Tech

The Latest Tech News in Crypto and Blockchain

Nov. 15: The banks UBS, SBI and DBS have “launched the world’s first live repurchase or ‘repo’ transaction with a natively-issued digital bond on a public blockchain,” according to a press release. “Conducted as part of Monetary Authority of Singapore’s Project Guardian, the transaction highlights how blockchain technology enables cross-border distribution and settlement of capital market instruments in a highly efficient, flexible and cost-effective manner while enhancing liquidity management for institutions. The transaction involved a repo to borrow tokenized Japanese yen (JPY) against a JPY-denominated natively-issued digital bond, with the borrowed tokenized JPY used to finance the purchase of the same bond. The subsequent digital bond redemption and payment of principal and interest at maturity was executed on-chain as well, demonstrating the potential to cover an entire transaction lifecycle on a public blockchain.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here.

Ethereum Platform Infura’s Step Toward Decentralization Includes Microsoft, Tencent

Nov. 15: Infura, the crypto infrastructure firm from ConsenSys, announced Wednesday it’s taking a first toward decentralization. With its new “Decentralized Infrastructure Network,” or DIN, Infura is joining with Microsoft, Tencent and a variety of crypto firms in what it described in a press release as “a powerful new way for developers to connect to Ethereum and other top-tier blockchains.” The new feature is a “failover” switch that Infura users can optionally flip on to protect against network hiccups.

Blockchain Developer Lattice Unveils ‘Alternative Data Availability’ Network for Optimism

Nov. 15: The Optimism blockchain ecosystem is getting its own “alternative data availability” or “alt-DA” chain, called Redstone – courtesy of the development team Lattice. Currently still operating as a test network, Redstone aims to be cost-effective for on-chain games and decentralized applications.

Blockchain Startup Kinto Plans ‘First KYC’d’ Ethereum Layer-2 Network After Raising $5M

Nov. 15: Ethereum-focused blockchain project Kinto disclosed it has raised $5 million in fundraising rounds this year to develop a layer-2 network that’s fully compliant with anti-money-laundering laws, aiming to connect financial institutions and real-world assets with decentralized finance (DeFi) rails. The project is built using the OP Stack, which is a set of software tools created by the developer OP Labs that companies can use to easily spin up their own customized layer-2 networks. (OP) (ETH)

JPMorgan, Apollo Tokenize Funds in ‘Proof of Concept’ With Axelar, Oasis, Provenance

Nov. 15: Traditional-finance giants JPMorgan and Apollo successfully worked with a handful of blockchain firms to demonstrate “proof of concept” for how asset managers could tokenize funds on the blockchain of their choice, according to a press release. JPMorgan’s Onyx Digital Assets collaborated with interoperability layer Axelar, infrastructure provider Oasis Pro and Provenance Blockchain to manage large-scale client portfolios, execute trades and enable automated portfolio management of tokenized assets, according to the release.

Visa-Backed Agrotoken, Stablecoin Backed by Commodities, to Launch on Polkadot

Nov. 14: Agrotoken, the first global tokenization infrastructure for agricultural commodities, has announced its plans to launch on Polkadot, to enable seamless tokenization of agricultural commodities. According to the team: “Visa-backed Agrotoken is to build a Polkadot parachain that tokenizes soybeans, corn and wheat. Agrotoken issues stablecoins with collateral in grains and food, and the value of each token reflects the price of its respective commodity – soybeans, corn or wheat. With this, farmers, businesses and financial institutions can easily trade, save, invest and transact with Agrotokens at any Visa point-of-sale.”

Rarimo Launches ‘Proof-of-Humanity’ 2.0

Nov. 14: Rarimo, an interoperability protocol for cross-chain identity and asset management, has launched version 2.0 of its Proof-of-Humanity plug-in, a solution that enables Web3 dApps to verify its users are humans instead of bots, according to the team: “While it initially launched with Unstoppable Domains, Gitcoin Passport, and Civic, the update delivers new integrations with Worldcoin, Zealy, QuestN, Blockvision, Arena Games and MetaMask identity snap RariMe.”

Cryptocurrency Exchange OKX Coming Out With Layer 2 ‘X1’ Built on Polygon Technology

Nov. 14: OKX, the sixth-largest cryptocurrency exchange, announced that it is coming out with a layer-2 network called “X1” using Polygon’s Chain Development Kit (CDK). X1, expected to go live in the first quarter of 2024, will make use of Polygon’s zero-knowledge technology, a type of cryptography that’s become one of 2023’s hottest trends in blockchain. (MATIC) [POL] [OKT]

Upshot Announces Machine Intelligence Network

Nov. 14: Upshot, a protocol for decentralized delivery of alpha signals, announced its Machine Intelligence Network, according to the team: “The network crowdsources financial alpha produced by disparate machine learning models. ‘Alpha Miners‘ contribute insights to the network in the form of proprietary data, predictive model features, or predictions, then are rewarded based on how useful their alpha is (as determined by our new ‘Proof of Alpha‘ scoring mechanism). The result is a decentralized, self-improving intelligence network optimized for modeling financial markets. This allows other protocols to wield decentralized AI as a new primitive.”

Beoble, Web3 Messaging Platform, Plans December Beta Launch

Nov. 14: Beoble, a Web3 messaging and social platform, announces its invite-only beta launch set for Dec. 2, according to the team: “With its advanced end-to-end encryption, beoble enables seamless wallet-to-wallet communication, ensuring a secure and decentralised experience for its users. This milestone is further bolstered by a recent $2 million pre-seed funding round, underscoring strong investor confidence in beoble’s vision and technology. The funding round saw participation from a range of leading venture capital firms, including industry leaders DCG, Samsung NEXT, and Hashkey Capital.”

Oasis Pro Digital-Securities Marketplace Integrates With Aptos

Nov. 14: Oasis Pro Markets, member FINRA/SIPC, has developed a marketplace allowing for the investment and issuance of digital securities, and has now integrated with the “high throughput Aptos L1 blockchain,” according to the team: “This is one of the first FINRA member marketplaces to integrate with a prominent Layer 1 chain—opening the door for institutional investors, TradFi leaders, and DeFi innovators to become involved in private market securities. Additionally, Oasis Pro Tokenization’s best-in class smart contracts can now be deployed on the wide-reaching Aptos Network.”

Tokenized Cash Fintech Fnality Raises $95M Led by Goldman and BNP Paribas

Nov. 14: Fnality, a fintech firm building tokenized versions of major currencies collateralized by cash held at central banks, has raised $95 million (£77.7m) in Series B funding led by Goldman Sachs and BNP Paribas. DTCC, Euroclear, Nomura and WisdomTree participated in the round, which also saw further commitment from a number of banks that backed Fnality’s $63m fundraise back in 2019: Banco Santander, BNY Mellon, Barclays, CIBC, Commerzbank, ING, Lloyds Banking Group, Nasdaq Ventures, State Street, Sumitomo Mitsui Banking Corporation, and UBS.

Hana Securities Launches Security Token Offering Portal

Nov. 14: Korea’s Hana Securities, the brokerage arm of Hana Bank, one of the nation’s largest commercial banks, recently announced that it is launching a Security Token Offering (STO) portal. STOs are gaining attention in the country as progressive crypto regulations pass through its legislature and an increasing number of financial companies are stepping toward the Real World Asset market. Korea’s INF Consulting and ITCEN have been tapped to build the portal, with the value of the contract coming in at $10 million, according to a release.

Circle to Enable Cross-Chain USDC Transfers With Cosmos’s Noble Later This Month

Nov. 14: Circle’s Cross-Chain Transfer Protocol (CCTP), an on-chain program that facilitates transfers of the dollar-linked stablecoin USDC between supported blockchains without a custodial bridge, will go live on Noble’s main network at the end of the month to offer users easy swapping. Noble, introduced in March 2023, is an application-specific blockchain built within the Cosmos ecosystem. (ATOM)

DYdX Community Votes to Start Beta Stage

Nov. 14: The community behind DYdX, a crypto derivatives marketplace that recently moved from a proprietary Ethereum layer-2 network to its own standalone blockchain in the Cosmos ecosystem, concluded a vote on Monday that supports the starting of the dYdX Chain Beta stage, according to the team: “This means that trading functionality is active for the first time on the newly launched chain and that validators and stakers are accumulating trading fees.” (ATOM) (DYDX)

Polimec Says Deloitte Switzerland’s Digital Identity Service Now Live

Nov. 14: Polimec, a protocol of decentralized, regulatory-compliant fundraising, said KYC Credentials issued by Deloitte Switzerland are now live, enabling global digital fundraising for Web3 startups, according to the team: “Our collaboration with Deloitte has resulted in KYC (Know Your Customer) credentials that empower users to verify their identities while preserving pseudonymity on our platform.”

SSV, P2P to Collaborate on ‘DVT Staking API’

Nov. 13: SSV.Network and P2P.org announced a plan to “collaborate on the DVT Staking API for decentralized Ethereum staking, streamlining processes for custodians and enhancing institutional staking security through the SSV protocol,” according to the team. “DVT, or Distributed Validator Technology, improves security by distributing Ethereum validator duties among nodes. As SSV.Network approaches its mainnet launch, the partnership accelerates the development of the DVT Staking API, fostering the deployment and decentralization of Ethereum staking applications.”

Privacy Protocol Aleo, Bitmain to Co-Host ‘SNARK Tank’ for ZK Tech

Nov. 13: Aleo, a privacy-focused protocol for decentralized applications with zero-knowledge proofs at layer 1, in collaboration with leading cryptocurrency mining server manufacturer Bitmain, is co-hosting SNARK Tank, a ZK pitch competition during Devconnect in Istanbul on Nov. 18. According to the team: “SNARK Tank is the largest-ever ZK pitch competition, providing ZK projects with increased visibility and potential funding. Judges from Aleo, Orange DAO, and more will help Aleo and Bitmain distribute up to $200,000 worth of prizes. More info for those interested in participating and/or attending is available here.”

IOV Labs Commits Extra $2.5M to Rootstock Grants Program

Nov. 13: IOV Labs is committing an additional $2.5 million in the Rootstock Grants Program, bolstering crypto innovation on the Bitcoin sidechain, Rootstock. According to the team: “This initiative, building on 20 successful projects like Asami and OKU, aims to enrich the dApp ecosystem. Applications for the next wave, supporting diverse solutions from DAOs to peer-to-peer systems, are open until Nov. 17, inviting more transformative ideas.”

EigenLayer, Cubist in New ‘Secure Staking Alliance’ for Anti-Slashing Standards

Nov. 9: Cubist, a crypto wallet-as-a-service provider, announced a new “Secure Staking Alliance” that also includes EigenLayer, Babylon, BridgeTower, Ankr and Redacted, along with several staking-related, security and interoperability protocols. According to a press release: “We are collaborating on technical standards and best practices that will help teams design, build, and run secure staking infrastructure. For example, we are writing specifications that will guide new protocols towards design points that consider “anti-slashers” from the start, making it possible to run secure validators (i.e., validators that won’t get slashed) even in the presence of bugs and human errors.”

JPMorgan Adds Programmable Payments to JPM Coin

Nov. 10: Users of JPMorgan’s (JPM) blockchain-based settlement token, JPM Coin, can now program their accounts to make payments automatically according to preset conditions. The financial giant is allowing clients to plug in conditions for funds to be moved to cover overdue payments or margin calls, according to an email on Friday.

Interop Ventures Raises $3.85M for ‘Interchain Economy’

Nov. 9: Interop Ventures, an early-stage venture fund that says it invests in the “Interchain economy,” has raised $3.85 million from investors including KR1, LBank Labs and Sunny Aggarwal. According to a press release, the fund is particularly focused on the Cosmos blockchain ecosystem: “The Interchain ecosystem and the Cosmos technology stack have always been at the forefront of innovation, and we believe will play a crucial role in fulfilling this vision,” said Sebastian Couture, general partner at Interop Ventures. (ATOM)

Polygon Labs Commences $85M Grant Program to Draw Builders to Its Ecosystem

Nov. 9: Ethereum scaling platform Polygon Labs has started a grant program to entice developers to build applications in its ecosystem. Polygon Labs is offering a total of 110 million of its native token, MATIC, worth around $85 million at the time of writing, to projects in decentralized finance (DeFi), gaming, social media and more. $MATIC

Risc Zero Open-Sources Technologies

Nov. 9: RISC Zero, developers of a general purpose zero-knowledge (ZK) virtual machine technology, announced the open sourcing of three key technologies as public goods for zero knowledge cryptography and blockchain developers. According to the team: “developers can now modify, enhance, audit and sublicense these potent tools under the permissive and community-friendly Apache2 license.”

Zircuit Launches New zkEVM Rollup

Nov. 9: Zircuit, a new EVM-compatible ZK rollup, is announcing its public testnet launch. According to the team: “Zircuit uses a hybrid approach that combines the latest ZK proofs with optimistic infrastructure. More efficient proof generation results in reduced fees and the development of new compression algorithms increases transaction speeds and saves users gas. By having security at the sequencer level, Zircuit will block any malicious transactions while still allowing developers to see an attempt to hack.”

Moflix Raises $3.1M to ‘Explore Ways of Incorporating’ Hedera Tech

Nov. 9: Moflix, which provides end-to-end digital solutions for “cloud-native, all-digital telco-in-an-app,” has raised a $3.1 million seed funding round with participation from The Hashgraph Association (THA), the Swiss-based non-profit organization accelerating the adoption of the Hedera network globally, alongside other strategic investors. According to the team: “THA’s financial commitment and engineering expertise will enable Moflix to explore ways of incorporating Hedera’s technology into its offering, empowering telcos to offer infrastructure, platforms, applications and user experiences for a Web3-enabled world.” (HBAR)

Stackr, Provider of Tools for ‘Micro-Rollups,’ Raises $5.5M

Nov. 9: Stackr Labs, provider of a software development kit to build app-specific “micro-rollups” using Web2 programming languages such as JavaScript and Python, announced its Seed round, raising a total of $5.5 million, according to the team. “The round was led by Archetype, with participation from Lemniscap, a16z CCS, Superscrypt, a_capital, Spartan, Scalar Capital, t0 Capital, as well as a host of angel investors including Anurag Arjun, Sreeram Kanan, Mustafa Al-Bassam, Arjun Bhuptani, Rahul Sethuram, Layne Haber, Lito Coen, Andrew Keys and Devfolio. The raised funds will be used to support team expansion, prepare for the upcoming v1 launch of the platform and to expand Stackr’s developer ecosystem.”

Standard Chartered, SBI Holdings Establishing $100M Investment Firm Targeting Crypto Startups

Nov. 9: Standard Chartered’s (STAN) venture arm is teaming up with Japanese financial services firm SBI Holdings to form an investment company with $100 million backing to target crypto startups. SC Ventures and SBI Holdings’ Digital Asset Joint Venture investment company will be established in the United Arab Emirates (UAE) and focus on firms in market infrastructure, risk and compliance, decentralized finance (DeFi) and tokenization, according to a Thursday email.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

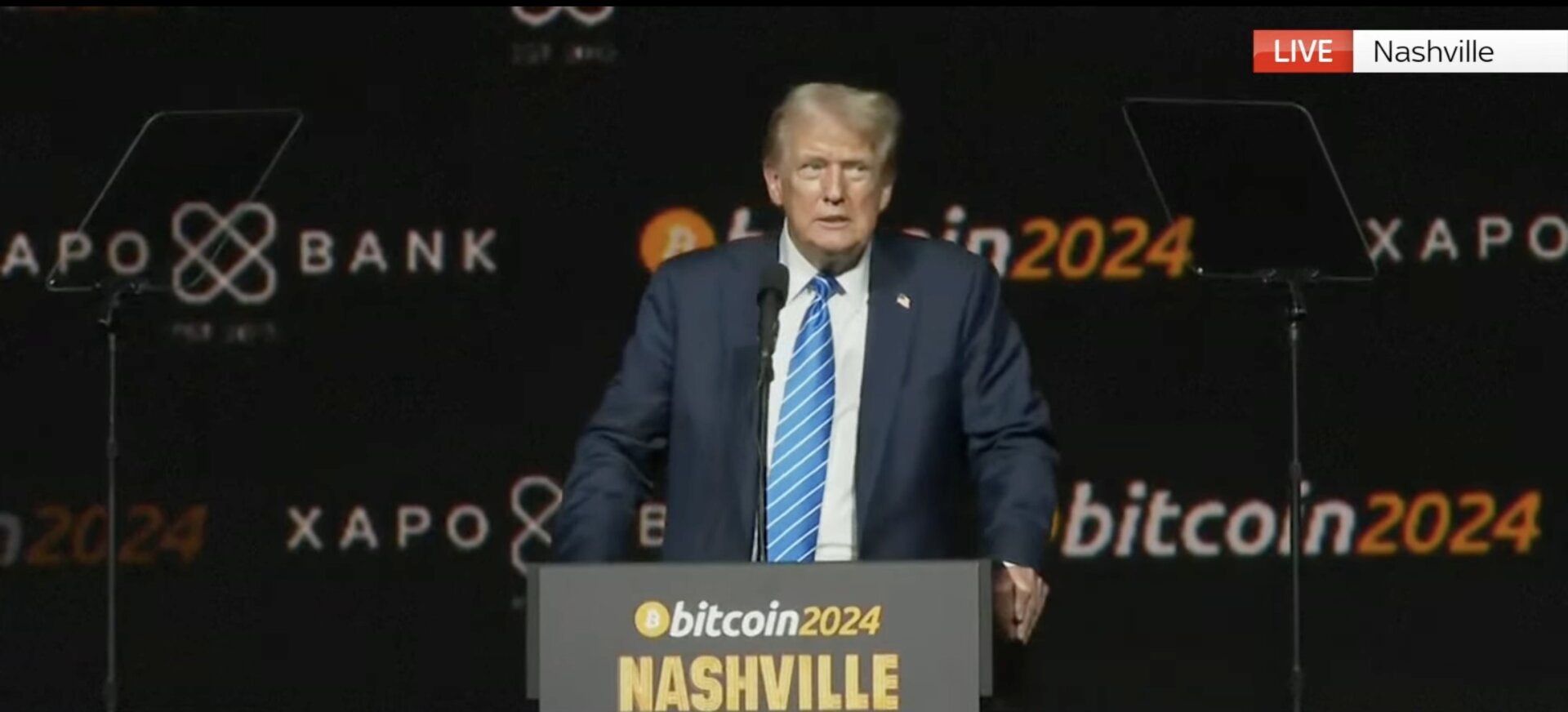

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!