Tech

The most infamous cryptocurrency fraud schemes of all time

Perianne Boring, founder and CEO of the Digital Chamber of Commerce, says the lawmaker’s “false and misleading statements” should be investigated on “The Claman Countdown.”

THE growing diffusion of cryptocurrencies it has also led to more frequent and elaborate cryptocurrency scams over the years.

One such scam by a fraudulent cryptocurrency company called Centra Tech is now the subject of a new Netflix movie called “Bitconned”, which is scheduled for release on January 1st.

“Ray Trapani has always wanted to be a criminal, ever since he was a boy,” reads the film’s description. “In 2017, amid the economic frenzy of the bitcoin boom, there was no better place for cryptocurrency scammers. So when a friend of Ray’s approached him with the idea of creating a cryptocurrency debit card, Trapani jumped at the opportunity. There was only one problem: he had no idea how to do it.”

Centra Tech is one of many recent, high-profile crypto scams that have resulted in millions and billions of dollars in losses for customers around the world.

DIGITAL ASSET MARKETS READY TO GROW IN 2024, SAYS GOLDMAN SACHS EXECUTIVE

Here are some of the most infamous cryptocurrency fraud schemes in history:

Tech Center

Principal co-founder Sohrab Sharma, along with Robert Farkas and Trapani, founded Centra Tech in 2017. The company advertised cryptocurrency financial products, including a so-called cryptocurrency debit card they dubbed the “Centra Card.”

The company tricked customers into believing they could use the card to make payments at establishments that accepted Visa or Mastercard payments. They also convinced investors to purchase unregistered securities in the form of digital coins, or “Centra Tokens,” according to the Justice Department.

BITCOIN “BONNIE AND CLYDE” PLEAD GUILTY OF MONEY LAUNDERING HACKED CRYPTOGRAPHY

The founders founded Centra Tech on the lie that its fictitious founder, “Michael Edwards,” had more than 20 years of banking experience and a master’s degree from Harvard. They also perpetuated other lies “that Centra Tech had partnered with Bancorp, Visa, and Mastercard to issue Centra cards licensed by Visa or Mastercard” and “that Centra Tech had money transmitting and other licenses in 38 states, among others claims,” the DOJ. said in a press release.

| CURRENCY | COINBASE GLOBAL INC. | 249.81 | +5.65 | +2.31% |

| REVOLT | BACKGROUND PLATFORMS | 9.89 | +0.17 | +1.80% |

| BYON | BEYOND INC. | 2.34pm | -0.60 | -4.02% |

| MARA | DIGITAL MARATHON | 7.46pm | +0.19 | +0.99% |

All three co-founders have since been convicted and sentenced to prison, according to the Securities and Exchange Commission.

“Sohrab Sharma conducted a scheme to deceive investors by falsely claiming that the startup he co-founded had developed cutting-edge, fully functional cryptocurrency-related financial products,” Ilan T. Graff, a U.S. lawyer, said in a statement of 2021. “In reality, Sharma’s most prominent inventions were the fake executives, fake business partnerships, and false licenses that he and his co-conspirators advertised to trick victims into handing over tens of millions of dollars.”

FTX

FTX, a bankrupt and fraudulent cryptocurrency company, made national headlines this year when its founder Sam Bankman-Fried was indicted in February and put on trial Manhattan Federal Court.

FTX founder Sam Bankman-Fried appears in federal court during his fraud trial in Manhattan, New York on October 26, 2023. (Jane Rosenberg/Fox News)

In November the court found Bankman-Fried guilty of defrauding investors, clients and lenders who took part in the collapse of his crypto empire in one of two criminal trials has faced.

THE TRIAL AND VERDICT OF SAM BANKMAN-FRIED IN PICTURES

The collapse of FTX wiped out about $1 billion in client funds.

“Sam Bankman-Fried perpetrated one of the largest financial frauds in American history.”

– US Attorney for the Southern District of New York Damian Williams

Bankman-Fried was charged with two counts of wire fraud and five counts of conspiracy. Prosecutors alleged that the 31-year-old founder of FTX and its sister hedge fund, Alameda Research, misappropriated and siphoned billions of dollars from FTX client deposits, planning to mislead investors and grooming other executives at his companies to do the same.

Sam Bankman-Fried, co-founder of FTX Cryptocurrency Derivatives Exchange, arrives in court in New York on January 3, 2023. (Stephanie Keith/Bloomberg via Getty Images / Getty Images)

“The cryptocurrency industry may be new. The players, like Sam Bankman-Fried, may be new. But this type of corruption is as old as time,” said US Attorney for the Southern District of New York Damian Williams after the announcement of the verdict.

THE FTX AND SAM BANKMAN-FRIED TRIAL: THE PLAYERS

The founder of FTX, who amassed an estimated net worth of $26 billion before his company filed for bankruptcy last year, also testified during his trial. He admitted he had made mistakes but maintained his innocence, saying he had not defrauded anyone.

BitConnect Ponzi Scheme

The FTX scam has often been compared to the BitConnect Ponzi scheme.

BitConnect, which has since collapsed, was a fraudulent cryptocurrency investment company that at one point reached a peak market capitalization of $3.4 billion, according to the Justice Department.

SEC KEEPS CALLS WITH SPOT BITCOIN ETF SPOTLIGHTERS AS POSSIBLE APPROVAL GEARS CLOSER

A San Diego federal grand jury last year indicted the founder of the company, the Indian Satish Kumbhani. Kumbhani is alleged to have deceived investors about the company’s “loan program,” which in reality operated as a Ponzi scheme by paying off BitConnect’s early investors with funds from new investors.

Prosecutors say Kumbhani and his co-conspirators received a total of $2.4 billion from BitConnect investors.

“This indictment involves a massive cryptocurrency scheme that defrauded investors of more than $2 billion.”

– U.S. Attorney Randy Grossman for the Southern District of California

“As cryptocurrency gains popularity and attracts investors around the world, alleged scammers like Kumbhani are using increasingly complex schemes to defraud investors, often stealing millions of dollars,” Special Agent in Charge Ryan L. Korner said in a statement of the Los Angeles field office of IRS Criminal Investigation. 2022 statement announcing indictment against Kumbhani.

OneCoin and the ‘Crypto Queen’

Ruja Ignatova, a Bulgarian woman Known as the “Cryptoqueen,” she is accused of defrauding millions of investors worth an estimated $4 billion through her fraudulent cryptocurrency company, OneCoin, since 2014.

FBI ADDS “CRYPTOQUEEN” TO TEN MOST WANTED LIST

Ignatova is on the FBI’s 10 Most Wanted list. Authorities believe she may have received assistance from armed guards or associates and she may have altered her appearance after traveling to Athens, Greece, in 2017. Her co-founder, Karl Sebastian Greenwood, was sentenced to 20 years in September.

Ruja Ignatova, a Bulgarian woman known as the “Cryptoqueen,” is accused of defrauding millions of investors worth an estimated $4 billion through her fraudulent cryptocurrency company, OneCoin, starting in 2014. (FBI/Fox News )

OneCoin marketed a fraudulent cryptocurrency to unsuspecting investors around the world.

“As the founder and leader of OneCoin, Karl Sebastian Greenwood operated one of the largest fraud schemes ever perpetrated. Greenwood and his co-conspirators, including fugitive Ruja Ignatova, swindled unsuspecting victims out of billions of dollars with the promise of a ‘ financial revolution’ and claims OneCoin is the ‘bitcoin killer,’” Damian Williams said in a September statement.

“In fact, OneCoin was completely worthless and investors were left with nothing, while Greenwood lined his pockets with over $300 million.”

SEC COULD MAKE CRYPTO HISTORY IN THE NEW YEAR WITH APPROVAL OF FIRST SPOT BITCOIN ETF

Ignatova, who is charged with conspiracy to commit wire fraud, conspiracy to commit money laundering, conspiracy to commit securities fraud and securities fraud, allegedly told investors to transfer funds to their OneCoin accounts to purchase packages OneCoin, according to the Department of Justice.

Bitclub network

Similarly, BitClub Network was a $722 million fraudulent cryptocurrency scheme “that solicited money from investors in exchange for shares of purported cryptocurrency mining pools and rewarded investors for recruiting new investors into the scheme” between 2014 and 2019, according to the Department of Justice.

Several people, including BitClub Network creator Matthew Brent Goettsche and Silviu Catalin Balaci, Russ Albert Medlin, Jobadiah Sinclair Weeks, Joseph Frank Abel and Gordon Brad Beckstead, have been charged in connection with the scheme.

A representation of bitcoin, June 23, 2017. (Benoit Tessier/File Photo/Reuters Photos)

Goettsche, Balaci, Abel and Weeks were all released on bail in 2020 and await sentencing hearings.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“The indictment describes the defendants’ use of the complex world of cryptocurrencies to take advantage of unsuspecting investors,” U.S. Attorney Craig Carpenito said in a 2019 statement. “What they allegedly did amounts to little more than a modern high-tech Ponzi scheme that defrauded victims of hundreds of millions of dollars Working with our police our partners here and across the country, we will ensure that these scammers are held to account for their crimes.”

The suspects spent their money “lavishly” defrauding investors, who Goettsche described as “stupid” and “sheep.” He also said that he was “building the entire model on the backs of idiots,” according to the Justice Department.

Fox News’ Breck Dumas contributed to this report.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

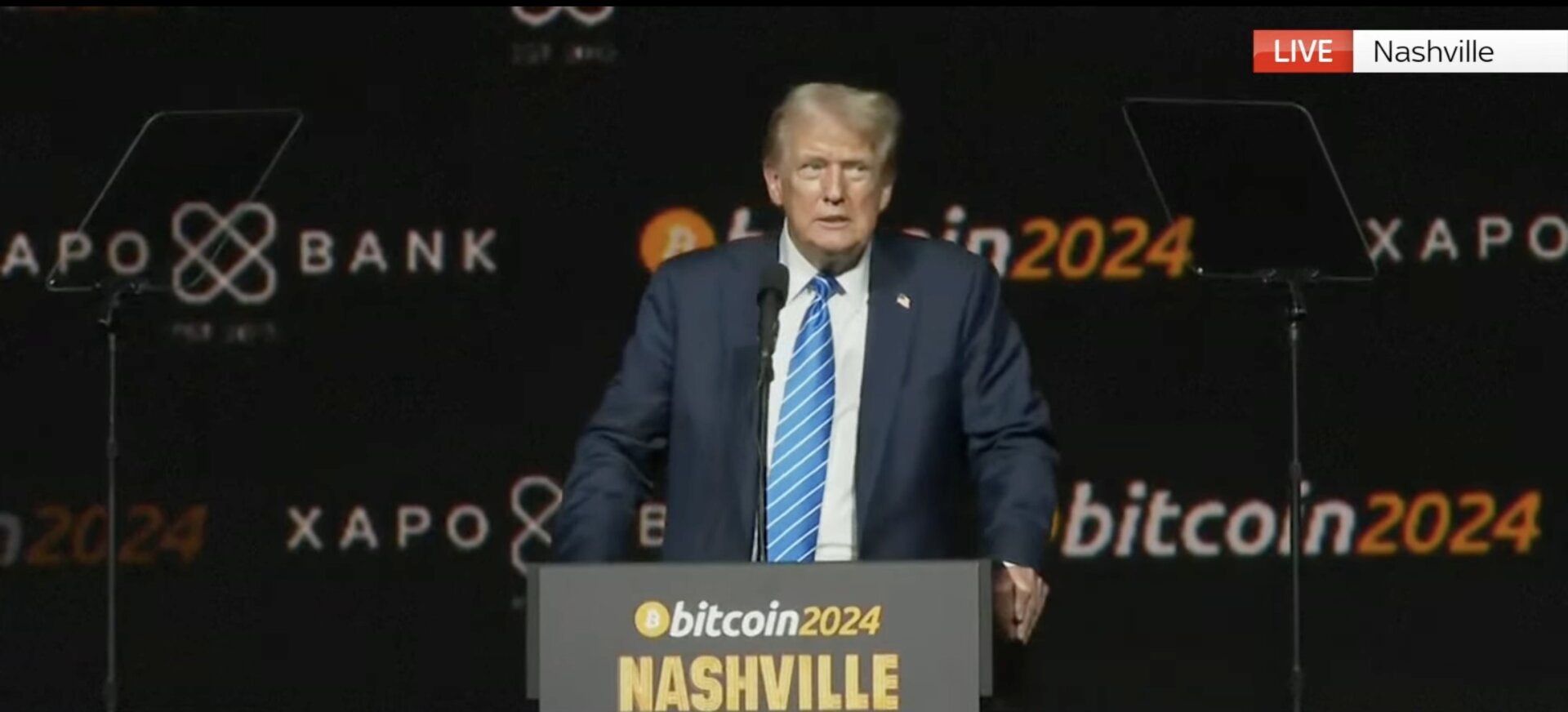

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!