News

Overvalued vs. Undervalued: Analyzing the Top Cryptocurrencies

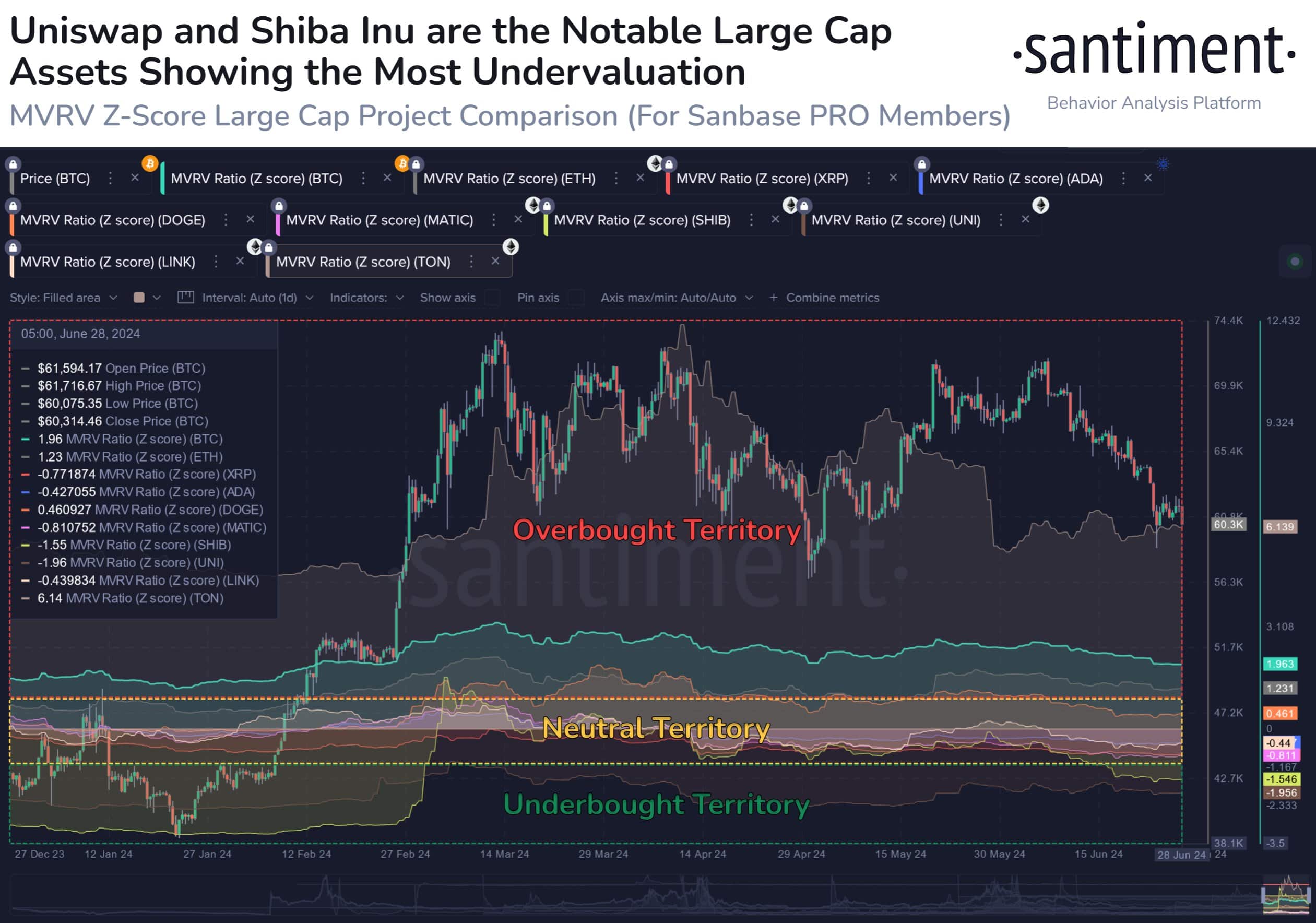

Understanding the true value of cryptocurrencies can be challenging in the volatile market. The Market Value to Realized Value (MVRV) Z-Score is a valuable tool for this goal. This metric helps investors determine whether a cryptocurrency is priced too high (overvalued) or too low (undervalued) by analyzing traders’ average profits. Recent data from Sanctification, revealed interesting findings about the valuation of several leading cryptocurrencies. Let’s delve deeper into these findings and analyze what they mean for investors.

What is the MVRV Z-Score?

The MVRV Z-Score quantifies the difference in value between a digital currency’s market value and its actual value. The current trading price is the market value, while the average price at which each coin was last traded is the realized value. A high MVRV Z-Score indicates that an asset is priced above its actual value, indicating that its market value is much higher than its actual value. Conversely, a low MVRV Z-Score indicates that the asset is priced above its actual value. MVRV Z-Score suggests that an asset is undervalued, indicating that its market price is lower than its real value.

Overvalued cryptocurrencies

1. Tokencoin (TON)

Toncoin, a strong player in the blockchain industry, has attracted significant interest in recent times. However, MVRV’s Z-Score indicates that TON is currently valued higher than it should be.

This implies that the market price of the asset is much higher than what is considered reasonable based on its true value. Investors need to be careful, as overvalued assets can experience corrections, leading to potential short-term price impacts.

2. Bitcoin (BTC)

BTC, the largest cryptocurrency by market capitalization, has experienced significant price growth since the beginning of the year. Even with its solid fundamentals and acceptance, the MVRV Z-Score shows that Bitcoin is currently considered overvalued.

This indicates that the current market price may not be sustainable in the near future, and investors may anticipate possible price adjustments.

3. Ethereum (ETH)

Ethereum, the dominant platform for smart contracts and decentralized applications, has seen substantial growth, partly due to recent upgrades and expected ETFs. However, based on the MVRV Z-Score, ETH is also considered to be expensive.

This suggests that the market may be too optimistic about Ethereum’s short-term performance, which could result in corrections.

Undervalued cryptocurrencies

1. Uniswap (UNI)

The MVRV Z-Score considers Uniswap, a decentralized exchange, to be undervalued, although its impact on DeFI sector can be recognized. This suggests that the true value or future potential is not adequately represented by the current market price.

This could be an opportunity for investors to buy, as the value of the cryptocurrency could increase once its true value is recognized by the market.

2. Shiba Inu (SHIB)

The MVRV Z-Score flags Shiba Inu as undervalued despite its fame as a meme coin and community-driven success. Although Shiba Inu has had a history of fluctuating prices, its current market value may be understated compared to its true value.

For those who are willing to accept greater risk, this may represent an opportunity to invest before possible price changes.

Implications for investors

Determining whether a cryptocurrency is overpriced or undervalued can greatly influence investment decisions. Investors may want to be cautious or take profits to reduce risks on assets like Toncoin, Bitcoin and Ethereum that are currently overvalued. On the other hand, overlooked assets like Uniswap and Shiba Inu could present growth opportunities given that investors are prepared for the underlying risks and volatility.

Conclusion

Using the MVRV Z-Score provides important insights into the comparative valuation of cryptocurrencies. By staying up to date with these factors, investors can make more calculated choices, weighing potential gains against risks in the ever-evolving crypto market.