Tech

Why Binance Fired an Investigator Hired to Clean Up Its Crypto Exchange – Tech News Briefing

This transcript was prepared by a transcription service. This version may not be in its final form and may be updated.

Alex Ossola: Welcome to Tech News Briefing. It’s Friday, May 10th. I’m Alex Ossola for the Wall Street Journal. Coming up on today’s show: A new generation of gadgets is designed to put artificial intelligence front and center, and I’m not talking about smartphones. WSJ senior personal tech columnist, Joanna Stern, tried out the latest devices and tells us which ones are worth the hype. And then crypto exchange Binance has been under scrutiny from regulators, but when an internal investigation found a top client was manipulating markets, Binance kept the client and fired its lead investigator. WSJ reporter Angus Berwick tells us about the investigation and what it means for the company’s future.

But first, what do AI gadgets look like beyond the smartphone? Some companies are betting on a new crop of separate devices that contain an AI assistant, kind of like in the movie Her. WSJ senior personal tech columnist, Joanna Stern, tried out three devices to get a sense of how we might interact with AI in the future. There was the Humane AI Pin, which attaches to your clothes like a brooch and also has a laser projector for a touchscreen. There’s the Rabbit R1, a square gadget that has a touchscreen and scroll wheel. And she also tried Meta’s Ray-Ban smart glasses. For all three, the primary way to interact with them is to use your voice. Joanna is here now to talk about what she learned from her testing. Joanna, what do you actually use these gadgets for?

Joanna Stern: The idea is that this is an assistant and you can use it for various things. I’ll be honest, that doesn’t work very well, and I put it through a series of challenges, just some of the basic general knowledge stuff. One of my favorite instances was I kept asking the Rabbit, when was the last solar eclipse? And according to the Rabbit, the last solar eclipse was in 2017. Obviously not true. So these devices have these assistants that have all the same flaws as these generative AI assistants. They hallucinate, they don’t know knowledge about certain things.

One of the things that I did think was really appealing about these each is that they all do live translation, and that’s something that generative AI models are actually quite good at because they know the intricacies of different languages. So I did test these by bringing them to a Mandarin tutor in New York City. Specifically the Rabbit and the Humane do live translation out loud. So I could say, “Hello, my name is Joanna,” and then it should say in Mandarin, “Hello, my name is Joanna.” And so did this back and forth, or tried to. The Rabbit completely didn’t work in this testing scenario. I mean, it did work, it just would do the translation five minutes later, which the company says they have since fixed in the software update. But when I was there about a week ago, this thing would just not translate for five minutes, which is not ideal for a live translation. In fact, we did the sentence, “I have to go to the bathroom.” And I would say, I have to go to the bathroom in English, and then five minutes later in Mandarin it would say that sentence.

Speaker 3: (Mandarin).

Joanna Stern: What’d it say?

Michelle: It says, where’s the bathroom?

Joanna Stern: Where’s the bathroom?

Michelle: So it’s delayed.

Joanna Stern: Imagine if you had to wait five minutes to not only go to the bathroom, but to ask-

Michelle: Ask.

Joanna Stern: … where the bathroom is.

And so that was the deal with the Rabbit. The Humane actually did quite well once I figured out the sequence of taps I had to do on the touchpad. I was able to go back and forth with my tutor Michelle and say a couple of things in English, and then she’d say them in Mandarin, and we were able to completely converse. Where is the bathroom?

Speaker 3: (Mandarin). Oh, the toilet. The toilet is on the second floor. Take the elevator from the side, then go straight and turn left.

Joanna Stern: Then we went down the street to a Chinese restaurant and it got stuck in Spanish translation, and it just kept saying in Spanish, “Are there peanuts in the soup dumplings?” But about 10 minutes later, I had futzed with it enough, I had reset it and it worked. So this is all to say these are really early devices that are just not ready for prime time, but they do create some pretty funny situations.

Alex Ossola: Tell us about the Meta Ray-Ban smart glasses.

Joanna Stern: Meta has made an amazing product with the Ray-Bans, and not because of AI. It’s nice that it has AI. That’s a bonus here. What’s nice about the Meta Ray-Bans is that you actually have a camera on your eyes and you don’t need to look at the world through a screen. And so I love these for going on vacation with my kids, going skiing where I want to take photos, I want to take some video, but I don’t want to be holding up a phone. And so that’s use case one, which is great, justifies the cost at 299. But then you get this new AI feature which will get better in the future.

The other main point about the Meta glasses is that they connect to your smartphone. The Humane Pin and the Rabbit don’t connect to your smartphone. They have independent Wi-Fi, independent cellular in it. When we think about the future of AI and gadgets, it has to connect to the most important device in our life, and that is the smartphone.

Alex Ossola: That was our senior personal tech columnist, Joanna Stern. Coming up, why did the world’s largest digital currency exchange fire an internal investigator charged with helping the company clean up its act? That’s after the break.

Binance, the world’s largest digital currency exchange, has been under scrutiny from regulators for allegedly failing to prevent manipulative trading. To stay on the right side of regulators, Binance created a market surveillance team of internal investigators to clean up the digital currency exchange. But when investigators found a top client was manipulating markets, Binance kept the client and fired its lead investigator. The Wall Street Journal interviewed former and current Binance employees and reviewed key documents and emails. WSJ reporter Angus Berwick joins me now with more on the investigation. Angus, Binance has been under scrutiny for the past few years. Tell me why and by whom.

Angus Berwick: Binance has been under investigation by numerous agencies in the US and there was a Justice Department investigation focused on Binance’s anti-money laundering and sanctions compliance, which resulted in a $4.3 billion fine last November, and the sentencing of founder Changpeng Zhao last week. In addition to that, there’s also been cases that were led by the Securities and Exchange Commission, which was more focused on Binance’s… their risk controls to prevent market manipulation in addition to another case by the CFTC.

Alex Ossola: So Binance, knowing that it was under scrutiny, started hiring investigators from the traditional finance world. What was this team of investigators hired to do?

Angus Berwick: They were hired to carry out surveillance on the immense amount of trades that are moving through the Binance platform. In traditional finance, like on the New York Stock Exchange, there are frameworks of rules that’s going to regulate what sort of trading is permitted. On Binance, for a long time, there was a very freewheeling culture and customers could largely come trade in a way that they pleased. So there was a lot of manipulative practices. For instance, wash trading, which is where a trader will be on both sides of the transaction. So they’re just trading against themselves, which is a practice that’s used to give the illusion of an active market so that other traders will be lured into participating. And also to try to target pump and dump schemes where somebody will boost the price for token and then sell it at the top causing a collapse. So they were kind of brought on to try to bring some order to this kind of wild West trading world.

Alex Ossola: It sounds like these investigators found a fair amount of questionable behavior. What was actually wrong with that behavior?

Angus Berwick: So Binance’s terms of use prohibits manipulative trading practices. The SEC part of… Their case against Binance is that there was an absence of risk controls to prevent manipulative trading. And there’ve been many legal cases in the US in which people have been prosecuted for wash trading or other manipulative practices. Through 2023, this team of investigators were recommending that Binance off-board, quite large clients. These were so-called VIPs who were trading in very large volumes and generating quite significant fees for the exchange. And they were targeting progressively larger VIPs. There was another company called the Tron Foundation, which is actually run by a friend of CZ, the Binance founder. And the team found that the Tron Foundation had been wash trading, and they off-boarded them.

Alex Ossola: Some Binance customers were booted off the platform, but not all, right?

Angus Berwick: Yeah. As the team was targeting larger and larger customers, they eventually started looking at a customer called DWF Labs, which is a trading and investment firm registered in Singapore, and it’s run by a Russian crypto trader called Andrei Grachev, who used to work at a different crypto exchange called Huobi in Russia. And the surveillance team had been tipped off about DWF’s trading activities by another client, and they began an investigation in which they surveilled DWF’s trading on the platform. And the conclusions that they reached in a report in September of last year was that DWF had manipulated the price of at least six different cryptocurrencies, and that through that year they’d made over $300 million in wash trades.

Alex Ossola: So it seems like that’s a big catch for the surveillance team. What did Binance do about it?

Angus Berwick: Yeah, so afterwards, the surveillance team went through their standard protocol. They’ve submitted their report in which they recommended DWF Labs off-boarding, and they can sort input from Binance’s VIP department, which handles these high-rolling clients. However, this department, the VIP team, they then questioned the findings of the reports and escalated their complaint to Binance company leadership. A follow-up investigation was then launched by a separate division of Binance called the internal audit team. And this investigation was then looking at how the surveillance teams had carried out its investigation and they were re-evaluating that same evidence. They also kind of looked into the relationship between the head of the surveillance team and this other customer that had tipped off Binance. Ultimately, what this led to was that those Binance executives rejected the surveillance team’s request to off-board DWF and fired the team’s top investigator.

Alex Ossola: We should note DWF and Grachev didn’t respond to requests for comment. After the Journal’s investigation was published, DWF said on X that “allegations reported in the press are unfounded and distort the facts”, and that DWF operates with “the highest standards of integrity, transparency, and ethics”. What has Binance said about this?

Angus Berwick: Binance, they reject any assertion that they’ve ever enabled market manipulation on their platform. They say that they don’t favor any one trader over any other, and that they’re prioritizing the improvement of their compliance functions. At the same time, they also say that any decision to off-board a client requires a high bar of evidence. And we were told by one current executive that this follow-up investigation found that they believed that the surveillance team’s findings weren’t fully substantiated.

Alex Ossola: Zooming out a little bit, what does this incident tell us about Binance’s future as it continues to face regulatory scrutiny?

Angus Berwick: The SEC case is continuing, and probably at the moment, the largest legal risk that Binance continues to face given the DOJ action was resolved. Binance’s new management since CZ’s resignation, they want to move into a new era and present the exchange as having turned a page. Obviously, any reporting that suggests that Binance didn’t keep to pass promises could raise questions about its commitments.

Alex Ossola: That was our reporter, Angus Berwick. And that’s it for Tech News Briefing. Today’s show was produced by Julie Chang. I’m your host, Alex Ossola. Jessica Fenton and Michael LaValle wrote our theme music. Our supervising producer is Katherine Milsop. Our development producer is Aisha Al-Muslim. Scott Saloway and Chris Zinsli are the deputy editors, and Philana Patterson is the Wall Street Journal’s head of news audio. We’ll be back this afternoon with TNB Tech Minute. And our host Zoe Thomas will be back on Monday. Thanks for listening.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

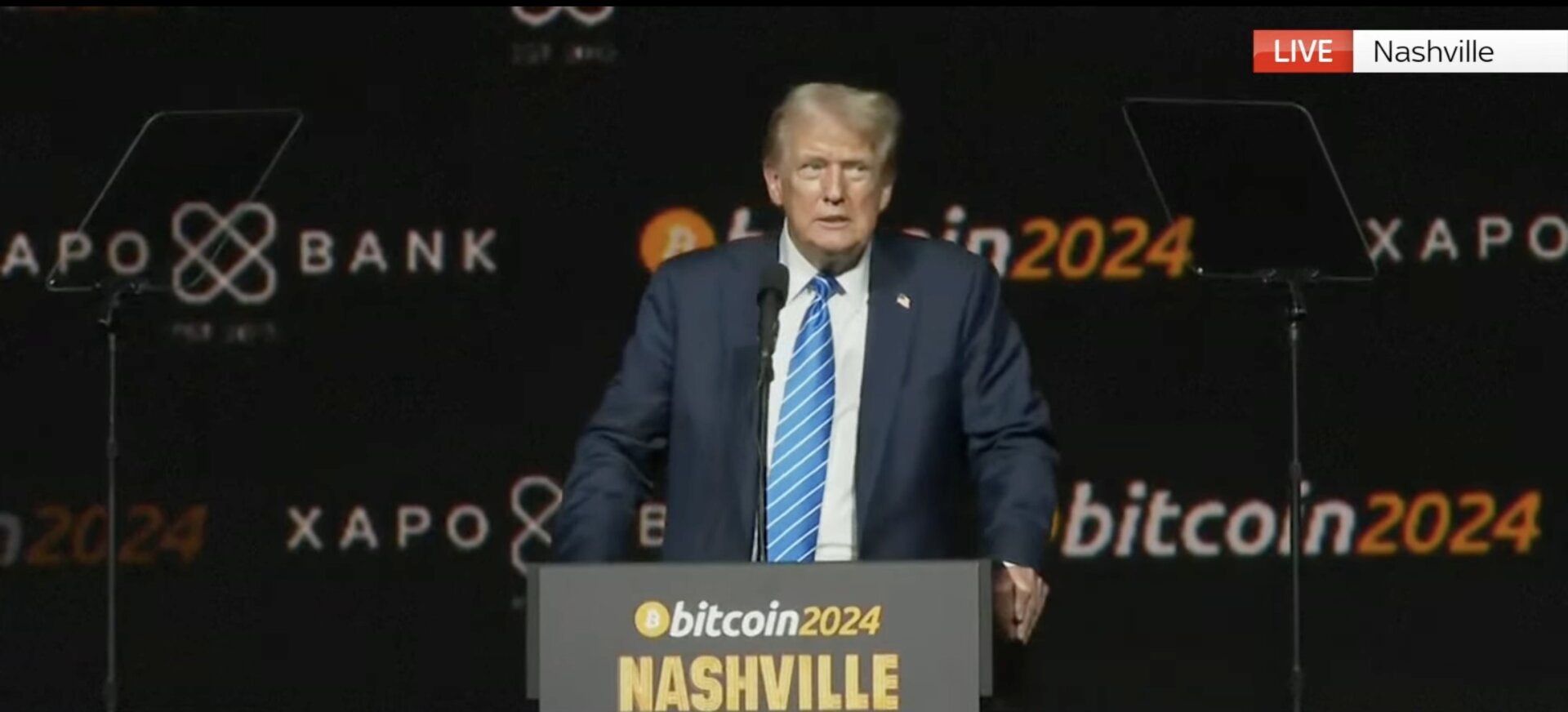

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News11 months ago

News11 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins11 months ago

Altcoins11 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!