Tech

What is Blockchain Technology and How Does it Work?

Last updated:

February 21, 2024 08:35 EST

| 15 min read

The concept of blockchain technology began to creep into public awareness in 2009 with the launch of the Bitcoin network. But blockchain technology predates Bitcoin, and its potential uses reach far beyond Bitcoin’s role as peer-to-peer money.

Blockchain tech already powers many other types of applications, ranging from electricity usage to recording stock transactions. In this guide, we’ll explore the purpose of blockchain technology, its various use cases, and how blockchains work to provide a secure record of data and transactions.

What is Blockchain in Simple Words?

A blockchain is a distributed ledger that can’t be changed. You can think of a blockchain as a timeline, a record of what happened and when.

Let’s break that down in simple terms, explaining each aspect briefly.

- A ledger is a record of transactions in its most simple form, but blockchains can also hold additional information.

- In a blockchain, the ledger is distributed, meaning many computers (called nodes) hold an identical copy of the ledger. On some blockchain networks, the number of nodes can reach into the tens of thousands. Bitcoin, for example, has over 50,000 nodes globally, with more than 17,000 reachable nodes.

- Blockchains are also immutable, meaning they can’t be changed — or, more accurately — blockchains can’t be changed easily. For example, transactions on the Bitcoin blockchain are nearly impossible to change with today’s technology.

In simple terms, a blockchain provides a record of transactions (and possibly other data), similar to a database. These transactions are held in blocks, like a container.

However, unlike a database, blockchain data can’t be changed easily. Someone can change or delete an entire database with a few clicks. Blockchains secure data by distributing the data and making the historical entries extremely difficult to change. We’ll discuss that aspect in more detail in the next section.

How Does Blockchain Technology Work?

First, let’s look at a typical blockchain structure. Then we’ll explore the pillars that support many of today’s well-known blockchains.

To illustrate how blockchain technology works, let’s examine a sample Bitcoin transaction and how it becomes part of the immutable ledger.

- Jack sends one bitcoin to Jill. Jack uses a Bitcoin wallet to initiate the transaction, and the wallet app broadcasts the transaction to the Bitcoin network. Jack’s wallet uses cryptographic addresses for Jack and Jill rather than the real-world identity of each.

- Bitcoin miners pick up the transaction. Computers in the network called miners work to solve a cryptography problem that includes the pending block transactions. This is the proof of work (PoW) used as the consensus method (agreement method) for Bitcoin.

- A miner finds a block to hold the transaction. Until the transaction is included in a block, it’s held in the mempool, a waiting area.

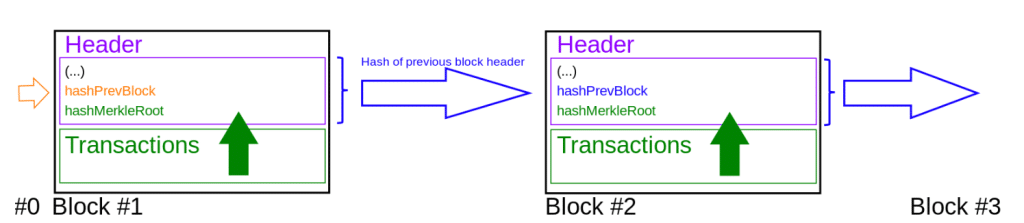

- The Bitcoin network verifies that the block is valid. Once the network agrees that the block is valid, the new block is added to the blockchain. As part of the process, a cryptographic hash of the previous block becomes part of the new block. This step links the blocks in a chain.

- Bitcoin nodes update their copies of the blockchain. Thousands of Bitcoin nodes worldwide now host the newly updated blockchain, in which Jack has one less bitcoin and Jill has one more bitcoin. The transactions in each block use timestamps to prevent double-spending.

Source: Wikimedia Commons

Source: Wikimedia Commons

This transaction between Jack and Jill includes all key pillars of the blockchain: decentralization, immutability, transparency, and security.

Next, let’s discuss each of these pillars in more detail.

1) Decentralization

Decentralization refers to the notion of no single entity or group having undue influence. In many blockchain networks, the blockchain is replicated on thousands of nodes distributed globally.

Consensus, the agreement on the state of the blockchain, also occurs in a decentralized way.

In short, no central authority governs the validity of transactions.

Instead, a set of rules — a protocol — determines how the network reaches an agreement regarding the state of the blockchain and how new transactions are added to the blocks in the chain.

This method differs from traditional finance, in which a bank or payment processor might be the final arbiter of transactions.

Generally, blockchain payment networks consider fewer criteria. In the example above with Jack and Jill, the Bitcoin network only considers whether Jack still has one bitcoin to send to Jill. The purpose of the payment and the real-world identities of the participants don’t come into play.

Not all blockchains are decentralized, however. For instance, private blockchains might be centralized in their consensus methods or in other aspects.

Similarly, blockchains might launch with centralized characteristics, later decentralizing. For example, the Cardano network is working towards decentralizing the development of the network through voting with its planned Voltaire fork.

2) Immutability: Data Can’t Be Altered

Immutability in a blockchain context refers to the inability to change transactions stored on the blockchain.

In traditional finance or data storage, a hacker or someone with administrator access can change the data. For instance, the television series Mr. Robot centered on the story of a hacking group that intended to erase worldwide consumer debts by attacking financial databases.

By contrast, blockchains are designed to be permanent, assuming nodes for the network still exist.

Another aspect of immutability is finality, meaning the point at which a transaction cannot be reversed. On the Bitcoin network, for example, a transaction is considered final after six confirmations (blocks), or about an hour. The computational cost associated with altering a transaction after that point makes it close to impossible.

As a practical matter, small transactions are final after they are included in a block.

Immutability brings several benefits, some of which benefit business use cases.

- Fraud prevention: Blockchain’s immutability makes it impossible to change prior transactions or insert new transactions to perpetrate fraud.

- Security: Financial transactions and business applications like supply chain tracking rely on dependable data, and immutability ensures that data has not been altered.

- Auditing efficiency: Audits based on blockchain data are more efficient than database audits, which can be costly. On blockchain, the data is what it is.

- Accountability: A permanent record lets anyone with blockchain access track events, pinpointing when an event occurred. This could be useful in resolving liability issues or improving efficiency.

3) Transparency: Public Ledger

Public blockchains use a public ledger. This characteristic allows anyone to view transaction data and history. Because the blockchain is replicated on nodes worldwide, the data remains available to everyone.

For example, blockchain.com provides full transaction data for the entire Bitcoin blockchain, starting with the Genesis Block, the first Bitcoin block. Similarly, the first Ethereum block remains available for all to view. Most popular cryptocurrency blockchains use a transparent public ledger.

However, not all blockchains are transparent. Private blockchains typically do not make transaction data available publicly.

4) Security: Cryptography for Information Protection

Blockchains use cryptography to secure the network, record transactions, and protect identities.

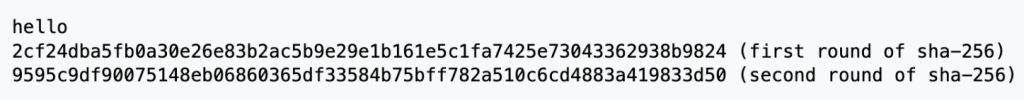

Cryptocurrencies get their name from the use of cryptography in their respective networks. Blockchains use cryptography hashes, an alphanumeric value derived from source data using an encryption algorithm.

For instance, Bitcoin uses double SHA-256 encoding to generate a hash for data inputs, as shown in this example:

In this example, “hello” represents the input.

In this example, “hello” represents the input.

Cryptography is at the heart of Bitcoin mining, but cryptographic hashes are also used for wallet addresses and to link one block to the next.

For instance, when Jack wanted to send one bitcoin to Jill in the earlier example, Jack used his public wallet address as the sending address and Jill’s public address as the receiving address.

Both addresses on the blockchain came from the encryption of each user’s private keys, generating a set of seemingly random letters and numbers. However, these are not random at all.

The same input will always generate the same output when using a given encryption algorithm. If one character of the input changes, the resulting hash will change as well.

The cryptographic hash of a block is included in the next block, forming an unalterable chain. As a result, cryptography protects both transactions and data stored on the blockchain from changes.

3 Key Types of Blockchain Networks

Blockchain networks are groups of computers that host the blockchain, perform validation of data or transactions to be included in the blockchain, and in some cases, execute smart contracts on the network. We’ll discuss smart contracts in more detail shortly.

Generally, these networks fall into three main types: public blockchain networks, private blockchain networks, and consortium blockchains.

Public Blockchain Networks

The earlier example describing a Bitcoin transaction sheds light on the key characteristics of a public blockchain network.

- Public blockchains offer universal access. Anyone can run a node, download a copy of the blockchain, or transact on the network.

- Public blockchains are transparent. Most public blockchains make the blockchain data available to anyone. However, privacy-based blockchains like Monero obscure transaction amounts or other data.

- Most public blockchains are decentralized. Decentralization can describe several aspects of the network, ranging from the number of nodes hosting the blockchain to the number of nodes involved in consensus to the method of decision-making for improving the network.

- Decentralized consensus often makes public blockchains slower than private blockchains. Consensus methods like Bitcoin’s proof of work lead to slower block times (about 10 minutes for Bitcoin).

- Public blockchains use pseudonymous addresses. Rather than your real-world name or a login, public blockchains use wallet addresses as users’ identities. However, it may be possible to connect your real-world identity to a blockchain address using patterns or other clues.

- Public blockchains are immutable. Transaction finality is at the heart of blockchain technology. Transactions and data cannot be changed.

For examples of public blockchains, we can look at several well-known cryptocurrency blockchains.

- Bitcoin

- Ethereum

- Avalanche

- Dogecoin

- Litecoin

Private Blockchain Networks

As the name suggests, private networks are not designed for public access. Businesses and organizations may use private blockchain networks to host data specific to their needs.

- Private blockchains restrict access. Only permissioned entities can view blockchain data or participate in the blockchain network.

- Private networks may use proprietary consensus methods. In contrast to public networks that find their value in decentralized consensus, private networks may use less secure methods involving fewer nodes.

- Private blockchains enable controlled review and auditing. Review and auditing rights are reserved for selected entities.

- Decentralization may be used. Private networks may still support peer-to-peer (P2P) transactions and decentralized nodes.

- Most private blockchains are immutable. Unlike private databases, which can be changed with a few keystrokes, data on private blockchains generally can’t be changed.

The Quorum blockchain, recently purchased by Consensys, is an example of a private blockchain network that uses permissioned access. The network was a fork of the Ethereum blockchain and supports smart contracts but provides block times up to ten times faster than Ethereum.

Another type of blockchain network, Hybrid blockchains, hosts both private and public data, with public data available to anyone and private data only visible to permissioned entities. Quorum, mentioned above, provides both open and private transactions.

Consortium Blockchains

A consortium blockchain is a type of blockchain network managed and run by multiple entities, such as members of the same industry or business units within the same company.

The consortium decides how to manage the blockchain to achieve common goals.

- Consortium blockchains maintain data privacy. Access may be restricted to protect sensitive data, ensuring privacy.

- Consortium blockchain networks enable fast transactions. Smaller user bases combined with more efficient consensus mechanisms make consortium blockchains much faster than public blockchain networks. Often, consortium blockchains use proof of authority, a trust-based consensus method that uses a few selected actors or nodes for validation.

- Consortium blockchain nodes follow an agreed-upon protocol. Although nodes may be managed by different entities within the consortium, all nodes follow the same protocol.

Corda, a popular consortium blockchain solution, links similar businesses, such as banking, financial services, or insurance — or business units within a company. For instance, Chubb used a Corda-based distributed ledger to automate workflow.

What are Blockchain Protocols and Platforms?

Blockchains have their own vocabulary and nuanced meanings. Protocols and platforms are two key components of blockchain technology, but they are not always clearly understood.

Blockchain Protocols: Sets of Rules & Procedures

Protocols are simply a set of rules. In a blockchain context, protocols define the rules by which the blockchain network operates. Think of it as the base layer. In the next section, we’ll discuss platforms, which enable secondary layers and app ecosystems to thrive. The two topics complement each other, with some overlap in blockchain projects.

At the nuts and bolts level, protocols define rules for how the blockchain works. Here are just a few elements of a blockchain protocol.

- Governance: Decentralized blockchains need a method of governance. Who decides when to make changes to the blockchain code? Many projects enable token holders to vote on improvement proposals. In other cases, the node operators must choose between software versions as a way of voting.

- Consensus method: Bitcoin uses proof of work as its way to reach an agreement between nodes on the state of the blockchain. Ethereum launched with proof of work but now uses proof of stake (PoS). Several other consensus methods are also with other projects.

- Cryptography: Hash functions follow a set of rules within their algorithms. However, each project might choose a different algorithm, each with its own reasoning. Bitcoin uses SHA-256, running the resulting hash through the algorithm again in many situations (double SHA-256). Ethereum, however, uses Keccak-256.

- Block size: Bitcoin uses memory size to limit blocks, whereas Ethereum uses a target size based on fees.

- Tokenonics: How new cryptos are produced and how the total supply is managed by the protocol represents another subset of rules.

Today’s blockchain networks are also protocols under the hood.

- Bitcoin protocol

- Ethereum protocol

- Solana protocol

- Cardano protocol

- Monero protocol

Blockchain Platforms: Ecosystems for Deployment

Blockchain projects may have simple goals, like Bitcoin, designed to be a peer-to-peer electronic cash system. Or, blockchain projects can serve as a platform third-party development.

The Ethereum protocol led the way with its support for smart contracts, which are conditional programs that run on the blockchain network. Subsequent blockchains took this expandability to a new level, building blockchains designed to run additional specialized blockchains, each also capable of executing smart contracts.

- Ethereum

- Avalanche

- Polkadot

- Polygon

Other projects target commercial applications, offering a way to deploy customized blockchains designed for specific industry use cases.

- R3 Corda

- Hyperledger

- Ethereum

- EOSIO

- ConsenSys Quorum

What are Smart Contracts?

Blockchains provide a powerful new way to store data and transactions, but smart contracts enable new functionality beyond recordkeeping.

Smart contracts are conditional switches built with programming languages. If this happens, then do that.

Ethereum launched with support for smart contracts, becoming the first smart-contract blockchain. Like many aspects of blockchain technology, the concept wasn’t entirely new, however. Smart contracts, as a notion, date back to the 1990s.

On public blockchains, smart contracts enable complex transactions, creating a decentralized finance (DeFi) world alongside other types of applications.

To compare and contrast, Bitcoin supports sending and receiving. Some additional features include inscriptions, but Bitcoin was designed to be decentralized money. Ethereum, on the other hand, hosts full-featured decentralized applications (dApps), ranging from decentralized exchanges to lending and borrowing platforms to metaverse worlds. Of course, Ethereum’s coin (ether) can also be used as money, much like bitcoins.

On private blockchains, smart contracts can include industry-specific contracts that execute when specific conditions are met.

The Advantages and Disadvantages of Blockchain Technology

Innovations in blockchain technology promise to revolutionize the way we interact with assets and data, but both blockchains and traditional systems bring pros and cons. Which is the best solution may depend on the goals.

The Positives

Blockchain brings several advantages compared to traditional systems.

- Immutability: Blockchain data cannot be changed easily. To do so would break the chain. Economic incentives and disincentives built into each protocol help to prevent attempts.

- Transparency: Public blockchains make transaction data available to anyone. This offers a number of advantages, including increased trust and accountability. Transparency often also carries over to the code itself. Most public blockchain protocols publish the source code.

- Censorship resistance: Blockchain networks use pseudonymous wallet addresses as identifiers. This allows people (or apps) to transact without concern over financial censorship.

- Traceability: Anyone can verify any transaction and even the history of transactions.

- Interoperability: Most of today’s blockchains can’t communicate with each other. However, protocols like Avalanche, Polygon 2.0, and Chainlink are building ways for blockchains to communicate with each other, making assets or data on one chain available on other compatible chains.

The Drawbacks

Blockchain tech also brings some disadvantages, however, compared to traditional systems.

- Speed and performance: Purpose-built databases and other applications can run much faster, bypassing the latency of decentralized networks and the slower consensus methods.

- Higher implementation cost: Building and maintaining a blockchain can be expensive compared to customizing off-the-shelf solutions or building an application with traditional coding languages.

- Data modification: Immutability is wonderful — until a mistake happens. Traditional systems allow easier corrections of incorrect data.

Blockchain Technology FAQs

What is blockchain technology in simple terms?

Blockchain technology refers to a way to store data and transactions using blocks of data linked together to build a timeline. By design blockchains are designed to be unchangeable. Often, blockchains are replicated on hundreds or thousands of nodes worldwide, preserving the data by decentralizing the network.

What is the blockchain?

There isn’t one singular blockchain. The term might refer to a specific blockchain, such as Bitcoin or Ethereum, or it may be used to describe blockchain technology, a way of securely storing data in linked blocks that form a chain.

Who owns a blockchain?

Most public blockchains aren’t owned by anyone. Bitcoin and Ethereum, for example, belong to the community. The collective community decides which changes to make to the protocol without any one person or group owning the blockchain.

Is blockchain the future?

For many applications, blockchain offers the best — or perhaps fairest — solution. These can include areas like finance. In other situations, traditional systems might remain the best solution, particularly in cases involving proprietary data or in which speed is a priority.

What is the purpose of blockchain technology?

Blockchain technology’s first common use was to provide peer-to-peer transactions without an intermediary like a bank or payment provider. Later uses include more complex applications such as decentralized exchanges for cryptocurrencies, lending and borrowing platforms, and gaming.

References

About the Author

Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined with a consumer advocate stance brought Eric to the crypto industry, where he writes articles and guides aimed at making crypto easier to understand.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

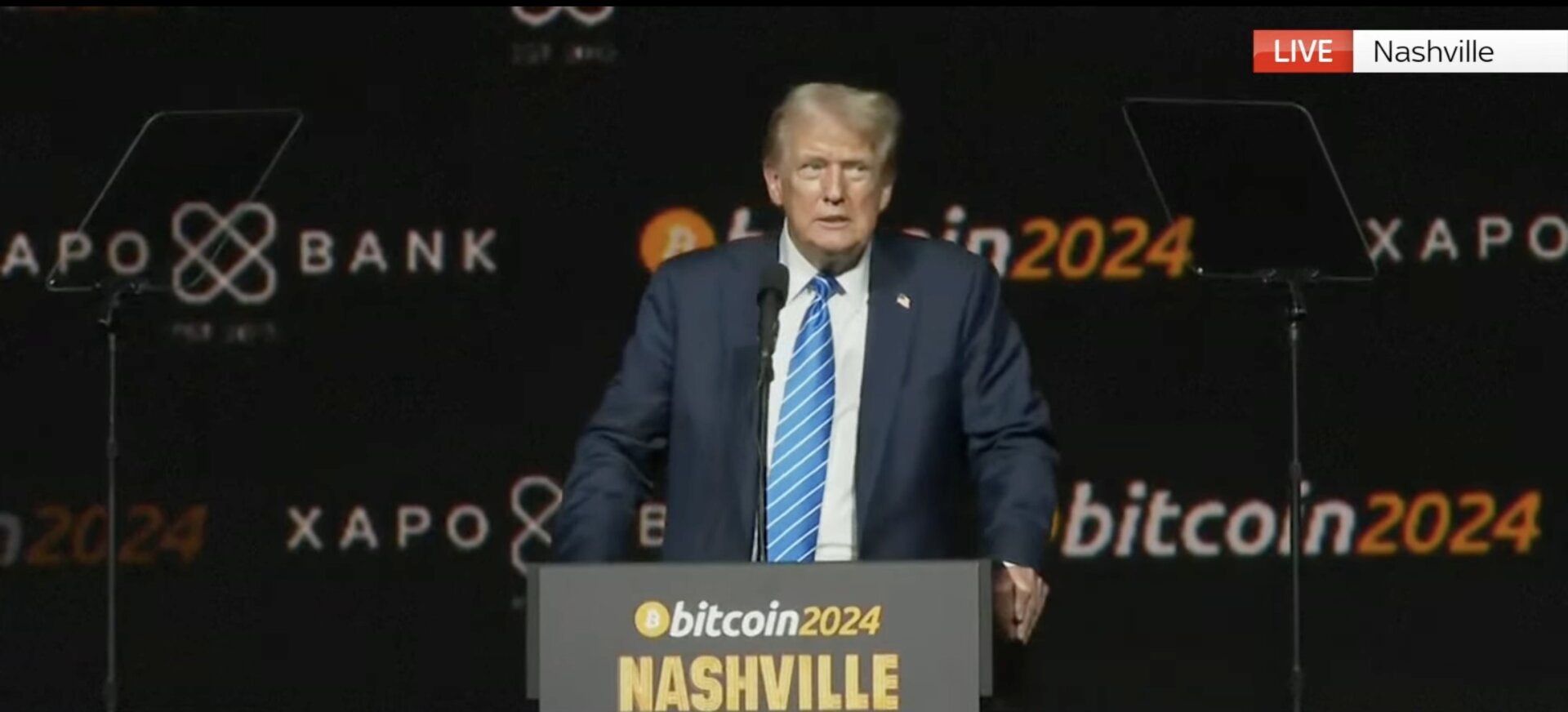

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!