Tech

Why Wall Street Firms Are Embracing Cryptocurrencies – Tech News Briefing

This transcript was prepared by a transcription service. This version may not be in its final form and may be updated.

Alex Ossola: Welcome to Tech News Briefing. It’s Tuesday, February 6. I’m Alex Ossola with the Wall Street Journal. The Securities and Exchange Commission approved spot bitcoin exchange-traded funds last month. That means traditional investors can now buy and sell cryptocurrencies as easily as stocks and mutual funds. The decision is already having a big impact. In today’s episode, we hear how some Wall Street financial firms like BlackRock are embracing cryptocurrencies and cryptocurrency culture. WSJ reporter Alexandra Osipovich tells us how it’s going and what the risks are. Then some of these firms are rushing to promote bitcoin ETFs to new audiences. We learn what’s behind the growing wave of ad campaigns targeting baby boomers from WSJ reporter Patrick Coffee. But first, after years of tiptoeing into the cryptocurrency world, some big financial firms are now diving in headfirst in search of a new revenue stream. They want to attract investors and speak the language of the cryptocurrency community. WSJ reporter Alexandra Osipovich joins us to tell us more. Alex, what are some of the Wall Street firms that are embracing cryptocurrency?

Alexander Osipovich: The biggest one is BlackRock, which is the world’s largest asset manager, known for its range of low-cost index funds. It has what is now the fastest-growing bitcoin ETF. Their CEO, Larry Fink, recently gave an interview where he said he’s a big believer in bitcoin. To be fair to Mr. Fink, he used to be more skeptical. But about two years ago he says he started thinking about it more seriously and had a bit of a conversion. His company’s bitcoin ETF launched in January along with ETFs from a number of other companies that are now competing for these investors’ dollars. The other big one that’s a household name is Fidelity, but then there’s a bunch of smaller companies like Franklin Templeton, VanEck, Invesco, Valkyrie. They’re all asset managers that offer different types of investment products for regular people. A lot of them have been around for decades. What strikes me is that a lot of them had a reputation for being boring, reliable, stable Wall Street firms. But since they got into crypto through these ETF products, they seem to be trying to be more bold. For example, Franklin Templeton is a $1.5 trillion asset manager that uses Ben Franklin as its mascot. In mid-January, they changed their logo from X to Ben Franklin with laser eyes. This is a meme that is popular among bitcoin people online and shows how bullish they are on bitcoin. Then on January 17th, they unleashed this tweet storm. They said they were handing over control of account X to Franklin Templeton’s digital asset team. They posted a lot of crazy stuff that sounded a lot like crypto in baseball, very jargon-filled tweets about different blockchains and their opportunities. They used some amazing language like crypto speculation is a feature, not a bug.

Alex Ossola: Who are they trying to sell ETFs to? Because it sounds very much like, as you say, cryptocurrency inside baseball.

Alexander Osipovich: They have a kind of two-pronged marketing strategy here. On one hand, they’re targeting boomers and trying to say, hey, cryptocurrencies are safe for you. You can invest in them through these ETFs. But on the other hand, they’re trying to show the cryptocurrency subculture that, hey, we’re cool, we’re hip, we’re happening. If you want to invest money in these products, you should use ours.

Alex Ossola: What are the big Wall Street firms that are not embracing cryptocurrencies?

Alexander Osipovich: Perhaps the biggest of these is Vanguard, another huge asset manager. Vanguard runs a brokerage, and this brokerage has blocked access to bitcoin ETFs for its clients, saying they don’t align with a long-term buy-and-hold investment philosophy. JP Morgan is another interesting example. As a bank, they actually offer investors access to some crypto-related products without directly touching cryptocurrencies. However, the CEO of JP Morgan, Mr. Jamie Dimon, is personally a big bitcoin skeptic. He recently called it a pet rock.

Alex Ossola: What are some of the risks for financial companies that trade cryptocurrencies?

Alexander Osipovich: There are some regulatory risks. If you are a wealth manager, you are subject to some marketing rules. If you are a brokerage firm, there is a FINRA rule that FINRA could challenge you. FINRA actually warned that they did a review of cryptocurrency disclosures dating back to 2022 and found that a large portion of them violated a rule that prohibits false and exaggerated disclosures to the public. Also, there is a risk that in a few years, cryptocurrencies will not go anywhere and these companies will just look ridiculous.

Alex Ossola: Let’s talk about cryptocurrency culture for a second. You mentioned a little bit about how these companies are jumping into it, but how has this culture merged? How do these two communities fit together?

Alexander Osipovich: Cryptocurrencies have evolved over the years. They started out as a very libertarian anti-government, anti-Wall Street subculture. Satoshi Nakamoto, the anonymous creator of bitcoin, talked about bitcoin as a way to make payments without going through banks, and that tension still exists in cryptocurrencies today. But a lot of people who are involved in cryptocurrencies also believe that eventually we will merge with traditional finance. There will be some kind of regulatory framework around cryptocurrencies, and maybe traditional finance will use cryptocurrency technology to do things. Those people, that faction, have welcomed Wall Street’s interest in cryptocurrencies and, in particular, their interest in bitcoin ETFs because there is an expectation that the price of bitcoin will go up as investors flock to ETFs and buy up the supply of bitcoin and drive up the price.

Alex Ossola: That was our reporter Alex Osipovich. Next up, why crypto marketers are targeting baby boomers in a growing wave of ad campaigns. This is after the break. Cryptocurrency ads are targeting baby boomers. The marketers behind the ads are aiming to explain cryptocurrency to a new audience while also stoking their curiosity, like this ad from crypto asset manager Bitwise. It stars Jonathan Goldsmith, best known for playing The Most Interesting Man in the World in Dos Equis beer commercials.

Jonathan Goldsmith: You know what’s hot these days? Bitcoin.

Alex Ossola: WSJ Reporter, Patrick Coffee joins us now to learn more about this new wave of crypto advertising. Patrick, why are marketers targeting this demographic in particular?

Patrick Coffee: Well, to stand out, these wealth management firms have to attract and raise capital from some of the people who actually control the money in this country, which are investors and advisors who tend to be older, more conservative, and more risk-averse.

Alex Ossola: How are these companies making cryptocurrencies attractive to baby boomers? What kind of marketing are they pursuing?

Patrick Coffee: In a way, they’re targeting boomers directly. There was a video that the VanEck firm released on January 10th right after the SEC decision, and it’s a text exchange from someone called Mom, who’s obviously texting one of her kids and says, “How do I buy bitcoin?” And the kid says, “Oh, it’s easy now, Mom, there’s ETFs.” And she says, “Oh, my God, thank you so much.” Emoji, emoji. This is targeting the younger audience but also the older audience.

Alex Ossola: During the pandemic, we saw these multimillion-dollar cryptocurrency ads. How are these new campaigns different?

Patrick Coffee: They are very different because unlike those commercials, they are highly regulated because they are talking about securities that are approved and managed by the SEC. They are like exchange-traded funds. Whereas FTX, et cetera, they didn’t really have any regulation. They can do whatever they want. They could call Tom Brady and Larry David and say, “You better invest in cryptocurrency or you’re really missing out.” Whereas the new ones have rules that they have to abide by. For example, if they have to call a famous name and say, in particular, you should invest in this fund that has this ticker, then that person has to have a reasonable level of expertise on the specific subject matter at hand. They have a lot of other rules. First of all, they have to include disclosures about the risk involved and investing in these products.

Alex Ossola: How much do these companies spend trying to court new investors?

Patrick Coffee: Just from January 11th to January 30th, the combined spend of four of them that advertised on TV was about $300,000. But that doesn’t include things like digital display ads in airports or homepage takeovers, email newsletter sponsorships, and search ads, which is a big thing that they can do now. If you look up this, some of the first things that come up are all advertising. They can also now do YouTube ads, pre-roll ads, things like that, sponsored videos, because Google changed their official policy when the decision was made. Very soon, they will most likely be able to advertise on Facebook and Instagram as well because Meta, as a spokesperson told me, is in the process of updating their policies and complying with what the SEC decided. Ultimately, as a Bloomberg analyst told me, the products they’re promoting are exactly the same. So if they don’t find a way to differentiate their brands, it’s going to be difficult for them to really compete in terms of raising assets.

Alex Ossola: Is it working? Are baby boomers buying these ETFs?

Patrick Coffee: It seems like it’s because, as Bloomberg told me, a lot of them have crossed a threshold in terms of assets to be viable. That essentially means they’ve established their place in this nascent market and they’re going to be around for a while.

Alex Ossola: That was our reporter, Patrick Coffee, and that’s it for Tech News Briefing. Today’s show was produced by Julie Chang with supervising producer Katherine Milsop. I’m Alex Ossola for the Wall Street Journal. We’ll be back this afternoon with TNB Tech Minute. Thanks for listening.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

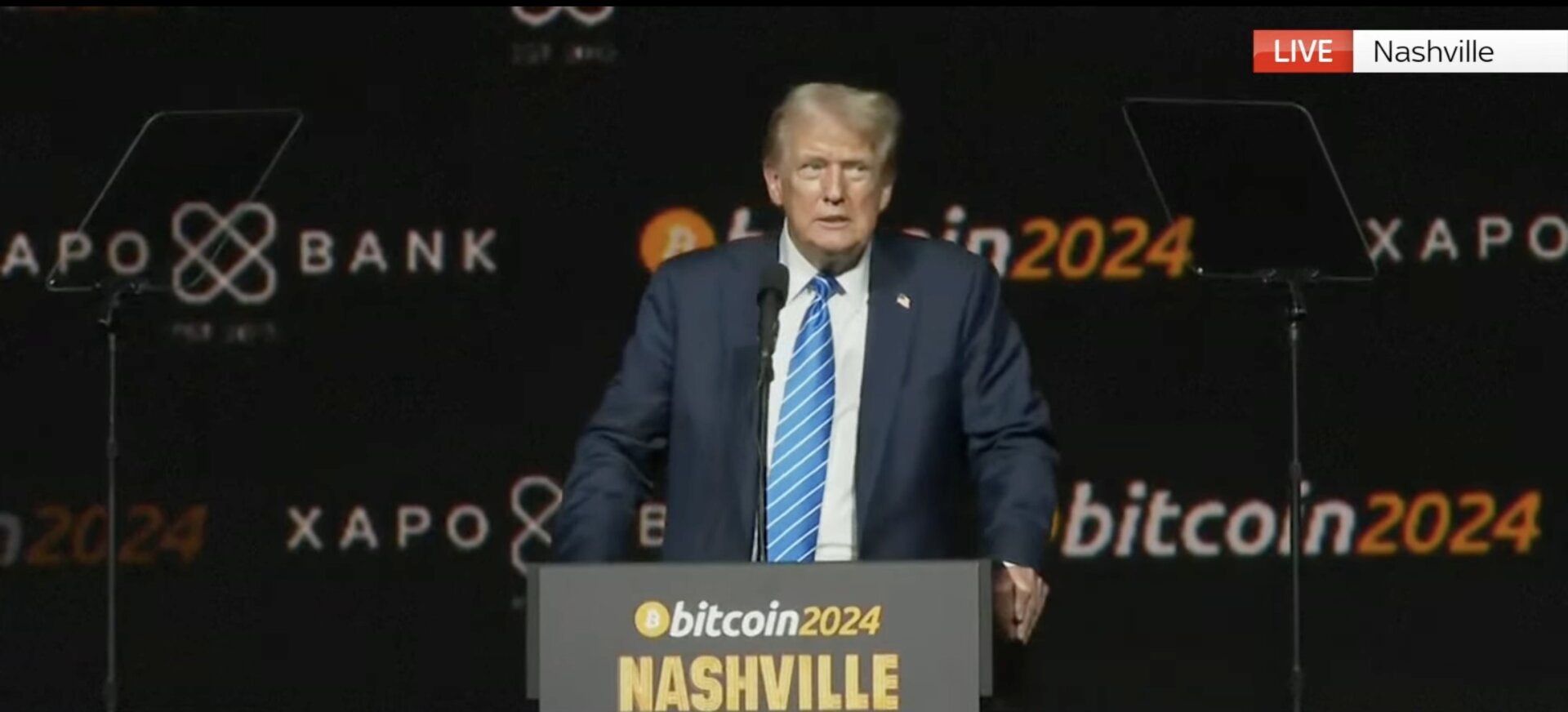

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins12 months ago

Altcoins12 months agoTop Solana-Based Altcoins Stack Up As Market Turns Bullish!

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News12 months ago

News12 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins12 months ago

Altcoins12 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech12 months ago

Tech12 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

News12 months ago

News12 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi12 months ago

DeFi12 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins12 months ago

Altcoins12 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!