DeFi

Top 5 winning and losing stocks: HEAT.CN, DEFI.NE, GRDI.NE

In this summary report, we’ll take a quick look at the top 5 winners and losers up or down double digits in the Canadian stock markets.

Here’s a summary of the assets’ intraday action:

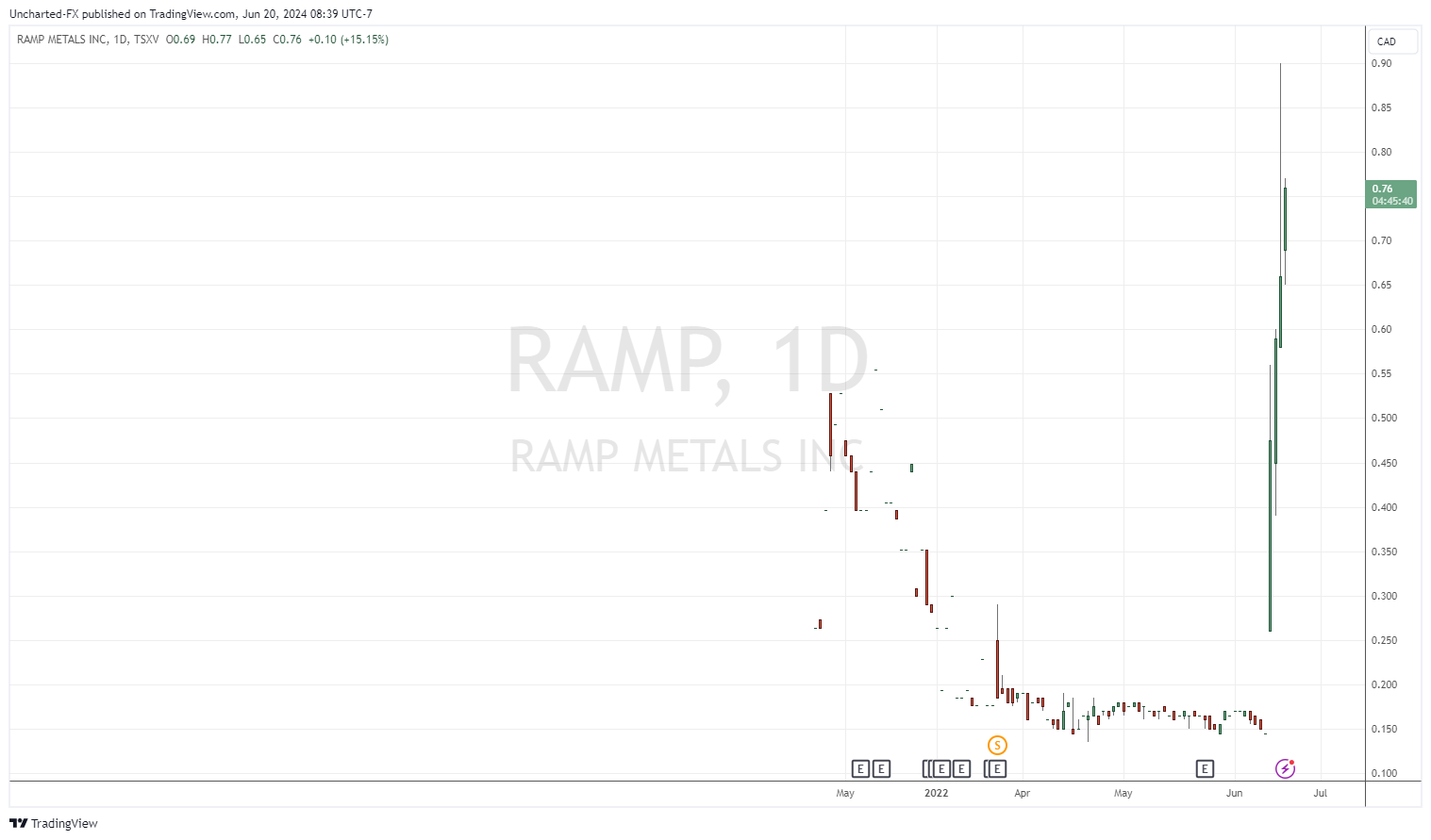

Railing metals (RAMP.V)

Market capitalization ~$26 million

Ramp Metals Inc. is engaged in the acquisition and exploration of battery and base metal properties. The Company mainly explores nickel, copper and lithium deposits. It holds an option to acquire a 100% interest in the Rottenstone SW property with a contiguous claim block covering 17,285.524 hectares; and the Peter Lake Estate property with 4 mining dispositions totaling approximately 2,163 hectares located in Saskatchewan, Canada.

The stock is up 21% without news. Three days ago, the The company announced a new high-grade gold discovery in Saskatchewan.

The upward trend continues. Be careful. We know there are sellers in this sector given the big wick from yesterday’s candle. The profits are taken. If today’s daily close is a full-bodied green candle, meaning the close is near the day’s highs, you would have a good chance of the momentum continuing tomorrow.

Hillcrest Energy Technologies (HEAT.CN)

Market capitalization ~$42 million

Hillcrest Energy Technologies Ltd. engages in the development of energy conversion technologies and digital control systems for powertrains, as well as grid-connected renewable energy generation systems. It offers electric vehicle traction inverter, power module, grid inverter and powertrain solutions, and develops zero-voltage switching inverter technology platform.

The stock is up 17% without news. Three days ago, the Company announced finalization of a joint development agreement with Ocean Batteries AS for the delivery of 300kVA | Hillcrest ZVS 800 V inverter prototypes.

Very strong price action from the bulls. Buyers are returning because profits were taken yesterday. $0.50 remains the next major resistance zone to test for the stock.

Network Infrastructure (GRDI.NE)

Market capitalization ~$111 million

Griid Infrastructure Inc. operates as a vertically integrated bitcoin mining company in North America. The company owns and operates a portfolio of energy infrastructure and data centers. It also engages in bitcoin mining operations, which operate specialized computers that generate cryptocurrency.

The stock is up 41% without news.

One for the lowest pickers. After printing record lows, the stock printed an engulfing candle and closed above $1.00. The $2.00 area is the current resistance.

Mogotes Metals (MOG.V)

Market capitalization ~$32 million

Mogotes Metals Inc. is engaged in the acquisition, exploration and evaluation of mineral exploration properties in Argentina and Chile. The company mainly explores copper and gold deposits. Its flagship project is the Filo Sur project located in the province of San Juan, Argentina and Chile.

The stock is up 19% without news.

There isn’t much price action here, but we have two key levels: support at $0.115 and resistance at $0.17. Bulls should wait for the upside resistance to break.

MiMedia Holdings (MIM.V)

Market capitalization ~$17 million

MiMedia Holdings Inc. operates a consumer cloud platform in the United States. The company’s platform allows consumers to access all their personal content, such as photos, videos, music, documents, text messages and contacts, on any device and operating system .

The stock is up 17% following the company news. signed a global distribution agreement with Schok Wireless.

A nice breakout here but we will have to wait until the end of the day for the close. A close above would see the stock test $0.50 in the coming days.

Fathom Nickel (FNI.CN)

Market capitalization ~$8.4 million

Fathom Nickel Inc., an exploration-stage company, is engaged in the identification, acquisition and exploration of base and precious metals for use in the electric vehicle and battery markets. The company mainly explores nickel deposits. Its flagship project is the Albert Lake project which includes 31 mining claims covering an area of 90,460 hectares located in the La Ronge mining district in Saskatchewan, Canada.

The stock is down 14% following the announcement of a new exploration permit and start of field activities at the Gochager Lake project.

The stock has reclaimed the broken support area. We have a “V” shaped bottom which is not my favorite, but the close above $0.06 is significant as it took out the current high.

FSD Pharma (HUGE.CN)

Market capitalization ~$9.6 million

FSD Pharma Inc., a biopharmaceutical company, researches and develops a portfolio of biotechnology assets and solutions for the treatment of challenging neurodegenerative, inflammatory and metabolic disorders, as well as alcohol abuse disorders, with drug candidates at different stages of development. The Company operates through two segments: biopharmaceutical and strategic investments. Its lead compound is Lucid-MS, a novel patented chemical entity that is in a Phase 2 clinical trial to prevent and reverse myelin degradation, the underlying mechanism of multiple sclerosis, in models preclinical.

The stock is down 14% with no news.

The stock continues to bleed lower and lower, printing new all-time highs. Wait for a range or large hammer candle to indicate possible selling exhaustion.

DeFi Technologies (DEFI.CN)

Market capitalization ~$565 million

DeFi Technologies Inc., a technology company, develops and lists exchange-traded products in Canada, Bermuda and the Cayman Islands. The Company provides asset management services, such as investment vehicles, indirect exposure to underlying cryptocurrencies, digital asset indices and other decentralized financial instruments. It also participates in decentralized blockchain networks by processing data transactions that contribute to network security and stability, governance and validation of transactions.

The stock is down 15% with no news.

The stock is testing key support at $2.00. Currently we are below, but as you can see from the large wick candles, buyers tend to flock around this area. If today’s candle is a big red candle whose close is near the lows, watch out below!

Graphene manufacturing (GMG.V)

Market capitalization ~$55 million

Graphene Manufacturing Group Ltd, a clean technology company, manufactures and supplies graphene powder. The company is engaged in the manufacture and sale of energy saving and energy storage solutions. Its product portfolio includes graphene aluminum-ion battery; THERMAL-XR, an HVAC coating system that improves the conductivity of corroded heat exchange surfaces and maintains unit performance; and G LUBRICANT, a graphene and lubricating oil.

The stock is down 13% with no news.

So far, just a step back. Bulls should be concerned if the stock closes below the $0.50 area. The breakout trend still continues.

KWESST Microsystems (KWE.V)

Market capitalization ~$5.2 million

KWESST Micro Systems Inc. is engaged in the development and marketing of tactical systems and munitions for the military, public safety agency and personal defense markets. The company produces non-lethal products, including PARA OPS devices and ARWEN products.

The stock is down 12% with no news.

After a strong rise, the momentum fades and we are now testing the lower part of the gap. If this gap closes, the stock will reverse its upward momentum. Important day of pricing action.