DeFi

What is happening in DeFi? dYdX, 3Jane, MakerDAO and more

Decentralized finance (Challenge) the industry continues to evolve, with several major launches and updates making waves. BeInCrypto has examined the latest events, providing a comprehensive overview of the most notable developments in the industry. Challenge space.

From the launch of dYdX’s Android app to 3Jane’s derivatives yield layer, the industry is teeming with innovation and advancement.

Term Structure Mainnet Launched

The term structure is now spear its main network on Ethereum (ETH). This marks the debut of the first institutional-grade, market-driven fixed income protocol. This changes the way lenders and borrowers manage liquidity in DeFi.

This platform allows users to borrow tokens at fixed rates and terms using their Liquid Staking Tokens (LST) and liquid recovery tokens (LRT). They can also earn points and staking rewards. The auction mechanism in primary markets facilitates borrowing and lending.

Additionally, secondary markets offer a real-time order book. This feature improves liquidity by supporting the trading of fixed income tokens.

Learn more: Top 11 DeFi Protocols to Watch in 2024

With this launch, Term Structure aims to set new global standards in liquidity management. It allows users to lock in a fixed cost of funds. This move is crucial to take advantage of opportunities to potentially earn higher floating annual percentage yields (APY) or capitalize on token price appreciation.

“Our mainnet, designed to meet the needs of institutional clients, traders and retail investors, marks a crucial development in DeFi. It allows users to mine their digital assets with fixed rates and conditions,” Jerry Li, CEO of Term Structure, said.

Term Structure is a fixed-rate lending and borrowing protocol powered by custom zero-knowledge (ZK) rollup, zkTrue-up. The Taiwanese DeFi platform specializes in non-custodial fixed-income protocols for peer-to-peer borrowing and lending.

dYdX Android App Launched and Channel Upgraded

On another front, dYdX, a decentralized perpetual trading exchange (DEX), now offers its app on Android. The app contains all current features of the dYdX channel.

“dYdX Chain for Android includes some of your favorite features like 24/7/365 markets, 20x leverage, 65 markets and more, low gas feesand much more”, the dYdX team note.

Additionally, dYdX revealed its upgrade to dYdX Chain v5.0. This software update was program for block 17,560,000 around June 6 at 3:16 p.m. UTC.

This decision follows a vote by the dYdX community, with 90% proof upgrading to version 5.0 and 98.5% vote in favour. The upgrade introduces several improvements: isolated markets, batch order cancellation, liquidity provider (LP) vault enshrined in the protocol, Slinky Sidecar/Vote extension, performance improvements, soft open interest cap and full Node Streaming. According to data from DefiLlama, the total value locked (TVL) of dYdX Chain stands at $146.28 million as of this writing.

dYdX TVL. Source: ChallengeLlama

3Jane revolutionizes resttaking with derivatives yield on EigenLayer

3Jane, a derivatives yield protocol, is live on EigenLayer. He unlocks a new layer of derivatives yield by enabling collateralization of ETH reinvested in derivatives contracts.

Chudnov Glavniy, founder of 3Jane, announced the launch of the protocol. According to Glavniy, the protocol opens a new layer of derivatives yield for restakers by enabling collateralization of ETH reinvested in derivatives contracts, particularly call options.

“3Jane is the first source of ETH yield for all EigenLayer assets and the first step towards the “financialization” of EigenLayer by obtaining yield not only from [Actively Validated Services] AVS security but also financial derivatives”, Glavniy explain.

The protocol helps collateralize all high-yielding exotic ETH and Bitcoin (BTC) variants on EigenLayer, Babylon Chain, and Ethena in options contracts. Users can wrap natively ETH reinvestedRestored LST, ether.fi Staked ETH (eETH), Renzo Restaked ETH (ezETH), Ethena Staked USDe (sUSDe) and Savings DAI (sDAI) on 3Jane to earn additional options with premium yield. 3Jane Vaults sells out-of-the-money options and accrues premiums on wrapped deposits.

Everclear: Introduction to Connext’s Rebranding and Clearing Layer

Interoperability protocol that Everclear has introduced the first “Clearing Layer” after Connext’s rebranding. These layers coordinate transactions across chains, clearing funds flows before settling them on the underlying chains and bridges. Live testnet starts today.

The string abstraction stack goals to solve fragmentation by eliminating the need for users to care about what channel they are on. However, it faces challenges in rebalancing and settling liquidity across chains.

Everclear solves this problem by creating compensation layers. These layers coordinate market participants to balance the flow of funds across chains before settling with the underlying chains and bridges. They form the basis of the Chain Abstraction stack, enabling transparent liquidity and permissionless chain expansion for protocols built on top of them.

Everclear reduces the cost and complexity of rebalancing by up to 10x. The system is built as a Arbitration Orbit rollup (via Gelato RaaS) and connects to other chains using Hyperlane with an Eigenlayer cross-chain security module (ISM).

On average, around 80% of daily cross-chain capital flows are nettable. For every dollar added to a channel, $0.80 is bridged. If solvers, market makers, and centralized exchanges coordinated, they could reduce transition fees by more than five times.

Deploying TrueFi on Arbitrum

TrueFi is now available on Arbitrum, marking a significant expansion of the partnership with Cicada Credit to bring on-chain credit to Arbitrum with market-neutral borrowers. The TrueFi team explained several reasons why they chose Arbitrum.

“Arbitration is largest TVL layer 2, the number of DeFi protocols and the balance of stable coins. According to L2beat, Arbitrum is furthest along the path to decentralization. They invest significant amounts of their cash in [real-world assets] RWA, as seen in their recent STEP program, where we also applied with Adapt3r Digital,” the team describe.

In the coming days and weeks, TrueFi will share more about the specific pool configuration and details about each of the borrowers. The first two pools will be with Gravity Team and AlphaNonce, with many more to come.

NSTR Tokenomics and Nostra Launch Events

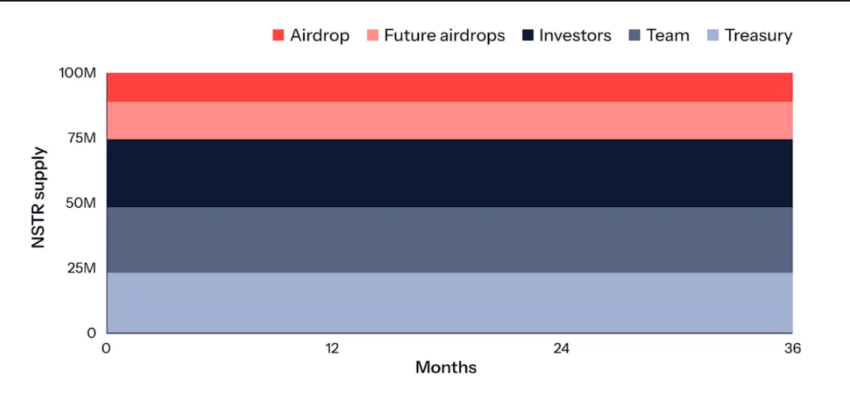

Nostra revealed their tokenomics for NSTR, with a total supply of 100 million tokens fully unlocked at launch. NSTR will serve as the governance token for the Nostra ecosystem.

They plan to distribute 11% to the community via an airdrop. Launch events include an upcoming snapshot, Liquidity Seed Pool (LBP) taking place June 10-13, and the Token Generation Event (TGE) on June 17.

NSTR supply. Source: Nostra

NSTR supply. Source: Nostra

Nostra claims that NSTR will be the fairest launch in DeFi. The Liquidity Bootstrapping Pool (LBP) pre-listing event aims to fund DEX liquidity.

They will drop tokens to the most active users and community members. All profits will be paid to the Treasury-owned DEX liquidity.

Solv protocol integrates Ethena for Yield Vault

Solv Protocol, a platform for optimizing yield and liquidity of major assets, has integrated Ethena to introduce the first yield vault for SolvBTC. This safe will allow users to Earn returns with Ethena strategies while maintaining exposure to Bitcoin.

Users can earn attractive returns with SolvBTC via two methods. First, using Solv’s Yield Vaults, users can deposit their SolvBTC into these vaults to access premium yield sources such as BTC staking, re-staking, and delta neutral trading strategies.

Second, users can explore DeFi opportunities using SolvBTC on various DeFi protocols. This provides access to various yield-generating options, thereby maximizing revenue within the dynamic DeFi ecosystem.

The “SolvBTC Yield Vault – Ethena” is the first of many collaborations planned by Solv Protocol. These partnerships aim to introduce new yield sources and strategies into the expanding SolvBTC ecosystem.

New proposal from MakerDAO: Etherfi’s weETH in SparkLend

MakerDAO has opened a new proposal to integrate Etherfi’s weETH into SparkLend. weETH is the largest Liquid Restaurant Token (LRT) on the market. It is also the only large LRT with fully enabled withdrawals, ensuring stable liquidity and a strong peg to ETH.

Phoenix Labs proposed listing weETH to increase DAI borrowing on SparkLend, given low competition for borrowing USD stablecoins using LRT collateral. Initial parameters and risk assessment are based on current market and liquidity conditions for weETH:

- Liquidation threshold: 73%

“If approved, this change will be part of an upcoming leadership vote in SparkLend,” MakerDAO Team said.

Learn more: Identifying and exploring risks on DeFi lending protocols

These advancements emphasize the evolution of the DeFi sector, showcasing incessant innovation and advancements that propel the industry forward. With projects like dYdX, 3Jane, and MakerDAO continually innovating, the future of decentralized finance looks exceptionally bright.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

Cryptocurrency sector is experiencing ‘most misjudged moment’ since 2020, says venture capitalist Arthur Cheong

Veteran cryptocurrency investor Arthur Cheong believes the digital asset sector offers long-term holders a golden opportunity.

Cheong, the founder of DeFiance Capital, tell His 171,700 followers on social media platform X indicate that he believes decentralized finance (DeFi) is hugely undervalued.

According to Cheong, DeFi projects are innovating at a rapid pace and leaving traditional financial (TradFi) companies in the dust.

“It’s been a long time since I’ve been this excited about the risk/reward and potential upside of DeFi. This is probably the most misjudged moment since the pre-DeFi summer of 2020, with extremely promising prospects.

I see opportunities not only in OG (original) DeFi, but also in some newer projects that are evolving rapidly and growing at a pace that fintech startups will do anything to match.

The veteran investor also believes that crypto is now here to stay following recent launch from the Ethereum spot market (ETH) exchange-traded funds (ETFs) last week.

“Overall, the floodgates are open and there is no turning back. TradFi asset managers will continue to launch new crypto products because, guess what: there is huge demand for them!”

I expect them to launch actively managed crypto ETFs [in the] coming years. ”

Earlier this month, Cheong laid that it might be a bad strategy for cryptocurrencies to seek mass adoption, believing that digital assets are designed to disrupt several key financial sectors.

“I think we should accept that cryptocurrencies may not be suited for mass adoption like Web2, but rather are optimized for some narrow but very high-impact use cases like stateless global money, cross-border payments, and decentralized finance.

Chasing mass adoption of normies may be chasing the wrong Grail from the start.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/ktsdesign

DeFi

If You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

Bonk and Pepe appear set to net new investors 10x to 100x returns over the next 12 months. However, cryptocurrencies in the DeFi play-to-earn gaming sector could offer even greater returns. As August approaches, Rollblock is emerging as a standout DeFi play-to-earn gem with the potential to 100x-1000x gains in the fourth quarter and beyond.

The project features an innovative revenue sharing model and exceptional accessibility, attracting players and investors. Additionally, Rollblock’s extensive game library of over 150 titles and enhanced sports betting are further driving excitement for the platform. Cryptocurrency analysts are expecting a sudden surge in demand. 800% a push for Rollblock from the beginning of September.

Bonk remains strong despite market fluctuations

While most well-known cryptocurrencies struggled throughout July, Bonk remained strong. As one of the highest-grossing meme cryptocurrencies of 2024, Bonk rose over 24% in July, while most cryptocurrencies experienced negative fluctuations.

Investors looking to add a relatively safe memecoin to their portfolio should consider Bonk. While Bonk is unlikely to generate explosive gains of 250x to 1,000x from here on out, Bonk could still theoretically provide returns in the 20x to 100x range.

Pepe should see a big rise in the next bull run

Alongside Bonk, Pepe has yet to go through a bull run. This means that there are still substantial gains to be made from Pepe over the next 12 months.

Pepe is down 4% in 30 days, but that shouldn’t worry Pepe investors in 2024. Experts believe Pepe’s best days are still ahead, with crypto analysts predicting a 10x to 50x surge in the next election cycle around November.

In the long term, Pepe could surpass the 100x mark for today’s investors. However, Pepe is a memecoin, and one should exercise caution when investing in purely speculative assets that have no utility.

Rollblock’s Unprecedented Hype Potential Could Push It Past 100x Valuation in Q4

Rollblock is a GambleFi Play-to-Earn token that integrates centralized and decentralized gambling on a single platform. By allowing players to earn rewards through active participation and gameplay, the platform creates a compelling incentive structure that appeals to both casual and competitive players.

With its cutting-edge blockchain technology, Rollblock offers top-notch security that keeps bets and transactions on the platform secure. The platform’s lack of KYC mandates appeals to both users who value anonymity and security.

Rollblock’s revenue sharing model, which allocates up to 30% of casino revenue to RBLK token holders, is a major draw for investors. The model involves burning half of the repurchased tokens and distributing the other half to stakers, increasing the token’s value and encouraging long-term investment.

The platform is also constantly evolving thanks to user feedback which has enabled updates such as the upcoming sports betting feature within the platform’s casino. This addition will complement Rollblock’s extensive game library of over 150 titles, ranging from traditional poker to innovative blockchain-based games.

RBLK is expected to emerge as one of the leading DeFi tokens in 2024. With a price of $0.0172 with impressive growth potential and over 140 million tokens sold recently, Rollblock is on track to enter the top 100 cryptocurrencies by Q4, making today a lucrative time to buy RBLK tokens.

Discover the exciting opportunities of the Rollblock (RBLK) presale today!

Website: https://presale.rollblock.io/

Social networks: https://linktr.ee/rollblockcasino

No spam, no lies, only insights. You can unsubscribe at any time.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!