Tech

Fujitsu launches blockchain collaboration technology to create Web3 services: Fujitsu Global

Effectiveness of Fujitsu’s ‘ConnectionChain’ technology for cross-border securities settlement demonstrated in Asian Development Bank field trials

Fujitsu Limited

Tokyo, 15 June 2023

Fujitsu today announced the successful completion of a one-year pilot project, which began in January 2022, for its proprietary blockchain technology “ConnectionChain” with the Asian Development Bank, blockchain provider ConsenSys Software Inc., R3 and SORAMITSU , LTD, demonstrating its effectiveness in streamlining and strengthening the security of cross-border transactions (1) of financial securities.

The experiments integrated “ConnectionChain” to create a system capable of connecting multiple blockchains to securely facilitate transactions between different economic areas. The trials focused on improving cross-border securities settlement in regions including ASEAN, Japan, China and South Korea.

Based on the project results, Fujitsu will begin offering a trial environment, “Fujitsu Web3 Acceleration Platform”, which integrates “ConnectionChain” to enable flexible and secure connectivity in multiple economies starting June 30, 2023. The Web3 Acceleration Platform of Fujitsu offers a number of “Fujitsu Computing as a Service Data e-TRUST” technologies to partners participating in the “Fujitsu Accelerator Program for CaaS”, Fujitsu’s global partner co-creation program Fujitsu for its Computing as a Service platform.

Looking to the future, Fujitsu sees applications for the technology for a wide range of payments use cases, not only in the financial sector, but also in the distribution and manufacturing sectors. By conducting verification tests with various partners, Fujitsu will further promote the social implementation of Web3-related technologies such as blockchain, and create new markets through “Hybrid IT“as part of its vision to create the digital infrastructure to achieve a connected society in the world”Fujitsu Uvance.”

Added development function to “Data e-TRUST”

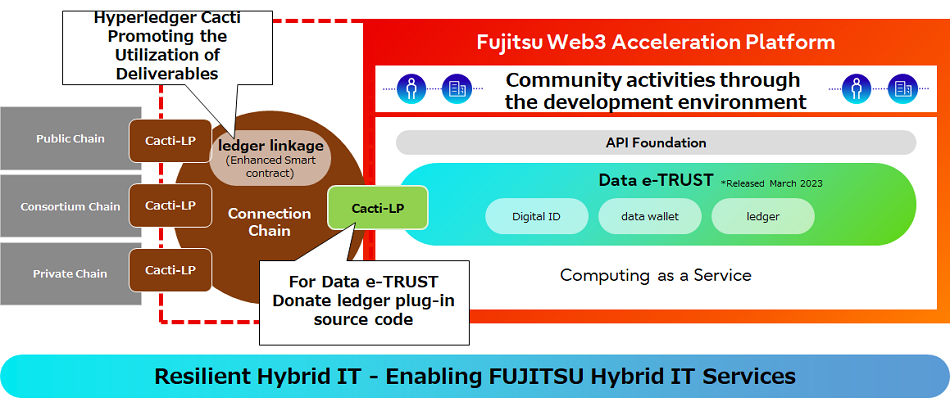

“ConnectionChain”, which will be added to “Data e-TRUST”, allows the “Extended Smart Contract” functionality to work autonomously, allowing multiple external blockchains to operate as a single integrated system. To connect different types of blockchains, it is necessary to develop a connection that absorbs the differences in the specifications of each blockchain, but since each type of blockchain needs to be developed, “ConnectionChain” has optimized this development by incorporating plugins called Cacti-LP(Ledger Plugins) , developed by “Hyperledger Cacti,” an OSS project hosted by the Hyperledger Foundation (2) on the topic of ensuring interoperability. This allows “Data e-TRUST” to connect to the various blockchains supported by “Hyperledger Cacti”, simplifying the creation of new Web3 services.

Fujitsu will also develop Cacti-LP to connect “Data e-TRUST” from third-party blockchains supporting Hyperledger Cacti, and contribute source code to the “Hyperledger Cacti” development community to accelerate the provision of Web3 services to external partners via “Cactus hyperregisters.”

Figure 1: Adding registry link function to Data e-TRUST

Figure 1: Adding registry link function to Data e-TRUST

“ConnectionChain” pilot project for cross-border securities settlement

In collaboration with the Asian Development Bank, ConsenSys, R3 and SORAMITSU, Fujitsu has developed a system to interconnect each company’s networks via “ConnectionChain”. Fujitsu has successfully confirmed the operation of a project aimed at improving the efficiency and security of cross-border transactions simultaneously carrying out remittances abroad and delivery of securities assuming their use by central banks and securities settlement institutions in each village. In this experiment, two ledgers were actually built to manage the balance of two fiat currencies and one ledger to manage the ownership of securities, and these three decentralized ledgers were implemented in “ConnectionChain” in accordance with the current transaction rules observed by all financial institutions. institutions involved in the transactions. This project is a field trial aimed at improving the efficiency and security of cross-border securities transactions in ASEAN, Japan, China and South Korea, where settlement takes at least two days due to the time difference between global centers in Europe and the United States States and difference in time of market transactions. Fujitsu, anticipating that central banks and securities settlement institutions around the world might one day use this system, has developed a cross-border securities settlement system by connecting decentralized ledger technology and blockchain-based financial system, which ConsenSys, R3 and SORAMITSU developed experimentally, with “ConnectionChain”.

Related links

- Fujitsu Research Topics

- Fujitsu launches “Fujitsu Computing as a Service (CaaS)” in Japan, a new global co-creation partner program (press release, October 25, 2022)

- Fujitsu launches new platform to support Web3 developers globally (press release, February 6, 2023)

- Fujitsu develops security technology to securely connect blockchains (Fujitsu Laboratories press release, November 15, 2017)

- Fujitsu and Accenture Collaboration Accelerates Trusted Blockchain Interoperability (Fujitsu Laboratories Press Release, May 15, 2020)

- Fujitsu and IHI launch joint project on new environmental value distribution platform using blockchain technology (press release, April 12, 2022)

*Fujitsu Laboratories Ltd. has been integrated into Fujitsu Limited effective April 1, 2021.

Fujitsu’s commitment to the Sustainable Development Goals (SDGs)

The Sustainable Development Goals (SDGs) adopted by the United Nations in 2015 represent a set of common objectives to be achieved globally by 2030.

Fujitsu’s purpose – “to make the world more sustainable by building trust in society through innovation” – is the promise to contribute to the vision of a better future strengthened by the SDGs.

The most relevant objectives for this project

About Fujitsu

Fujitsu’s purpose is to make the world more sustainable by building trust in society through innovation. As the digital transformation partner of choice for customers in more than 100 countries, our 124,000 employees work to solve some of the greatest challenges facing humanity. Our range of services and solutions is based on five key technologies: computing, networks, artificial intelligence, data and security, and convergent technologies, which we bring together to achieve a sustainability transformation. Fujitsu Limited (TSE:6702) reported consolidated revenue of 3.7 trillion yen ($28 billion) for the fiscal year ended March 31, 2023 and remains the largest digital services company in Japan by market share. Find out more: www.fujitsu.com.

Press Contacts

Fujitsu Limited

Public and Investor Relations Division

Investigations

All company or product names mentioned herein are trademarks or registered trademarks of their respective owners. The information provided in this press release is accurate at the time of publication and is subject to change without notice.

Date: June 15, 2023

City: Tokyo, Japan

Agency: Fujitsu Limited

Fuente

Tech

The Information Hires Peterson to Cover Tech, Finance, Cryptocurrency

My life is nice

Tech news site The Information has hired Business Insider actress to cover technology, finance and cryptocurrencies.

She was part of Business Insider’s investigative team. She was also previously a corporate technology reporter and a technology deals reporter.

Peterson has been with Business Insider since June 2017 and is based in the San Francisco office.

She previously worked for Folio as an associate editor. She holds a bachelor’s degree from the University of California-Davis and a master’s degree from New York University.

Chris Roush

Chris Roush is the former dean of the School of Communications at Quinnipiac University in Hamden, Connecticut. Previously, he was the Walter E. Hussman Sr. Distinguished Professor of Business Journalism at UNC-Chapel Hill. He is a former business reporter for Bloomberg News, Businessweek, The Atlanta Journal-Constitution, The Tampa Tribune, and the Sarasota Herald-Tribune. He is the author of the leading business journalism textbook, Show Me the Money: Writing Business and Economics Stories for Mass Communication, and of Thinking Things Over, a biography of former Wall Street Journal editor Vermont Royster.

Tech

Trump Courts Crypto Industry Votes, Campaign Donations

About the article

- Author, Brandon Livesay

- Role, BBC News

-

July 27, 2024

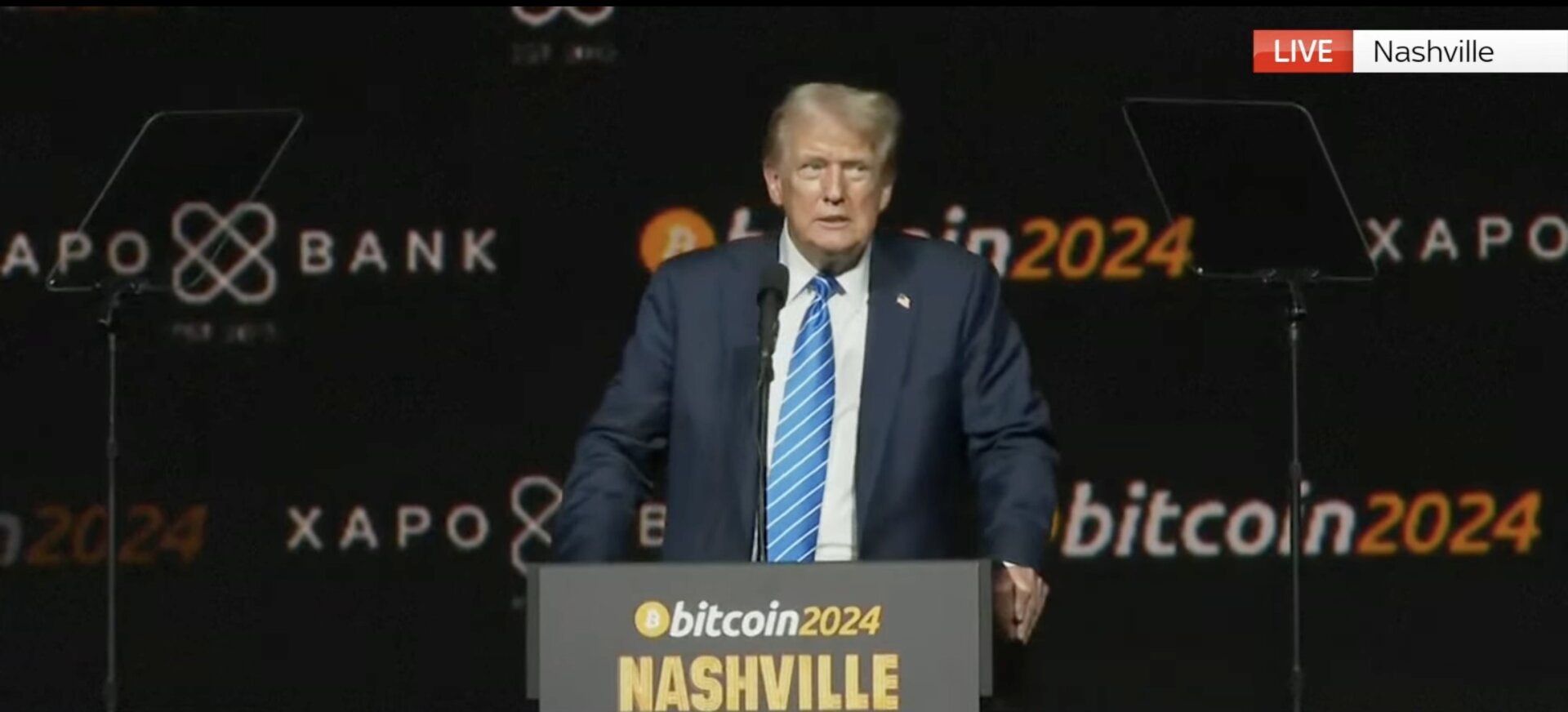

Donald Trump said at one of the biggest cryptocurrency events of the year that if he is re-elected president, he will fire the chairman of the U.S. Securities and Exchange Commission (SEC) on his first day.

On Saturday, Trump was the keynote speaker at Bitcoin 2024, a gathering of industry heavyweights in Nashville, Tennessee.

The Republican presidential candidate used the event to woo voters and encourage the tech community to donate to his campaign.

Cryptocurrencies have emerged as a political battleground for Republicans, with Trump saying that the Democratic Party and Vice President Kamala Harris were “against cryptocurrencies.”

The crowd was at its most animated when Trump declared, “On day one, I will fire Gary Gensler,” the SEC chairman appointed by now-President Joe Biden. The crowd applauded loudly and began chanting “Trump” at this statement.

SEC files charges against ‘Cryptocurrency King’ Sam Bankman-Frittosentenced to 25 years for stealing billions of dollars from customers of his cryptocurrency exchange FTX.

Speaking for about 45 minutes, Trump outlined some of his ideas for the industry if he wins the November election. He said he would make the United States the crypto capital of the world. His support for the sector is a 180-degree reversal from his comments in 2021, when he told Fox Business he saw Bitcoin as a “scam” that influence the value of the US dollar.

Trump told the crowd at the event that he would retain 100% of the Bitcoin currently owned or acquired by the U.S. government, adding that it would be a “national stockpile of Bitcoin.”

The former president also said he would “immediately appoint a presidential advisory council on Bitcoin and cryptocurrencies.”

He talked about the power needed to mine cryptocurrencies. “It takes a lot of electricity,” he said, adding that he would build power plants “to do that” and that it would “use fossil fuels.”

In recent months, some tech leaders have seen growing support for Trump’s presidential campaign. Tesla founder Elon Musk, who is the world’s richest person, has backed Trump. And cryptocurrency moguls the Winklevoss twins, who attended his speech on Saturday, have also come out in support.

Trump noted that his campaign accepts cryptocurrency donations, saying that in the two months since allowing cryptocurrency transactions, he has received $25 million (£20 million) in donations. However, he did not say how much of the payments came from cryptocurrency.

Trump used his speech to frame cryptocurrency regulation as a partisan issue, saying the Biden administration was “anti-crypto.”

Several Republican lawmakers also attended Trump’s speech, including Senators Tim Scott and Tommy Tuberville. Former Republican presidential candidate and Trump ally Vivek Ramaswamy was also in attendance.

The event was also attended by independent presidential candidate Robert F Kennedy Jr. and Democratic Party congressmen Wiley Nickel and Ro Khanna.

Earlier, during Bitcoin 2024, Democratic Congressman Nickel said that Kamala Harris was taking a “forward-thinking approach to digital assets and blockchain technology.”

Tech

WazirX Crypto Exchange Hack and Its Bounty Program: What Does It Mean for Crypto Investors in India?

On July 18, India Cryptocurrency exchange WazirX has been hit by a cyber attack which resulted in the loss of over $230 million worth of digital assets from one of its wallets. The exchange responded by suspending regular trading and reporting the incident to Indian authorities and other cryptocurrency exchanges. The company also launched two reward programs for ethical hackers who can help the exchange trace, freeze, and recover stolen funds.

WazirX said there was a cyberattack on a multi-signature wallet operated through a digital asset custodian service known as Liminal. Multi-signature wallets have a built-in security feature that requires multiple parties to sign transactions.

“The impact of the cyberattack is over $230 million on our clients’ digital assets,” WazirX said in a blog post, adding that INR funds were not affected. The company has firmly denied that WazirX itself was hacked and has brushed aside rumors that it was tricked by a phishing attack.

The exchange also noted that it was “certain” that its hardware keys had not been compromised, adding that an external forensic team would be tasked with investigating the matter further.

But Liminal, after completing its investigation, said: “It is clear that the genesis of this hack stems from three devices compromised by WazirX.”

Meanwhile, WazirX founder and CEO Nischal Shetty said that the attack would have been possible only if there were four points of failure in the digital signature process.

Who is behind the cyber attack?

WazirX has not yet disclosed the suspected parties or perpetrators responsible for the hack. However, news reports have emerged that North Korean hackers were responsible for the incident.

On-chain analytics and other information indicate “that this attack was perpetrated by hackers affiliated with North Korea,” blockchain analytics platform Elliptic said.

In response to The Hindu’s questions to WazirX about the North Korean hackers, cryptocurrency exchange WazirX directed us to its blog and said it was working with law enforcement to investigate whether a known malicious group was behind the attack.

“This incident affected the Ethereum multisig wallet, which consists of ETH and ERC20 tokens. Other blockchain funds are not affected,” WazirX said in its official blog, specifying that approximately 45% (according to preliminary work) of cryptocurrencies were affected by the attack.

The company largely placed the blame on the process of securing Ethereum multisig wallets and said that the vulnerability was not unique to WazirX.

How important is WazirX in the cryptocurrency industry?

WazirX calls itself India’s largest cryptocurrency exchange by volume. As of June 10, it reported total holdings of ₹4,203.88 Crores, or 503.64 million USDT. Tether [USDT] It is a stablecoin, that is, a cryptocurrency pegged to the value of the US dollar, but it is not an official currency of the United States.

When The Hindu tried to access WazirX Public and Real-Time Reserve Proof After the hack, we were greeted with a notice that the page was under maintenance.

WazirX has received both positive and negative reviews in India. The Enforcement Directorate froze the exchange’s assets in 2022, criticizing its operating procedures and lax Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations.

“By encouraging obscurity and adopting lax AML norms, it has actively assisted around 16 accused fintech companies in laundering proceeds of crime using the cryptocurrency route. Accordingly, equivalent movable assets amounting to Rs 64.67 Crore in possession of WazirX have been frozen under the PMLA, 2002,” the ED said in a statement.

What will happen to WazirX assets?

It is unlikely that the stolen WazirX assets will be fully recovered anytime soon. This is due to the very nature of cryptocurrency, where assets can be easily mixed, transferred, converted, and sent to anonymous wallets. The chances of asset recovery are even slimmer if it is confirmed that North Korean hackers are behind the incident.

CEO Shetty said on X on July 22 that “small” portions of the stolen funds had been frozen, but declined to provide further details. He added that the majority of the funds had not been moved from the attacker’s wallet.

In recent years, North Korean hackers have stolen billions of dollars in cryptocurrency, aiming to circumvent various financial and economic sanctions.

WazirX is currently working to resume normal operations and has planned to launch an online survey to decide how to resume trading on the platform.

While the Indian exchange has defended its security practices and highlighted the challenges facing the cryptocurrency industry as a whole, savvy crypto traders will be looking for action plans and accountability, rather than emotional reassurance.

What does your rewards program consist of?

WazirX has announced two bounty programs: one to gain more information about stolen funds, and the other to recover them. Both programs are open to everyone except WazirX employees and their immediate family members.

Under the first program, WaxirX will reward up to $10,000 to anyone who can provide the exchange with information that can help freeze the funds. If the bounty hunter is unable to freeze the funds on their own, they should work with WazirX by providing enough evidence to facilitate the process.

But “if the participant fails to freeze and/or does not cooperate with WazirX to facilitate the freezing of funds, then the participant will not be entitled to any rewards,” the exchange said.

The second program, called White Hat Recovery, is aimed at recovering funds. Participants are offered 10% of the amount recovered as a white hat incentive.

“This reward will be paid only after and subject to the successful receipt of the stolen amount by WazirX. The above rewards will be payable in USDT or in the form of recovered funds at the sole discretion of WazirX,” the exchange noted.

The bounty programs are expected to last for the next three months.

This is a Premium article available exclusively to our subscribers. Read over 250 premium articles each month You have exhausted your limit of free articles. Support quality journalism. You have exhausted your limit of free articles. Support quality journalism. X You have read {{data.cm.views}} of {{data.cm.maxViews}} free articles. X This is your last free article.

Tech

Trump Vows to Make US ‘Crypto Capital of the Planet and Bitcoin Superpower’

Speaking to a crowd of supporters at the Bitcoin 2024 Conference in Nashville, Tennessee, former President and Republican candidate Donald Trump said that if elected, he would make the United States the “crypto capital of the planet and a Bitcoin superpower.”

Trump added that he would “appoint a Presidential Advisory Council on Bitcoin and Cryptocurrencies,” which would have 100 days to “design transparent regulatory guidance that will benefit the entire industry.”

Trump has publicly opposed cryptocurrencies until recently. His latest statements serve as a rallying cry for a tech industry that has long called for more flexible regulatory oversight.

Shortly after taking the stage, Trump spent several minutes naming some of the conference attendees, at one point describing Winklevoss Twins Cameron and Tyler as “male role models with big, beautiful brains.” The former president has continued to speak out against electric car mandates and called for more fossil-fuel burning power plants.

Trump also said he would order the United States to withhold all Bitcoin it currently owns “in the future.” The U.S. government reportedly holds billions of dollars in Bitcoin.

About three years ago, Trump called Bitcoin “a fraud“that is “competing against the dollar.” In February 2024, the former president said that establishing a central bank digital currency would represent a “dangerous threat to freedom.” Yet, in May, Trump declared that he was “good with [crypto]“, adding, “if you’re pro-cryptocurrency you’d better vote for Trump.” That same month, he said he would commute with the Silk Road founder Ross Ulbricht’s Sentencingand his campaign said it would accept cryptocurrency donations.

Recent comments from Trump and independent presidential candidate Robert F. Kennedy Jr. have helped make cryptocurrency regulation a major political issue in the 2024 U.S. presidential election. This comes as the SEC intensifies its scrutiny of the cryptocurrency industry. SEC Chairman Gary Gensler, appointed by President Joe Biden, called the activity “full of fraud, scams, bankruptcies and money laundering.” Trump drew applause at the conference after promising to “fire” Gensler. (U.S. presidents have the power to appoint the heads of many federal commissions, including the SEC.)

With Biden out of the raceVice President Kamala Harris’s campaign advisers have He is said to have contacted to cryptocurrency leaders in an effort to “reset” relations with the industry. Harris’s campaign has not yet said whether her stance on the industry differs from Biden’s.

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Are Severely Undervalued, Awaiting Ethereum Move | Flash News Detail

-

News10 months ago

News10 months agoAI meme Raboo and crypto newbie ZRO

-

Tech1 year ago

Tech1 year agoThe Latest Tech News in Crypto and Blockchain

-

Altcoins10 months ago

Altcoins10 months agoAltcoins Correct Amid ETH Decline, Grayscale Outflows | Flash News Detail

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

DeFi10 months ago

DeFi10 months agoIf You Missed BONK and PEPE This Year, This Viral New Crypto Might Be Your Salvation

-

News11 months ago

News11 months agoDonald Trump vows to make the US a ‘Bitcoin superpower’ and create a national stockpile of tokens

-

Tech11 months ago

Tech11 months agoLogan Paul Offers Partial Refund for Failed CryptoZoo Game

-

Altcoins10 months ago

Altcoins10 months agoAltcoins set to make new crypto millionaires during summer rally

-

DeFi1 year ago

DeFi1 year ago🪂EigenLayer Airdrop Claims Go Live

-

DeFi1 year ago

DeFi1 year ago🥛 The “war on DeFi” continues ⚔️

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!