Tech

The Latest Tech News in Crypto and Blockchain

Feb. 7: Layer-2 network Metis launched the “Metis Liquid Staking Blitz (LSB), an initiative to bolster their LSD ecosystem and accelerate the growth of LSDs and LSD-focused products on their Layer 2 network and leveraging the 4.6M METIS Ecosystem Development Fund,” according to the team: “Metis’ LSB will create the first LSD for a layer-2 network’s native token, unlocking LSDs’ versatility and blending it with the Layer 2 network’s profit and growth potential. For the first 12 months, a 20% Mining Rewards Rate (the rate at which smart contracts reward lockers for block production) will apply to all sequencer nodes.”

Zengo Wallet Now Supports Layer-2 Network Arbitrum One

Feb. 7: Zengo’s support for Arbitrum One “is a big moment for the community, as it offers a seamless gateway to Zengo’s renowned security and user-friendly experience,” according to the team: “Zengo’s impeccable record of zero hacks or thefts since launch in 2018 (with over 1 million customers) is especially exciting for the Arbitrum One community, as they can now manage their assets with unparalleled security and engage in the ecosystem without the traditional complexities associated with seed phrases.”

Paxos Adopts Chainlink’s PayPal USD Price Feed to Accelerate RWAs

Feb. 7: To accelerate the adoption of PayPal USD (PYUSD), PayPal’s USD-backed stablecoin issued by Paxos, Chainlink now supports a PYUSD Chainlink Price Feed on Ethereum mainnet, according to the team: “This new PYUSD Price Feed allows users to view highly accurate, reliable and decentralized market data for PYUSD on the blockchain. This provides users the information needed to help create secure markets around PYUSD and adopt it as their preferred stablecoin to facilitate on-chain payments.” CoinDesk 20 asset: {LINK}

Solana-Based Neon EVM Integrates With deBridge for Cross-Chain

Feb. 7: Neon EVM, a parallelized Ethereum Virtual Machine on Solana, and deBridge are officially integrating for cross-chain interoperability, according to the team: “The blockchain interoperability market, expected to reach $2.8 billion by 2032, has adoption barriers due to user experience complexities. This integration is a streamlined solution. Users can bridge tokens directly to enhance the overall user experience by eliminating unnecessary intermediary steps and constraints. This has the potential to provide access to Ethereum’s $32.5 billion Total Value Locked (TVL) as of 1/30/2024. For Neon EVM’s devs, it gives a direct gateway for interoperability with EVM-native chains.” CoinDesk 20 asset: {SOL}

OP Labs Hires Former Consensys Developer Ben Edgington as Lead Technical Program Manager

Feb. 7: OP Labs, the primary developer firm behind the Optimism blockchain, has brought on Ben Edgington as lead technical program manager. Edgington was previously at Consensys for over six years, where he founded their Protocols R&D team, and was part of the core group in charge of developing Teku, an Ethereum software client.

Solana-Based Digital Art Marketplace Exchange.art Appoints Laris Barbu as CEO

Feb. 7: Exchange.art, a digital art marketplace on Solana, has appointed Larisa Barbu as CEO, “marking the first female to lead an on-chain marketplace,” according to the team: “Focused on broader digital art adoption, Larisa plans to forge strategic partnerships and drive Exchange.art to be the premier digital hub for fine art. Larisa’s interim leadership showcased adaptability and resilience throughout the bear market. In Q4 the platform had a 1,000% sales increase, outperforming competitors. This success positions Larisa to confidently lead through future industry volatility, entering her role during a promising market rebound.”

Voi Network Launches as ‘Iteration’ of Algorand’s Open-Source Code

Feb. 7: Voi Network has been launched by veteran members of the Algorand proof-of-stake blockchain ecosystem, as a new iteration of the open-source code, according to the team: “The development of Voi, a layer-1 blockchain that will be launching in Q2, was fueled by the team’s frustration with the current shortcomings of the crypto industry. In response, Voi will allocate a significant 75% of its market cap to provide economic incentives for its network contributors and almost 800 participation nodes.” The project disclosed in December that it was backed by Arrington Capital, an original investor in Algorand, as well as Sonic Boom Ventures, founded by former Algorand Inc. CEO Steve Kokinos.

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

DeFi Credit Marketplace Clearpool Launches on Mantle Network

Feb. 6: Clearpool, the leading DeFi credit marketplace powered by its native token, $CPOOL, has “announced its successful launch on Mantle Network, a layer 2 rollup that combines Ethereum’s security with cheaper gas fees and higher throughput,” according to the team. “Clearpool has received a significant grant of 250K MNT tokens – dedicated to promoting Clearpool’s growth on Mantle. Continuing with the impressive expansion of its borrower ecosystem, Clearpool also announces two new borrowers, Arbelos Markets and Adaptive Frontier, who are launching permissionless pools on the Clearpool Mantle Market.”

Omega Announces $6M in Funding to Launch Bitcoin Web3 Infrastructure

Feb. 6: Omega announces $6M in funding from investors including Lightspeed Faction, Bankless Ventures, Wave Digital and more. According to the team: “The funding will be used to help launch Omega’s Bitcoin Web3 infrastructure – the first decentralized solution that enables bitcoin holders to utilize the value of their Layer 1 BTC for yield generation without having to bridge, wrap or synthesize it, allowing native Bitcoin to be used for DeFi.” CoinDesk 20 asset: {BTC}

Citrea, by Chainway Labs, Emerges From Stealth as ‘Bitcoin’s First ZK Rollup’

Feb. 6: Citrea, incubated by Chainway Labs and billed as “Bitcoin’s first ZK rollup,” emerged from stealth. As reported by CoinDesk Turkiye: “Ekrem Bal, co-founder of Chainway Labs, stated that they have made important progress with the verification of the groth16 proof of this technology on BitVM in 20B cycles, and emphasized that this progress represents an ‘amazing milestone’ for the Bitcoin ecosystem. By strengthening the Bitcoin blockchain space with zero-knowledge technology, Citrea aims to enable more complex applications while maintaining the security of the Bitcoin network. This technology offers a way to scale Bitcoin without changing its fundamental principles.”

Radix Releases Wallet Update, Triggers ‘Anemone’ Upgrade on Mainnet

Feb. 6: Radix, a platform for DeFi and Web3, released two updates this week. According to the team, Radix “has launched its v1.4.0 version of the Radix Wallet, which aims to improve the network staking experience. The update introduces an at-a-glance summary of a user’s total stakes, un-stakes and claims, rather than showing these as raw transaction manifests as it did previously. Additionally, Radix also launched its Anemone upgrade on mainnet. The upgrade includes support for new protocol update features such as the flash transaction type, system API extensions, protocol update thresholds, and node monitoring enhancements.”

Oasys to Integrate With NFT Marketplace X2Y2

Feb. 6: Oasys, a blockchain gaming ecosystem, “is joining forces with X2Y2, an NFT marketplace platform, to integrate their X2Y2 Pro NFT aggregator,” according to the team: “The integration brings numerous advantages to both gamers and developers. Players will gain enhanced capabilities to trade and lend their in-game NFTs, while developers will have the ability to leverage X2Y2 Pro to create more engaging and dynamic economies. Gaming platforms already involved are Gesoten by GMO, DM2 Verse (user base of 41 million members and part of DMM Group), HOME Verse (operated by publicly traded company double jump.tokyo Inc.).”

Railway Wallet Open-Sources Code Under GPL v2 License

Feb. 6: Railway Wallet has made its code fully open-source under a GPL v2 License, clearing the way for Ethereum developers to build their own robust privacy wallets and apps, according to the team: “Named by Ethereum co-founder Vitalik Buterin as a promising ‘second-generation’ privacy product, the Railway privacy wallet is the most popular frontend for the RAILGUN privacy system for Ethereum and EVM chains. Railway’s move comes in response to Buterin’s call to ‘make Ethereum cypherpunk again.’ View and download the code at: https://github.com/Railway-Wallet.“

Truflation, Provider of Economic Data Via Chainlink, Raises $6M

Feb. 6: Truflation, a provider of verifiable economic data that makes data available on-chain via Chainlink, has closed a funding round, raising $6 million from leading crypto investors, according to the team: “The list of VCs includes Laser Digital, Red Beard Ventures, Modular Capital, Abra, G20 and Four Seasons Ventures (4SV), alongside existing investors Chainlink, Fundamental Labs, C2squared, Cogitent Ventures, and the Israeli Blockchain Association. The investment round also saw the Base Ecosystem Fund, managed by Coinbase Ventures, select Truflation among its first cohort of investments from a shortlist of more than 800 applications.” CoinDesk 20 asset: {LINK}

Reflexer Team Says HAI Stablecoin Set for Optimism Mainnet, Airdrop

Feb. 6: The team behind Reflexer Finance, a platform for minting stablecoins backed by crypto collateral, says “HAI, a decentralized, community-governed, controlled-peg stablecoin and lending protocol built on Optimism,” will go live on Optimism Mainnet on Feb. 20. According to the team: “The project will airdrop tokens to qualifying wallets on Feb. 12.”

Nibiru Chain Raises $12M From Kraken Ventures, ArkStream, NGC, Master, Tribe, Ban

Feb. 5: Nibiru Chain, a developer-focused Layer-1 chain, has raised $12 million funding from Kraken Ventures, ArkStream, NGC, Master Ventures, Tribe Capital and Banter Capital to accelerate its ecosystem growth, according to the team: “Nibiru optimizes for developers with a built-in dev toolkit, easy-to-use APIs, language SDKs, and a native oracle. It offers 40,000 TPS, 1.4s block times, and robust security, thanks in part to the CosmWasm smart contracts. Its built-in DeFi super applications, along with native oracle and data-indexing functionalities, significantly reduce the technical selection difficulties for DeFi projects.”

Filecoin’s Liquid Staker Glif Raises $4.5M, Hints at Token Airdrop

Feb. 5: Data storage-centric blockchain Filecoin isn’t exactly known for its decentralized finance (DeFi) landscape. Glif, one of its longtime ecosystem contributors, is trying to change that. The startup has raised $4.5 million in seed funding from Multicoin Capital and other VCs to build out its tools for earning yield on FIL, Filecoin’s “gas” token that pays for data storage and retrieval on the network. CoinDesk 20 asset: {FIL}

Radix Launches Ecosystem Fund for Developers Worth More Than $1M

Feb. 5: Radix has launched a 25 million XRD Ecosystem Fund to accelerate the growth of its builders’ community, according to the team: “Currently worth over US$1 million, the fund will support new activities, rewards and grants to developers and entrepreneurs in the ecosystem. These include developer incentives of up to $1,500 in XRD, milestone rewards as well as Booster grants for co-marketing and partnership opportunities. The fund will also be funneled towards Radix’s upcoming Scrypto challenges and the second cohort of the Radix Grants Program.”

Web Registry GoDaddy, Ethereum Name Service Connect Domain Names With Crypto Wallets

Feb. 5: Ethereum Name Service (ENS), a domain name protocol that runs atop of Ethereum, reached an agreement with GoDaddy to allow users to link internet domains to their ENS addresses for free. “Beyonce owns Beyonce.xyz, and now she can set up a wallet just by going into the GoDaddy page and entering your address,” Nick Johnson, the founder of ENS, told CoinDesk as an example. “Now Beyonce.xyz is her wallet identifier for all intents and purposes.”

Crypto Payments App Oobit Raises $25M in Series A Funding Round Led by Tether

Feb. 5: Mobile payments app Oobit raised $25 million in a Series A funding round, the company said Monday. The round was led by the investment arm of Tether, CMCC Global’s Titan Fund, 468 Capital and Solana co-founder Anatoly Yakovenko. Consumers can use the Oobit app to pay for purchases using crypto, while merchants receive fiat currency. The tap-and-pay feature helps make crypto payments more accessible, as users can pay at any point of sale that accepts Visa (V) or MasterCard (MA) using funds from their Oobit wallet.

Kodiak Finance, Berachain-Based DEX Project, Raises $2M

Feb. 2: Kodiak Finance, aiming to becoming the “community-native DEX of Berachain,” announced the close of a $2 million seed financing round. According to the team: “The funding will further enable us to increase the pace at which we scale Kodiak and allow us to continue delivering amazing trading products native to Berachain.”

Schematic from Berachain-based DEX Kodiak Finance’s Jan. 15 blog post. (Kodiak Finance/Medium)

Staking Service Luganodes Adds Support for Bitcoin L2 Stacks

Feb. 1: Luganodes, provider of an institutional-grade staking service, is “bringing its muscle” to Stacks, a Bitcoin layer-2 network, according to the team: “This means institutions can now easily earn native BTC rewards while supporting the network and enjoying faster, cheaper transactions with complete Bitcoin security. Luganodes will also be a Signer on the upcoming Nakamoto upgrade, solidifying its commitment to the Stacks ecosystem.” According to a blog post, Luganodes “ranks among the top validators on Polygon, Polkadot, Sui and Tron.”

Pyth Deploys ‘Pyth Entropy,’ for On-Chain Random Number Generation

Feb. 1: Pyth, a blockchain oracle project, announced the future deployment of Pyth Entropy, “aimed at enhancing on-chain random number generation across various Web3 verticals such as prediction markets and GameFi,” according to the team: “The announcement marks a significant milestone as Pyth Entropy is primed to launch on a blockchain on mainnet for the first time, ushering in a new era for decentralized applications. Additionally, Pyth has unveiled the mainnet deployment of Pyth Price Feeds on LightLink, an Ethereum layer-2 blockchain. This now enables dApps and enterprises to offer users instant, gasless transactions. Starting today, smart contract developers in the LightLink ecosystem can permissionlessly access over 400 real-time price feeds across major asset classes to power their DeFi applications.”

Cube.Exchange Raises $12M From Investors Including 6th Man, Asymmetric

Feb. 1: Cube.Exchange, a soon-to-launch digital asset trading platform, has raised $12 million as part of a Series A fundraise, according to the team: “Investors in the round, led by 6th Man Ventures, include Asymmetric, ParaFi Digital, Foundation Capital, Susquehanna Private Equity Investments, LLLP, GSR Markets, Everstake Capital, Big Brain Holdings, Third Kind Venture Capital, Arche Fund, WW Ventures and prominent angels. Proceeds will be used to expand engineering, customer service, operations, legal and compliance, business development; and to obtain licenses.” This raise came as a result of inbound interest, according to the company, and comes on top of a $9 million seed round announced in October.

Sanctor Capital Raises $10M for Early Stage Web3 Fund

Feb. 1: Sanctor Capital raised $10 million for its early stage Web3 investment fund, according to the team: “It is also announcing a partnership with Press Start to launch a pre-accelerator program called The Multiplayer Fellowship. Together, Sanctor and Press Start aim to fund 100 teams over the next 18 months. Half of the graduates of Press Start’s previous fellowship programs have gone on to raise or join top accelerators such as Alliance DAO, a16z Crypto Startup School & SPEEDRUN, Binance Labs and Y Combinator.”

Upshot Unveils Allora, a Network for ‘Self-Improving Decentralized AI’

Feb. 1: Upshot unveiled Allora, a new “trustless, self-improving decentralized AI network,” according to the team. “Allora is designed to empower applications with smarter, more secure AI through a self-improving network of machine learning models. Upshot is backed by industry investors including Polychain, Framework, Blockchain Capital, and CoinFund.”

Prediction Market Zeitgeist Launches DLMSR-Based AMM

Feb. 1: Zeitgeist, a prediction market dApp, launched its DLMSR (Dynamic Logarithmic Market Scoring Rule) based automated market maker (AMM), according to the team, “marking a significant advancement in the blockchain prediction market with a dynamic liquidity model previously unseen in the industry. The DLMSR model represents a first-of-its-kind application in blockchain technology, enhancing the flexibility of market creation and liquidity provision while drastically improving operational dynamics by reducing slippage and thereby transforming trading efficiency and profitability, especially in larger trades.”

WOOFi, Cross-Chain DEX, Launches on Mantle Network

Feb. 1: WOOFi, a cross-chain DEX based in Saint Vincent and the Grenadines, has launched on Mantle Network, the Ethereum layer-2 scaling solution, according to the team: “This positions WOOFi as one of the first protocols to support LayerZero-powered cross-chain swaps into Mantle from eight top chains, including Arbitrum, Optimism, and Avalanche. Mantle’s MAU hit 370k in Jan 2024 post-LSP launch. VP of Ecosystem Ben Yorke notes the expected rise is fueled by easier mETH access, with WOOFi pivotal for its hyper-efficient cross-chain swaps, comprising 3.7% of LayerZero transactions.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

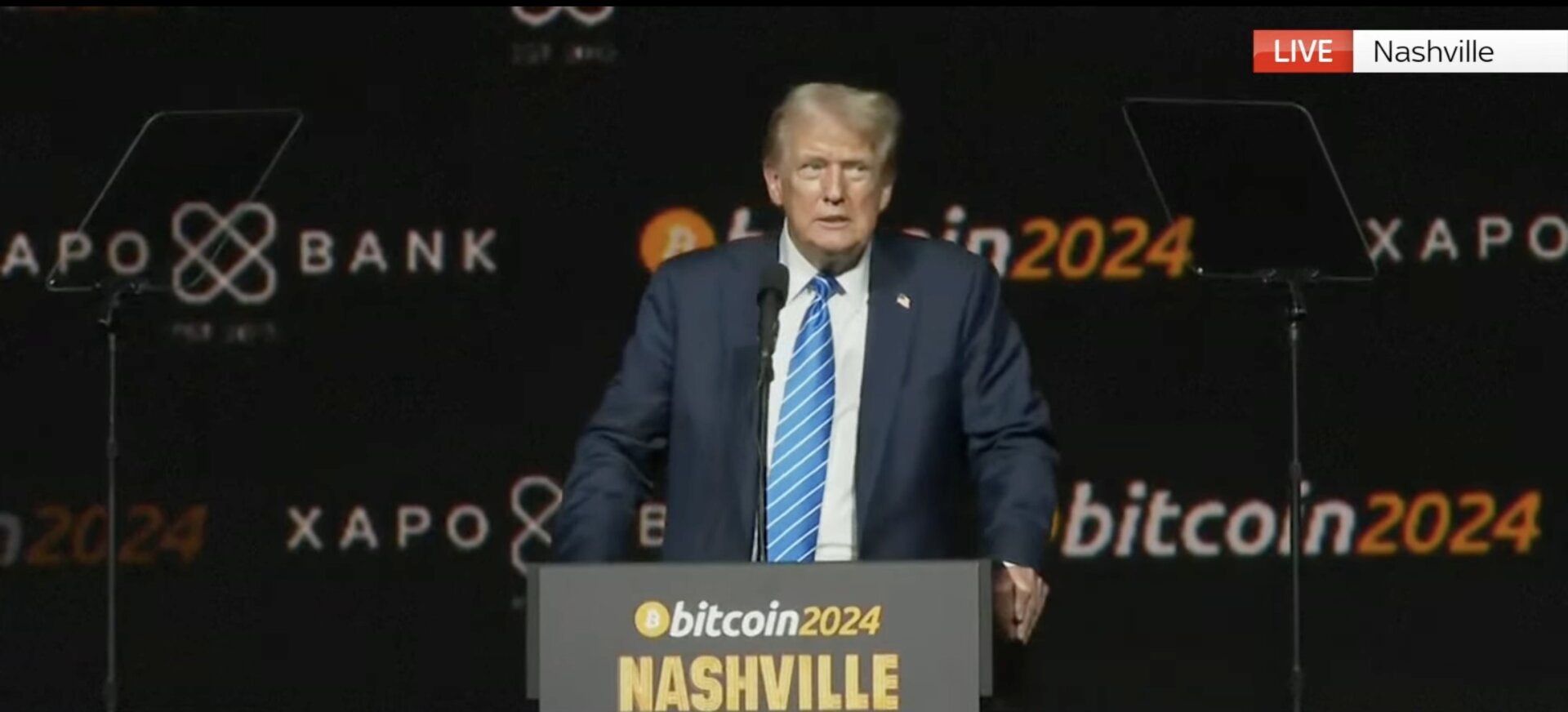

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!