DeFi

Cardano DeFi Trading Volume Surpasses $22M: Will ADA Price React?

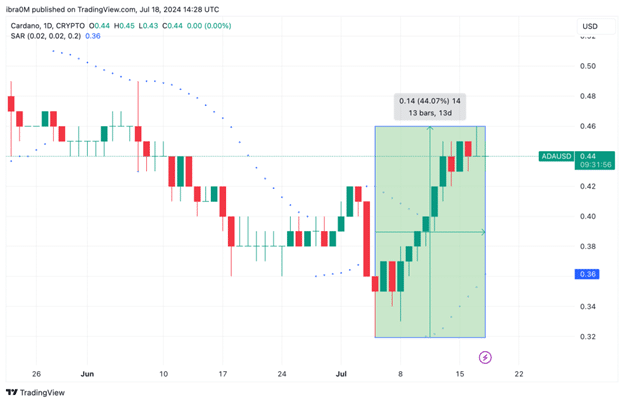

Cardano price rally stalled at $0.44 on July 18 after 40% gains in 14 days; on-chain data analysis explores the bullish and bearish catalysts that impacted ADA price stagnation over the past 72 hours.

Cardano DEX Volumes Soar Despite Mixed Market Signals

Since July 5, Cardano has been on an upward trajectory, mirroring broader trends in the cryptocurrency market. But after nearly two weeks of persistent bullish trends, mixed signals have emerged within the Cardano ecosystem, as bulls and bears struggle to dominate the next phase of the market.

Over the past two weeks, between July 5th and July 18th, ADA prices have increased significantly. The chart above shows that ADA prices have increased by 44% from the monthly low recorded on July 5th.

However, a closer look at the chart shows that Cardano’s price rally has struggled to break above the $0.45 resistance despite the bullish sentiment surrounding the cryptocurrency sector this week. This rare market alignment suggests that conflicting bullish and bearish catalysts are currently in play in Cardano markets.

On the bright side, Cardano’s decentralized exchange (DEX) trading volumes have increased significantly, highlighting the growing interest in its DeFi ecosystem. According to recent data, Cardano’s 24-hour trading volume has surpassed $350 million, with DEX volumes surpassing 50 million ADA this week.

This increase indicates a growing adoption of DeFi applications on the Cardano blockchain, which is generally correlated with higher network activity and potentially positive impacts on network health. Despite this increase in DEX activity, CardanThe stock price continues to show bearish trends. ADA has seen a notable correction, trading at around $0.4493, a 3% decline over the past week.

A closer look reveals a decrease in network activity, with daily active addresses dropping from 39,300 to 31,000 and daily transactions dropping from 94,000 to 49,500. These metrics suggest some bearish pressure on ADA, which is reflected in the recent price action.

Despite the short-term bearish signals, the long-term outlook remains optimistic. co-founder Charles Hoskinson and other proponents believe in its potential to revolutionize financial markets. Additionally, speculation about a possible approval of a Cardano spot ETF could serve as a significant bullish catalyst.

Cardano Price Prediction: Bulls Struggle Against $0.45 Resistance

Cardano (ADA) has been performing impressively in recent days, with the price surging from $0.30 to $0.44, representing a 44.07% increase in the last 13 days. This bullish momentum has brought ADA closer to the critical resistance level of $0.45, which it needs to break to maintain its upward trajectory.

The chart illustrates a robust uptrend, supported by a series of higher highs and higher lows. The Parabolic SAR dots below the price indicate continued bullish sentiment, while the ALMA (Adaptive Moving Average) line is currently at $0.44, acting as a dynamic support level. This suggests that any short-term pullback could find support around this level, potentially providing a buying opportunity for traders.

Despite the recent gains, ADA faces significant resistance at $0.45. A decisive break of this resistance could pave the way for further upside, targeting the next major resistance level around $0.50. On the downside, the main support level lies at $0.36, as indicated by the Parabolic SAR, which also aligns with a previous consolidation area. A drop below this level could signal a change in sentiment, potentially leading to a deeper correction.

The Relative Strength Index (RSI) is at 55.93, which remains below overbought territory, suggesting that there is room for further upside. This is consistent with the overall bullish outlook, although traders should watch for any signs of RSI divergence that could indicate weakening momentum.

In summary, Cardano’s technical indicators are trending to the upside, with the potential for further gains if the $0.45 resistance is broken.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-