Oct. 19, users will have the ability to engage in trading across multiple aggregated decentralized exchanges (DEXs). This includes features such as leverage, limit orders, and position management, mirroring the functionality and interfaces of centralized exchanges (CEXs), all powered by a decentralized trade execution mechanism.”

‘Ryder One’ Hardware Wallet Released

Oct. 19: Ryder announced the launch of the Ryder One hardware wallet, “introducing a new standard for Web3 self-custody that eliminates the complicated seed phrase process with novel TapSafe recovery,” according to a message from the team. “The launch of the wallet comes on the heels of Ryder’s close of a successful $1.2M raise from industry heavyweights Oak Grove Ventures, Co-founder of Trust Machines Muneeb Ali, and SBX Capital, Bitcoin Frontier Fund, among others.”

Quantstamp Adds ‘DeFi Protection’

Oct. 19: Quantstamp is announcing DeFi Protection, “a new security product that will reimburse users for their DeFi losses,” according to a message from the team. “DeFi Protection checks the safety of smart contracts, alerts users to any threats and provides 24/7 support from security auditors. Critically, the product also features a guarantee program that will reimburse DeFi Protection customers for any losses due to a gap in Quantstamp’s security services.”

Insomnia Labs Announces Blockchain Tech Stack ‘Loyalty+’

Oct. 19: Insomnia Labs, an NYC-based Web3 solutions firm dedicated to bringing brands into Web3, is set to announce the launch of Loyalty+, a next-generation blockchain-based tech stack aimed at transforming the landscape of brand loyalty, in collaboration with Web3 loyalty and rewards program provider Co:Create, Smart Token Labs, Cookie3 and Crossmint, according to a message from the team.

Helix, Injective-Based DEX, to Offer ‘Pre-Launch’ Token Futures, Starting With Celestia’s

Oct. 18: Helix, the decentralized orderbook exchange built on the Injective blockchain, on Wednesday announced plans for Pre-Launch Futures, according to a message from the Injective team: “Helix will be the first exchange to grant the general public access to the Celestia (TIA) token through its perpetual market through this new Pre-Launch Futures product. Traditionally, gaining access to assets before their official launch has been a privilege reserved for early contributors, VCs or wealthy insiders. Helix is aiming to disrupt this closed system by allowing, for the first time ever, the decentralized trading of popular upcoming tokens prior to their official launch or listing on a public cryptocurrency exchange.” $INJ

Masa Unveils V3 of its Dapp

Oct. 18: Masa, an on-chain identity infrastructure for Web3, has unveiled Masa Dapp 3.0, offering a simplified and improved user experience, according to the team. “The launch marks an evolution in their product suite and services, including Masa Analytics. Special limited-time reward campaigns with partners like Base Daily and QuickSwap are being introduced to celebrate the launch. Masa 3.0 also introduces a newly designed dashboard, streamlining user navigation.”

SYS Labs Announces Next Phase of Rollux Layer-2

Oct. 18: SYS Labs, a Web3 product suite powered by Syscoin, has announced the next phase of Rollux, an innovative EVM layer-2 solution, according to a message from the team: “Harnessing the strength of Bitcoin to optimize the performance of Ethereum network applications, Rollux has introduced a full suite of DeFi tools -including a ZK-lite client, cross-chain bridges, DEXs, liquidity protocols, yield aggregators and a launchpad- to lay the foundation of a comprehensive Web3 ecosystem.” $ETH $BTC

Hyper Oracle Launches OpML

Oct. 18: A message from the Hyper Oracle team: “@punk6529 tweeted: ‘in a world of infinite AI content and avatars, only crypto will be used to ‘prove’ anything.’ And indeed zkML is all over X/Twitter being promoted as the solution. But does it work? It’s too early. Generating a zero-knowledge proof of a one-time Twitter algorithm inference would cost $80K. However, we can generate optimistic proofs with opML. OpML is to zkML, what optimistic rollups are to zk rollups, the efficient and cheap alternative. Hyper Oracle just launched opML and put a 7B parameter ML model onchain. With opML, we can bring unparalleled transparency into the AI space.”

Methodic CoinDesk ETH Staking Fund Launches

Oct. 19: Methodic Capital Management on Wednesday announced the launch of the Methodic CoinDesk ETH Staking Fund, designed to offer professional investors the total return of ether (ETH) by combining exposure to both the token itself and staking rewards.

API3 Deploys ‘Decentralized Data Feeds’ to 5 Chains

Oct. 18: According to a press release: “API3 recently announced the deployment of its decentralized data feeds (dAPIs) across five new chains: Base, Kava, Linea, Mantle and Rootstock. This significant expansion reflects API3’s commitment to revolutionizing decentralized finance (DeFi) by supporting as many chains as possible with verifiable, decentralized data feeds maintained on-chain directly by the data providers.”

Ether.Fi Rolls Out Liquid Staking Token eETH, to Be Restaked on EigenLayer

Oct. 18: Decentralized finance (DeFi) protocol ether.fi, which raised $5.3M in March in a seed round led by North Island VC, has rolled out a liquid staking token (LST) called “eETH” that allows users to generate rewards by staking ether (ETH). The plan “will allow users to stake their ETH to accrue staking rewards and automatically restake their ETH in EigenLayer,” according to a press release. “Ether.fi will be working with DeFi launch partners to create utility for eETH from day one, including Balancer, Gravita, Pendle and LayerZero.”

Cobo Launches ‘MPC Lite’ for Lower-Cost Crypto Custody

Oct. 18: Cobo, a digital-asset custody solutions provider, has launched Cobo MPC Lite, according to a message from the team: “The high costs and technical complexities associated with enterprise-grade MPC custody solutions have made them out of reach for many growing Web3 teams. To address this need, Cobo developed Cobo MPC Lite, paving the way for widespread adoption of enterprise-grade MPC custody.” MPC stands for “multi-party computation,” a cryptographic security measure that is used in a growing number of crypto wallets.

Bracket Launches Testnet for Arbitrum-Based Trading Platform ‘Passage’

Oct. 17: Bracket Labs, a finalist in Binance’s 2023 Summer Web3 Reality Show “Build The Block,” has launched the testnet for Passages, its Arbitrum-based volatility market product, according to a message from the team. “Built by a senior team with experience from D.E Shaw, Merrill Lynch, Barclays, Bloomberg, Consensys, DeerCreek and more, Passage is a new one-click range-bound trading platform with leveraged volatility options for any market condition.”

Taurus to Integrate Elliptic’s Wallet Screening Tool

Oct. 17: Taurus SA, a FINMA-regulated custody and tokenization technology provider, and Elliptic, a global leader in cryptoasset risk management, announced a partnership “to provide banking-grade security and compliance to the market,” according to the team. “As part of this collaboration, Taurus will integrate Elliptic’s wallet screening tool into Taurus-PROTECT, the European leading digital asset custody solution for banks and corporates. Merging Elliptic’s crypto screening capabilities with its custody platform will allow Taurus to seamlessly manage AML and fraud risks in full compliance with all applicable regulations.”

Spheron Embarks on Next Phase, Discloses $7M 2022 Fundraise

Oct. 17: Spheron, a specialist in Web3 infrastructure and “platform-as-a-service” or “PaaS,” has “embarked on a phase 2 of its roadmap with the primary goal of addressing the UX, security and reliability issues in the existing Web3 Infra layer,” according to a press release. The startup disclosed that it raised $7 million in a funding round in August 2022 from investors including Alphawave Ventures, NexusVP, Zee Prime Capital, Protocol Labs, ConsenSys Mesh, Paradigm Shift Capital,Matrix Partners India and Tykhe Ventures. Angel investors including Sandeep Nailwal, Aniket Jindal Julian Traversa also joined in the round.

ARPA Network’s Random Number Generator ‘Randcast’ Live on Optimism

Oct. 16: ARPA Network’s random number generator (RNG), Randcast, has gone live on Optimism, a layer-2 blockchain atop Ethereum. “Their aim is to foster a more secure, dynamic, and immersive experience in the world of on-chain games and autonomous worlds,” according to a message from the team. “Random Number Generation (RNG) is vital to many digital and online spaces, including the gaming industry. There is currently no mature and secure random number solution available on Optimism, which is why ARPA made this move.” $OP $ETH

Acme, Backed by Safe, Announces Beta Launch

Oct. 16: Acme, the intent-based network simplifying on-chain transactions, is announcing its beta launch onstage today at GITEX in Dubai, according to a message from the team. “Acme seeks to break down barriers to digital ownership, enabling secure digital asset transactions with one tap. Acme’s intent-based network is backed by Safe, the pioneering account abstraction infrastructure provider, and Gelato, the Web3 service provider enabling gasless transactions.”

Unstoppable Domains Integrates with Webacy

Oct. 16: Unstoppable Domains, a platform for user-owned digital identity with 3.9M domains, has announced a partnership and integration with the leading crypto-wallet security protocol, Webacy, backed by Gary Vaynerchuk, according to a message from the team. “This will enable users to assess the risk levels of wallets connected to their Web3 domains via a ‘safety score’ and inform them of potential financial risks based on a set of factors. It also gives users the power to trigger a Panic Button, enabling them to move assets in bulk to another wallet in case of a compromise.”

EOS EVM Releases Trustless Bridging of USDT From Native Layer

Oct. 16: The EOS Network Foundation (ENF) said EOS EVM v0.6.0 has gone live on the main network. “The highlight of this release is the trustless bridging of USDT from the EOS Native layer to the EOS EVM,” according to a message from the team. “The release also introduces mechanisms for cross-virtual machine communication, opening the door for novel use-cases.” $EOS

Contango Spreads to Optimism After Arbitrum Launch

Oct. 16: Contango, a decentralized market that builds futures on top of money markets, has brought its flasgship product, cPerps, to Optimism, after a successful launch on Arbitrum recently, according to a message from the team.”CPerps are built by automating a looping strategy on money markets using flash loans. Looping, also known as recursive borrowing and lending, is the DeFi-native way of leveraging on-chain. Currently Contango has integrated with Aave, the leading lending market in DeFi, to tap into its $4.6B liquidity. The team, however, plans to expand both horizontally, to more chains, and vertically, to more money markets.” (The debut of cPerps was reported in Protocol Village on Oct. 4.) $OP $ARB

Gnosis Developers Get Access to Moralis Web3 APIs

Oct. 16: Gnosis Chain, an EVM layer-1 blockchain, and Moralis, a leading Web3 data provider, “announced a collaboration to empower development of advanced Web3 solutions on Gnosis Chain. A response to substantial demand from the Moralis community, this partnership gives developers building on Gnosis Chain access to Moralis’ expansive suite of Web3 APIs, further solidifying the blockchain’s position as a developer-optimized, innovation-focused network.” Developers can access resources and tutorials at moralis.io/chains/gnosis/.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

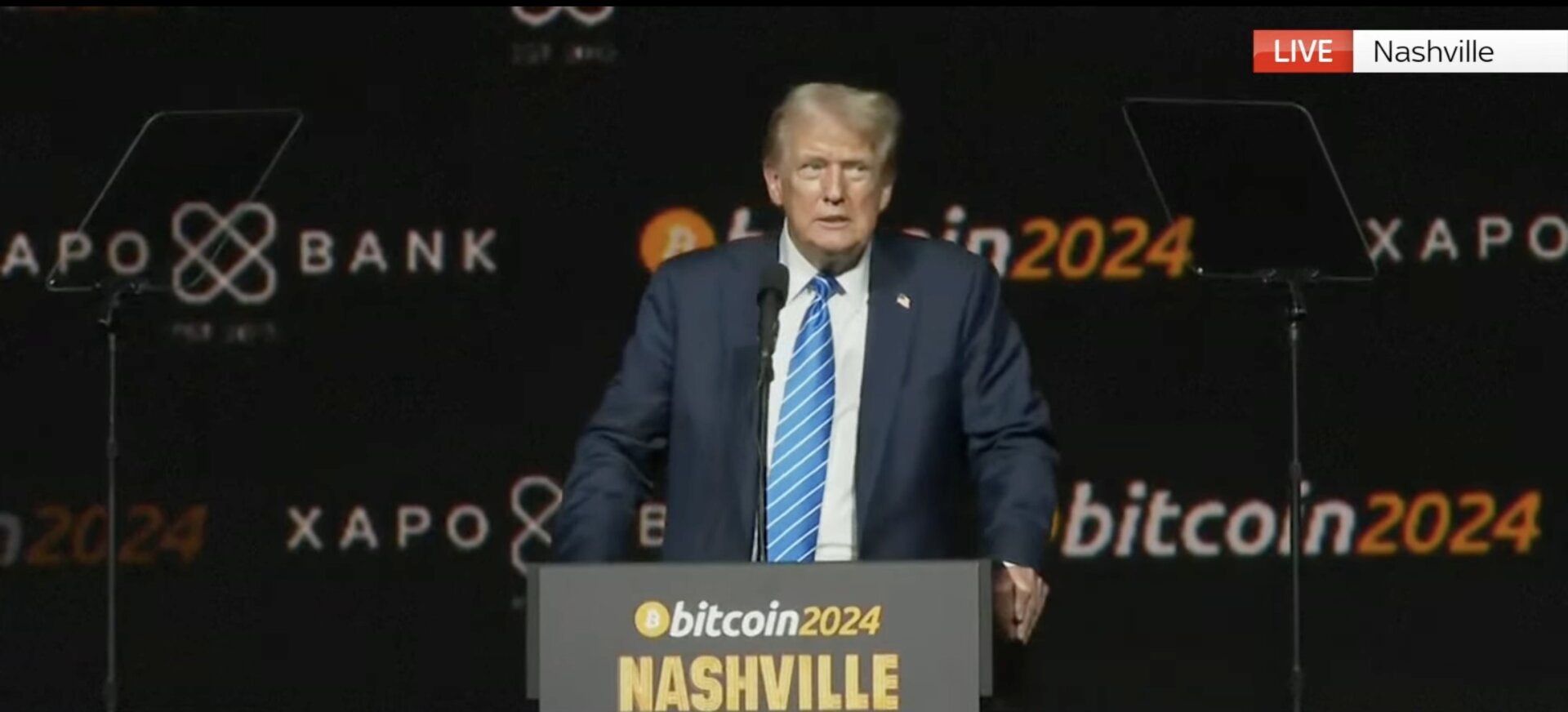

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!