Tech

Azioni della tecnologia Blockchain: le 10 aziende più grandi

Il settore della tecnologia blockchain ha registrato una crescita notevole nel corso degli ultimi anniSebbene il 2022 sia stato un tempo turbolento per il mercato, gli investitori stanno iniziando a imparare a convivere con la volatilità dei titoli azionari della tecnologia blockchain.

Come Zia Yusuf del Boston Consulting Group appunti in Barron’s“La combinazione di blockchain, Internet of Things (IoT) e intelligenza artificiale (AI) per l’ottimizzazione delle supply chain è profondamente entusiasmante”. L’utilizzo di queste tecnologie emergenti in settori con margini ridotti e complesse esigenze di supply chain potrebbe fare una grande differenza per la logistica.

Allo stesso modo, la rete di servizi professionali Deloitte afferma che la tecnologia blockchain può svolgere un ruolo fondamentale in garantire la fiducia degli stakeholder nei mercati dei capitali. “Forse è inevitabile che la tokenizzazione delle attività nei mercati dei capitali sia uno dei principali casi di utilizzo della blockchain aziendale, con organizzazioni come Broadridge (NYSE:Brasile), Clearstream e Goldman Sachs (NYSE:GS) utilizzando piattaforme di transazione basate su blockchain per contribuire a eliminare le inefficienze di sistema e di processo e ad aumentare la fiducia dei partecipanti nei mercati dei capitali”, ha affermato Mike Bechtel, amministratore delegato e capo futurista dell’azienda.

Con la maturazione della tecnologia blockchain, ci saranno molte opportunità per gli investitori. Insieme ai fondi negoziati in borsa blockchain e ad altre vie, le aziende di tecnologia blockchain sono un mezzo per ottenere visibilità in questo segmento del mercato tecnologico.

Azioni blockchain statunitensi

Di seguito sono riportate cinque delle più grandi azioni tecnologiche blockchain statunitensi per capitalizzazione di mercato sul NASDAQ e NYSE che gli investitori dovrebbero prendere in considerazione. Le cifre della capitalizzazione di mercato erano aggiornate al 5 aprile 2023.

Capitalizzazione di mercato: 150,35 miliardi di dollari USA

La società di software tedesca SAP è nota soprattutto per il suo software di pianificazione delle risorse aziendali, progettato per aiutare le aziende a gestire le operazioni e le relazioni con i clienti. La Business Technology Platform dell’azienda è composta da quattro portafogli tecnologici: database e gestione dei dati, sviluppo e integrazione delle applicazioni, analisi e tecnologie intelligenti.

Le soluzioni SAP includono offerte di blockchain-as-a-service, che consentono l’accesso ai servizi blockchain forniti da aziende come Hyperledger Fabric, MultiChain e Quorum Information Technologies (TSXV:QIS). La società è pronta a lanciare un nuova suite basata su blockchain prodotti per applicazioni business-to-business.

Capitalizzazione di mercato: 122,34 miliardi di dollari

La società fintech globale Intuit è leader mondiale nel software per la finanza personale e aziendale. La sua piattaforma serve oltre 100 milioni di clienti in tutto il mondo che utilizzano marchi noti come TurboTax, Credit Karma, QuickBooks e Mailchimp.

Intuit ha iniziato l’anno mediante deposito una domanda di brevetto per un token non fungibile (NFT) presso l’ufficio brevetti e marchi degli Stati Uniti in preparazione del lancio di un software scaricabile per le transazioni di asset virtuali nel metaverso.

Capitalizzazione di mercato: 119,99 miliardi di dollari USA

Il conglomerato multinazionale americano IBM è una delle più grandi aziende di tecnologia informatica al mondo, ed è meglio conosciuto per i suoi prodotti hardware e software, come computer, server, sistemi di storage e apparecchiature di rete. Negli ultimi anni, IBM ha cercato di lasciare il segno anche nello spazio blockchain.

Alcune delle offerte blockchain del gigante dell’IT includono IBM Food Trust Ecosystem, che applica la tecnologia blockchain alla gestione della supply chain; SecureKey, che è basato su IBM Blockchain e utilizzato nell’app di verifica dell’identità Verify.Me; e IBM Blockchain World Wire, che consente di compensare e regolare i pagamenti transfrontalieri in pochi secondi.

Capitalizzazione di mercato: 94,54 miliardi di dollari USA

ServiceNow, con sede in California, è una società platform-as-a-service e software-as-a-service (SaaS) che fornisce funzionalità di cloud computing per aiutare le aziende a gestire i flussi di lavoro digitali per le operazioni aziendali. La Now Platform di ServiceNow è una piattaforma basata su cloud per automatizzare i flussi di lavoro di gestione IT.

ServiceNow è membro dell’Hedera Governing Council, il principale organo di governo del registro distribuito pubblico. L’azienda è anche un utente della rete tecnologica del registro distribuito Hedera, che consente ai suoi clienti e partner Now Platform di trarre vantaggio dalle capacità della rete.

5. Società quotata in borsa PayPal (NASDAQ:PYPL)

Capitalizzazione di mercato: 82,86 miliardi di dollari USA

PayPal ha guidato la carica nella rivoluzione dei pagamenti digitali per oltre due decenni. La piattaforma della società fintech è utilizzata da oltre 425 milioni di consumatori e commercianti in oltre 200 mercati a livello globale.

PayPal consente ai suoi clienti con sede negli Stati Uniti e nel Regno Unito di acquistare, detenere e vendere quattro tipi di criptovaluta — Bitcoin, Ethereum, Litecoin e Bitcoin Cash — tramite la sua piattaforma. Queste criptovalute possono ora essere utilizzate insieme ad altri metodi di pagamento nel portafoglio PayPal per effettuare acquisti. Negli Stati Uniti, la società ha introdotto servizi di criptovaluta sul suo servizio di pagamento mobile Venmo.

PayPal sta anche valutando partnership con piattaforme di criptovaluta autorizzate e regolamentate e con banche centrali. A dicembre 2022, PayPal ha stipulato un accordo di partnership con MetaMask per consentire agli utenti di acquistare criptovalute tramite la piattaforma MetaMask utilizzando i loro account PayPal. la società ha aderito Coinbase (NASDAQ:MONETA) TRUST Network nel tentativo di rafforzare la propria conformità normativa.

Azioni blockchain canadesi

Di seguito sono elencate cinque delle più grandi azioni canadesi della tecnologia blockchain per capitalizzazione di mercato sul Stazione di Toronto per gli investitori da considerare. I dati sulla capitalizzazione di mercato erano aggiornati al 5 aprile 2023.

1. Negozio di abbigliamento Shopify

Capitalizzazione di mercato: 81,71 miliardi di dollari canadesi

Shopify ha sviluppato una piattaforma di e-commerce globale proprietaria per negozi online e sistemi POS al dettaglio. Il suo sistema comprende software basato su abbonamento che consente agli utenti di lanciare, creare e gestire le proprie vendite online. La piattaforma dell’azienda con sede a Ottawa consente inoltre agli utenti di sviluppare marketplace per NFT. A luglio 2021, i Chicago Bulls della NBA hanno lanciato un negozio online su Shopify per vendere i primi NFT dell’associazione sportiva, tra cui opere d’arte digitali di anelli del campionato NBA.

Shopify ha partecipato al Round di finanziamento di serie A da 24 milioni di dollari per la startup Thirdweb, che ha creato un toolkit di sviluppo per la creazione e il lancio di prodotti Web3 come giochi blockchain, NFT e marketplace. Più di recente, Shopify è stato lanciato una serie di strumenti di commercio basati su blockchain per i commercianti sulla sua piattaforma.

Capitalizzazione di mercato: 31,15 miliardi di dollari canadesi

CGI è una delle più grandi società di consulenza aziendale e di integrazione di sistemi IT al mondo. Si definisce “una delle poche società di consulenza end-to-end con la scala, la portata, le capacità e l’impegno per soddisfare le esigenze di trasformazione digitale aziendale dei clienti”.

In termini di blockchain, CGI aiuta i clienti a utilizzare la tecnologia per costruire reti aziendali pronte per il futuro, sicure ed efficienti. La Bank of Montreal (TSX:OMO,NYSE:BMO), Banca Reale del Canada (TSX:RIV,NYSE:RY), Mitsubishi UFJ Financial Group (NYSE:MUFG,TSE:8306) e Banca Nazionale del Canada (TSX:N / A,OTC Pink:NTIOF) hanno stretto una partnership con CGI per integrare il suo SaaS Trade360 con la piattaforma blockchain di Skuchain, sostituendo la natura tradizionalmente complessa e ricca di documenti cartacei del finanziamento del commercio.

Capitalizzazione di mercato: 13,97 miliardi di dollari canadesi

OpenText è un leader globale nella gestione delle informazioni aziendali e fornisce una piattaforma di integrazione cloud per catene di fornitura digitali ed ecosistemi aziendali. I clienti dell’azienda includono alcune delle più grandi aziende al mondo nei settori della produzione, della vendita al dettaglio, dei beni di consumo e dei servizi finanziari.

La piattaforma di OpenText integra tecnologie IoT, AI e blockchain per creare catene di fornitura autonome, intelligenti e connesse. Secondo l’azienda“La tecnologia OpenText può consentirti di costruire la dorsale digitale necessaria per l’integrazione B2A che include dati IoT, nonché analisi predittive AI/ML e alla fine ti consentirà di integrare la tecnologia blockchain tramite i suoi partner commerciali”. OpenText è un membro della Blockchain in Transport Alliance, la più grande alleanza commerciale blockchain al mondo, con quasi 300 membri provenienti principalmente dai settori del trasporto merci, dei trasporti e della logistica.

Capitalizzazione di mercato: 8,07 miliardi di dollari canadesi

Il processore di pagamento elettronico Nuvei offre soluzioni di pagamento online, mobile e in-store e consulenza ai marchi nei mercati locali e globali. La sua piattaforma proprietaria fornisce funzionalità di pagamento in entrata e in uscita senza soluzione di continuità per aiutare le aziende a “rimuovere le barriere di pagamento, ottimizzare i costi operativi e aumentare i tassi di accettazione”.

Attraverso la sua controllata Simplex, che ha una partnership con Visa (NYSE:E), Nuvei offre carte di debito Visa brandizzate ai suoi partner in Europa e nel Regno Unito. A metà del 2022, la società ha lanciato una partnership con Bibox, la prima piattaforma di trading di asset digitali basata sull’intelligenza artificiale al mondo, che consente un accesso più facile a oltre 145 criptovalute.

5. Commercio Lightspeed (TSX:LSPD)

Capitalizzazione di mercato: 2,99 miliardi di dollari canadesi

Lightspeed Commerce, fornitore di software per POS ed e-commerce, offre un sistema POS basato su cloud completo per piccole e medie imprese in oltre 100 paesi.

La piattaforma aiuta ristoranti e rivenditori a gestire l’inventario, visualizzare i dati dei clienti e analizzare i dati di vendita multicanale all’interno di un unico sistema. Un modo in cui lo fa è integrando un sistema POS elettronico con tecnologia blockchain proprietaria; questo aiuta i ristoratori a garantire la conformità alle normative fiscali, riducendo al contempo la complessità della fatturazione e della gestione della supply chain.

Domande frequenti sulle azioni della tecnologia blockchain

Cosa dovrebbero sapere tutti su Bitcoin?

Bitcoin e altre criptovalute sono soggette a oscillazioni volatili, che possono portare a guadagni monetari importanti così come a perdite catastrofiche. Ma questo significa le criptovalute sono un cattivo investimento? Ogni investitore deve prendere le proprie decisioni.

In futuro avremo solo valute digitali?

Mentre banche centrali in tutto il mondo stanno valutando come integrare le valute digitali regolamentate nell’attuale sistema finanziario, le criptovalute sono ancora intrinsecamente vulnerabili all’instabilità. Le criptovalute non sostituiranno il denaro contante tanto presto.

Perché le monete e le azioni blockchain crollano contemporaneamente?

Chi investe in criptovalute spesso investe anche in azioni. Quando gli investitori perdono fiducia in un’area del mercato, tendono a perdere fiducia anche in altre. Le azioni focalizzate sulla blockchain saranno particolarmente vulnerabili ai grandi cali dei prezzi delle criptovalute.

Non dimenticarti di seguirci @INN_Tecnologia per aggiornamenti in tempo reale!

Informativa sui titoli: io, Melissa Pistilli, non detengo alcun interesse di investimento diretto in nessuna delle società menzionate nel presente articolo.

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

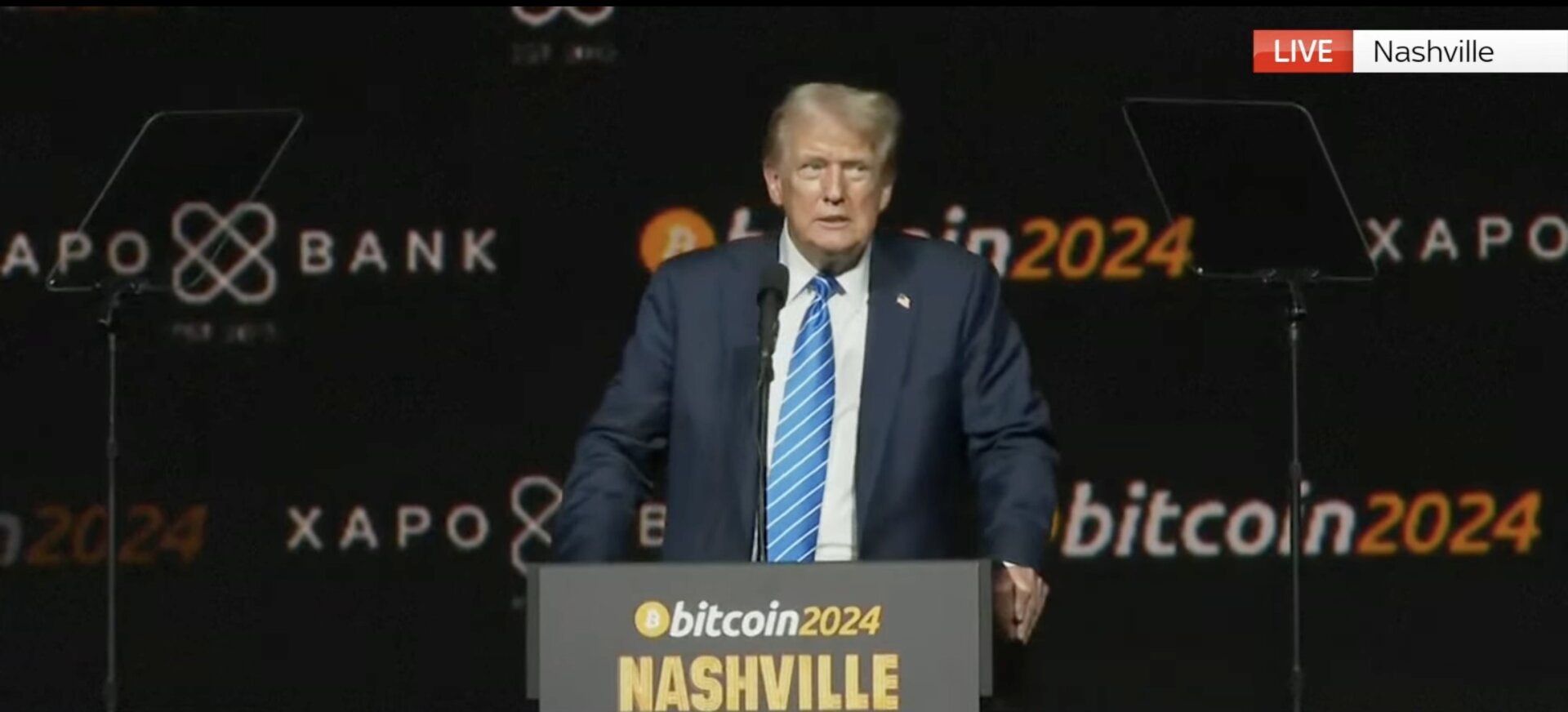

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News11 months ago

News11 months agoAI meme Raboo and crypto newbie ZRO

-

Altcoins11 months ago

Altcoins11 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

DeFi11 months ago

DeFi11 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins11 months ago

Altcoins11 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!