Tech

The Latest Tech News in Crypto and Blockchain

Feb. 14: Sommelier, a DeFi platform offering yield-generating vaults, is expanding to Ethereum layer 2s via Axelar’s cross-chain messaging. According to the team: “This allows accessing new opportunities and users across chains. Sommelier launches its first layer 2 vault, Real Yield ETH, on Arbitrum. The vault uses dynamic strategies like liquidity provision and risk-managed leverage to optimize yields on ETH-denominated assets. Building on the success of a similar vault on Ethereum mainnet, the Arbitrum vault aims to outperform holding staked ETH two- to three-fold.”

Core Chain, Blockchain With Bitcoin Security, Ethereum Compatibility, Offers $300K for Developers

Feb. 14: Core Chain, a blockchain that combines the security of Bitcoin with Ethereum’s EVM compatibility, is launching its support program called Core Starter, according to the team: “This program provides over $300,000 in tools and incentives for developers building dApps on Core. Core Chain will provide cost support to platforms like Google Cloud, CertiK, TokenSoft, Hacken, Halborn, Elixir, Request Finance and Questly.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Nym Gets Grant to Bridge Privacy Protections of Mixnet to Zcash

Feb. 13: Nym Technologies, focused on privacy, announced that it has received a grant from the Zcash Community Grants, bringing the metadata privacy protections of the Nym mixnet to the Zcash ecosystem. According to the team: “Nym will work with Zcash’s already privacy-preserving infrastructure to help provide an end-to-end protected solution for privacy for Zcash users, solving data leakage at the network layer that is currently undefended by Zcash. Unlike any other privacy technology, the Nym mixnet prevents government, corporate and criminal surveillance adversaries from tracing metadata.” (ZEC)

Babylon Staking Protocol (on Bitcoin) to Integrate Into Cosmos Network

Feb. 13: Cosmos Hub and Babylon, a platform developing the first Bitcoin Staking Protocol for the PoS ecosystem, announced a proposed initiative to integrate Babylon’s staking protocol into the Cosmos network. According to the team: “If the proposal passes, Bitcoin holders will be able to stake their bitcoins to secure Cosmos Hub ICS consumer chains. Babylon is a trustless and self-custodial staking protocol that leverages timelock contracts to enable Bitcoin staking across traditional PoS chains. The result is a secure method that allows PoS chains to access over $800 billion in idle bitcoin.” CoinDesk 20 assets: (ATOM) (BTC)

Peaq Blockchain Expands Ecosystem With PowerPod’s DePIN for ‘Community-Owned EV Charging’

Feb. 13: Peaq, a blockchain for real-world applications, announced the expansion of its ecosystem, as PowerPod joins to decentralize electric vehicle (EV) charging. According to the team: “PowerPod is building a decentralized physical infrastructure network (DePIN) of community-owned EV charging stations. As part of the integration, the project will use peaq as the layer-1 backbone for its DePIN, using it to store charging session data, handle transactions and reward the users with tokens for powering a more sustainable future of mobility… As part of its integration with peaq, PowerPod will outfit these devices with their multi-chain self-sovereign peaq IDs, enabling them to connect with the blockchain. It will also leverage peaq for data storage and eventually launch its token on the peaq mainnet, set to go live in the coming months. It will also use peaq to set up its rewards mechanism, granting users tokens for interacting with the DePIN.”

Toposware Collaborating With Polygon to Build Type 1 ZkEVM

Feb. 13: Toposware and Polygon have joined forces to introduce Plonky2, describing it as “the most cost-effective Type 1 ZK-EVM, and a breakthrough in cryptographic research. The Plonky2 zkEVM operates within Ethereum’s ecosystem and reduces transaction costs.” according to the team. From the blog post: “This means all new and existing smart contracts deployed to Ethereum and compatible chains are now able to take advantage of the power of zero-knowledge proofs.” Separately, the Topos Builders Program Community Fund is now live.

Feb. 13: Watches.io, an end-to-end tracking and trading ecosystem for watches, has raised $1.9 million in a pre-seed funding round, led by Lemniscap. According to the team: “Watches.io aims to simplify the tracking, trading, and purchasing process for luxury watches, turning them into tradable assets.” According to a press release: “The round was led by Lemniscap, with participation from Big Brain Holdings, Marin Ventures, Soft Holdings Inc, Builder Capital, Darkside Capital, Non-Fungible Technologies, and a host of top Web3 founders and angel investors, including partners from top funds such as Dragonfly, Lattice, No Limit Holdings.” It uses an NFT infrastructure supported by NFT finance (NFTfi) platforms.

Titan Mining Enables ‘Frequent BTC Earnings’ Through Lightning Network

Feb. 13: The Titan Mining team is enabling frequent BTC earnings for mining efforts, providing Bitcoin miners with immediate access to their earnings through the Lightning Network, according to the team: “Miners receive their Bitcoin earnings approximately every 10 minutes without needing to reach a minimum balance before payout.”

Ledger, Coinbase Pay Give Users Direct Access to Buy, Sell Crypto

Feb. 13: Hardware wallet maker Ledger announced that it is integrating products with Coinbase, allowing Ledger users to buy digital assets using the crypto exchange’s Coinbase Pay as an on-ramp. Bringing Coinbase Pay into the Ledger Live app is supposed to benefit Ledger users, according to a press release seen by CoinDesk, making it easier for users to receive their crypto purchases from Coinbase directly on their Ledger hardware wallet, without any additional fees.

Fordefi Raises $10M to Make Crypto Safer With Institutional-Grade Wallet to Retail-Facing Platforms

Feb. 13: Crypto wallet firm Fordefi raised $10 million in venture capital investment, aiming to solve one of the biggest pain points in crypto by expanding its institutional-focused wallet offering to retail-facing platforms, the company told CoinDesk in an exclusive interview. The fundraising was led by Electric Capital, with Paxos and Alchemy joining as new investors. The investment followed a $18 million seed capital raise in November 2022 with Lightspeed Ventures, Pantera Capital, and Jump Crypto, among others.

Crypto Exchange Bybit Announces Launch of Bybit Card in Australia

Feb. 13: Bybit, a crypto exchange, announced the launch of the Bybit Card in Australia. Powered by Mastercard, this card debits crypto balances on Bybit and converts them seamlessly into fiat money used to pay for card transactions.

Analog Raises $16M To Become One-Stop Shop For Blockchain Interoperability

Feb. 12: Analog, a U.S.-based Web3 platform focused on omni-chain interoperability, announced the completion of its latest funding round. According to the team: “Investors in the round include Balaji Srinivasan, Mike Novogratz’s Samara Asset Group, Tribe Capital, NEAR and many more. A main component of Analog, The Timechain, is a Rust-based blockchain that hosts a number of validators, called Time Nodes and Chronicle Nodes, that validate and relay messages. It enables different applications to connect to different blockchains.”

Identity Protocol Rarimo’s New ‘Freedom Tool’ Uses Phones for Biometrics

Feb. 12: Rarimo, a digital identity protocol based on the Tendermint Consensus and Cosmos SDK blockchain development kit, has released Freedom Tool, an open-source software for running anonymized elections and polls, according to the team: “Built with a combination of zero-knowledge and blockchain technology, it aims to solve the technical challenge of enabling digital identity checks while also protecting citizens from tracking. Citizens prove their eligibility by scanning their biometric passports with their phones. The data on the biometric chip inside the passport is verified, and upon confirming authenticity, an anonymous voting pass is issued. The citizen then uses this pass to cast their vote.”

Aave V3 Now on Ethereum Layer-2 Scroll’s Mainnet

Feb. 12: The Aave-Chan Initiative and Scroll, an Ethereum layer-2 network powered by zero-knowledge or ZK technology, announced the successful deployment of Aave V3 on the Scroll Mainnet, according to the team, “marking the first market on a ZK rollup and providing users with a secure, scalable and user-friendly environment. The combined expertise of Aave V3 and Scroll creates a synergy that is set to invigorate both communities. This launch on Scroll represents Aave DAO’s first deployment to a zkEVM chain with others expected to be coming shortly this quarter.” (AAVE)

Lit Protocol, for Identity-Based Encryption, Launches ‘Litv0’

Feb. 12: Lit Protocol has launched Litv0, “a significant advancement in the way developers can create, control and manage secrets, keys and private data,” according to the team: “Lit offers a native system for identity-based encryption, compute and signing, merging TSS, secure hardware, blockchain, and IPFS for fault-tolerant key management and serverless functions.”

Tezos Blockchain’s ‘Oxford 2’ Upgrade Brings ‘Private Smart Rollups’

Feb. 10: The Tezos blockchain on Friday activated its fifteenth upgrade, called Oxford 2, according to the team: “The upgrade introduces private smart rollups as a new security feature for developers, a smoother staking process for validators and an adjustment to slashing penalties, among other changes. The upgrade comes a month before the main net launch of Etherlink, an EVM-compatible Layer 2 built on Tezos and powered by Smart Rollups.” (XTZ)

Aptos Ecosystem Summit Highlighted News, Best Practices Across 32 Projects

Feb. 10: The Aptos Ecosystem Summit was built around setting up Aptos ecosystem projects, protocols and builders for success, according to the team: “The week-long event celebrated achievements, unveiled news and highlighted best practices across 15+ countries, 32 projects, and 50+ investors from 26 firms. On the sidelines of the agenda, 122 one-on-one conversations took place. These 1:1 interactions between ecosystem leaders and Aptos Foundation representatives allowed for in-depth discussions, hands-on support, and the sharing of specific insights related to engineering, marketing, product development, legal, and more.” (APT)

DYdX Foundation Gets $30M From DYdX Treasury After DAO Vote

Feb. 9: The dYdX Foundation has secured $30M in DYDX from the dYdX Chain Community Treasury, after a vote by the dYdX DAO, according to the team: “The Foundation Fundraise proposal had a 98% Yes vote and a 86.4% voter turnout. This funding provides 3 more years of runway for the dYdX Foundation to execute its roadmap.” (DYDX)

Web3 Foundation Funds Ideal Labs, ‘Encryption to the Future’

Feb. 9: Web3 Foundation, supporting Polkadot as its flagship protocol, announced funding support for Ideal Labs in the creation of the Encryption to the Future (ETF) network, according to the team: “The funding is part of the Foundation’s Decentralized Futures Funding Program, backed by $20M USD and 5M DOT. The ETF Network is a cutting-edge substrate-based blockchain leveraging a unique consensus mechanism focused on publicly variable on-chain randomness and timelock encryption. The initiative is a crucial step towards addressing the challenges of secure delayed transactions.” (DOT)

Zeitgeist to Integrate USDC Via Cross-Consensus Messaging (XCM)

Feb. 9: Zeitgeist, a leading platform in the decentralized prediction markets, is announcing its integration of USDC, according to the team: “USDC will be integrated via Cross-Consensus Messaging (XCM). The development allows for the effortless transfer of USDC from two projects within the Polkadot ecosystem, HydraDX & Moonbeam, into Zeitgeist. This is more than just an event; it’s a testament to Zeitgeist’s ongoing commitment to the Polkadot ecosystem. By leveraging Polkadot’s advanced technological framework and collaborative ethos, Zeitgeist continues to offer innovative solutions in the prediction market arena.”

Polygon Releases ‘Type 1 Prover,’ Claiming Milestone Set by Ethereum’s Vitalik Buterin

Feb. 8: Polygon Labs, the developer behind the Polygon blockchain, released Thursday a “Type 1 prover,” a new component allowing any network compatible with Ethereum’s EVM standard to become a layer-2 network powered by zero-knowledge proofs, and to connect to Polygon’s broader ecosystem. The Polygon team claimed the release as a major breakthrough, a technological feat that even Ethereum co-founder Vitalik Buterin has touted as key to making auxiliary layer-2 networks nearly equivalent to the base blockchain. CoinDesk 20 asset: {{MATIC}}

Schematic of Polygon’s “Type 1 Prover” (Polygon)

Layer-2 Blockchain Developer StarkWare Plans ‘Cairo’ to Verify Layer-3s

Feb. 8: StarkWare, the developer behind the Starknet blockchain, announced on Thursday the launch of a new “Cairo Verifier” in the next few weeks, opening the door to layer-3 application-based chains on Starknet. Cairo, which the StarkWare and another developer, Herodotus, worked on together, is a key piece of technology that verifies proofs and posts them back to the layer-2 blockchain, instead of Ethereum’s mainnet.

FuzzLand, Web3 Security Firm, Raises $3M Led by 1kx

Feb. 8: FuzzLand, a Web3 security and analytics company, has closed a $3M seed funding round led by 1kx with participation from HashKey Capital, SNZ and Panga Capital, according to the team: “The funding will help accelerate research and development into automated solutions for smart contract analysis using dynamic analysis and distributed computing software. Founded by Chaofan Shou, Jeff Liu and Koushik Sen, FuzzLand aims to deliver cutting-edge vulnerability detection and analytics capabilities that go beyond traditional solutions.”

Order-Routing Protocol Flood Raises $5.2M Led by Bain Capital Crypto, Archetype

Feb. 8: Flood, a protocol for order routing, management, and settlement, announced its $5.2M seed funding round, co-led by Bain Capital Crypto and Archetype, with participation from Robot Ventures. According to the team: “Flood provides decentralized application (dApp) developers with a suite of tools for owning and managing the entire lifecycle of their application’s order flow. As the only decentralized exchange (DEX) currently available on the market with operational hooks, the user experience allows traders to quickly settle their transactions while seamlessly staying within the Flood ecosystem.”

Casper Releases ‘Peregrine’ Patch for 16-Second Block Times, Cost Reductions

Feb. 8: Casper Association, supporting the proof-of-stake, smart-contracts blockchain Casper Network featuring a WASM code environment, sent the following message: “The Casper Network Peregrine (v1.5.6) update is a patch release that includes enhancements and exciting new features to network operations. Significant changes are: the reduction of block times to 16 seconds, the 99% refund of unspent funds, and the lowering of control flow opcode costs, resulting in a reduction in mint and transfer costs for contracts. Casper’s architecture is uniquely designed for continual evolution, meeting the evolving demands of its users, partners, and the projects it supports.”

APAC-Focused ‘TON Bootcamp’ Accepts First 12 Projects for Up to $500K Each

Feb. 8: Created in collaboration with Hashkey, TON Bootcamp has now accepted its first twelve projects, according to the team: “The APAC-focused accelerator has earmarked up to $500,000 for each of these teams, with the selected projects uniquely leveraging blockchain technology within Telegram’s Web3 ecosystem. These projects will further embed TON’s Web3 functionalities within Telegram’s existing platform and engage Telegram’s over 800 million monthly active users. The program reflects TON Foundation’s commitment to the APAC region and community as it looks to leverage Hong Kong’s industry-leading regulatory environment.”

Dtravel Receives Backing From Borderless Capital for DePIN Peer-to-Peer Vacation Rentals

Feb. 8: Dtravel says it has received “backing and stamp of approval from Borderless Capital with a strategic investment to support its DePIN peer-to-peer vacation rental (VR) ecosystem. The partnership not only brings financial backing, but opens up a wealth of expertise and networking opportunities, including access to Borderless’ DePIN portfolio companies, that will support Dtravel in becoming a leading provider for the VR industry. The funding will pave the way for the next phase of growth with hundreds of thousands of operators, travelers and TRVL token holders engaging with the Dtravel ecosystem.”

Cornucopias, a Multiplayer Online Role-Playing Game Originally on Cardano and BSC, Expands to Base

Feb. 8: Cornucopias, a massive multiplayer online role-playing game (MMORPG) originally on Cardano and BSC, is moving ahead with a node sale and partnership with the Ethereum layer-2 network Base, according to the team: “Currently in pre-alpha, the platform has already secured over 50K users following successful launches on both Cardano and the BNB Smart Chain. Developed with Unreal Engine 5, this expansion now allows gamers within the Eth ecosystem to experience Cornucopias superior graphics and immersive gaming experiences. Node sale participants will not only receive Cornucopias’ native token, COPI, but are also now able to engage and transact with the platform’s digital assets.”

Transak, On-Ramp Solution, Moves Into Hong Kong After Fundraise

Feb. 8: Transak, a crypto on-ramp solution, “is expanding into the APAC region with a new entity in Hong Kong, aiming to leverage the city’s status as a financial hub and its regulatory framework for cryptocurrencies,” according to the team. “This move follows a Series A funding round led by CE Innovation Capital. Transak plans to integrate local payment methods and adhere to Hong Kong’s regulatory standards to simplify Web3 accessibility. The company’s global operations highlight its commitment to regulatory compliance. Additionally, Transak has joined Web3 Harbour to foster collaboration in the APAC’s Web3 ecosystem.”

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

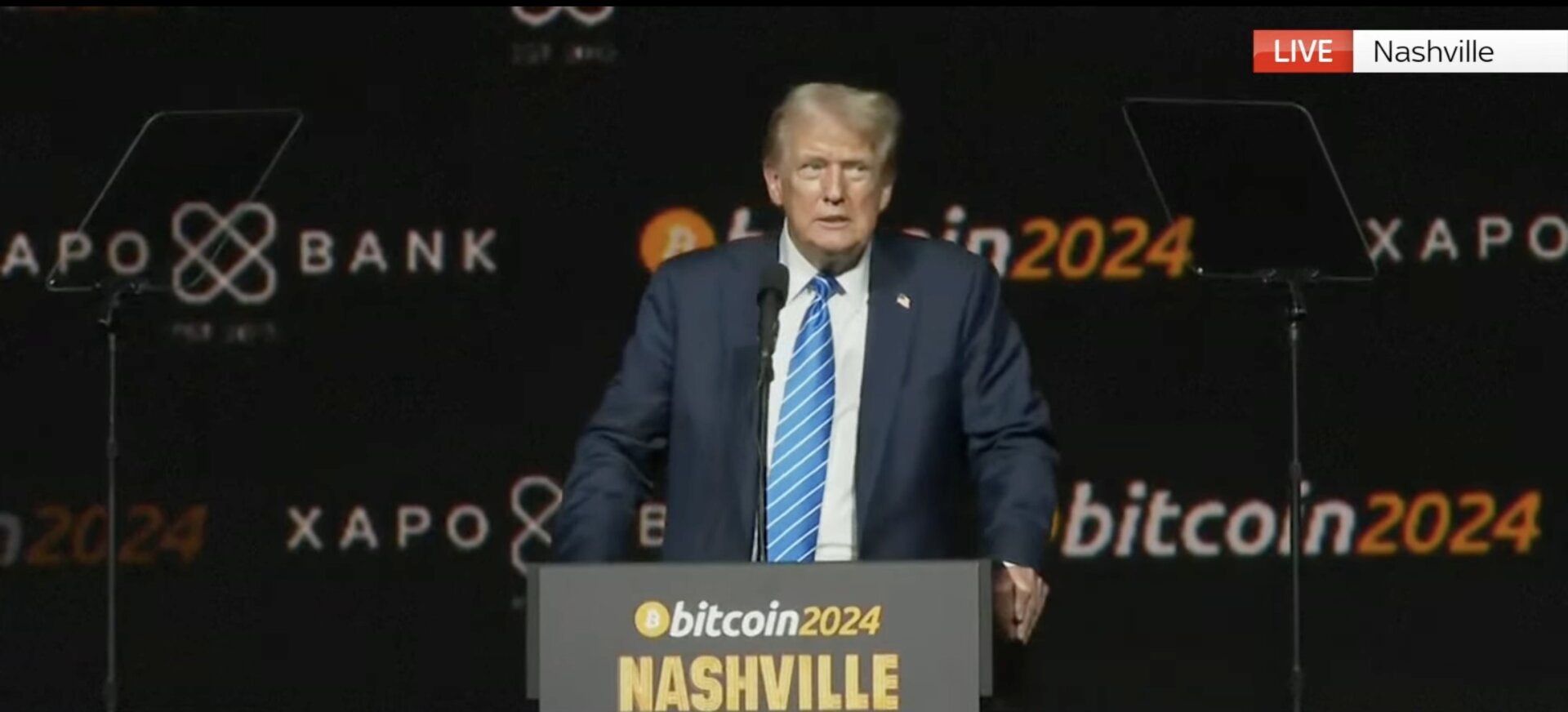

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!